A month has gone by since the last earnings report for Celanese Corporation (NYSE:CE) . Shares have lost about 1.7% in that time frame, outperforming the market.

Will the recent negative trend continue leading up to the stock's next earnings release, or is it due for a breakout? Before we dive into how investors and analysts have reacted of late, let's take a quick look at its most recent earnings report in order to get a better handle on the important catalysts.

Celanese Beats Earnings and Revenue Estimates in Q2

Celanese kept its earnings streak alive with a beat in second-quarter 2017. The company logged adjusted earnings per share of $1.79 in the reported quarter, up 12.6% from $1.59 reported a year ago. The figure was above the Zacks Consensus Estimate of $1.74.

Celanese reported sales of $1,510 million for the quarter, up roughly 11.8% year over year. Sales also beat the Zacks Consensus Estimate of $1,454 million.

Segment Review

Material Solutions: The unit witnessed an improvement in volume due to acquisitions, growth in Asia and success of the project pipeline. Within this segment, the Advanced Engineered Materials unit delivered operating profit of $97 million and record adjusted EBIT of $142 million.

In the second quarter, an all-time high of 547 projects were commercialized on the back of the organic opportunity pipeline and the recent SO.F.TER. and Nilit acquisitions. Tow volume and pricing declined mainly due to lower industry capacity utilization rates and outpaced productivity gains in the quarter.

The Consumer Specialties unit’s performance suffered a decline on a year-over-year basis.

Acetyl Chain: The unit witnessed pricing expansion in excess of higher input costs across products and more than offset increased turnaround costs. Operating margin was $135 million, up 26% year over year.

Financials

Cash and cash equivalents were $511 million as of Jun 30, 2017, down 30.5% year over year. Long-term debt was up 19% to $2,931 million as of Jun 30, 2017. Capital expenditure in the quarter was $54 million.

Celanese generated operating cash flow of $298 million and free cash flow of $240 million in the quarter. During the quarter, the company returned $237 million to its shareholders, including $172 million in share buy backs and $65 million of dividends.

Outlook

Celanese sees adjusted earnings per share to increase 9–11% in 2017. Advanced Engineered Materials is also expected to generate strong earnings growth driven by an exciting project pipeline and early success from the integration of SO.F.TER. and Nilit acquisitions. The Acetyl Chain is anticipated to drive earnings growth in the second half of 2017 by leveraging raw material volatility and improved volumes as Clear Lake returns to pre-turnaround capacity.

Additionally, the company intends to repurchase shares worth at least $500 million in 2017.

How Have Estimates Been Moving Since Then?

Following the release, investors have witnessed an upward trend in fresh estimates. There have been three revisions higher for the current quarter compared to two lower.

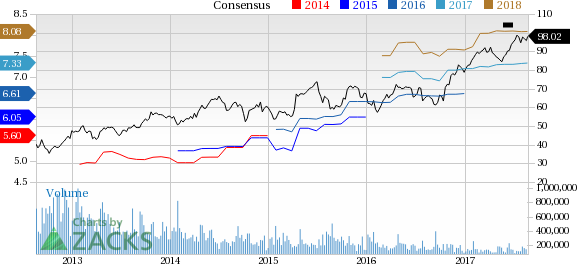

Celanese Corporation Price and Consensus

VGM Scores

At this time, Celanese's stock has a subpar Growth Score of D, however its Momentum is doing a bit better with a C. The stock was allocated a grade of B on the value side, putting it in the top 40% for this investment strategy.

Overall, the stock has an aggregate VGM Score of C. If you aren't focused on one strategy, this score is the one you should be interested in.

Our style scores indicate that the stock is more suitable for value investors than momentum investors.

Outlook

Estimates have been trending upward for the stock. The magnitude of these revisions also looks promising. Notably, the stock has a Zacks Rank #3 (Hold). We expect in-line returns from the stock in the next few months.

Celanese Corporation (CE): Free Stock Analysis Report

Original post

Zacks Investment Research