It has been about a month since the last earnings report for Cadence Design Systems, Inc. (NASDAQ:CDNS) . Shares have added about 5% in that time frame, outperforming the market.

Will the recent positive trend continue leading up to the stock's next earnings release, or is it due for a pullback? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at the most recent earnings report in order to get a better handle on the important drivers.

Recent Earnings

Cadence Design Systems reported earnings of 34 cents per share, reflecting an increase of 17.2% from the year-ago quarter. The figure beat the Zacks Consensus Estimate by a penny.

Revenues also increased 5.7% year over year to $479 million, beating the Zacks Consensus Estimate of $478 million.

Quarter Details

Product & Maintenance generated revenues to the tune of $443.8 million, which accounted for 92.7% of total revenue. Segment revenues were up 5.7% on a year-over-year basis.

On the other hand, Services generated revenues of $35.1 million, which accounted for the remaining 7.3% of total revenue. Revenues were up 6.3% on a year-over-year basis.

Product wise, revenues from Digital and signoff grew 14% year over year, with deeper market penetration. IP revenues grew 15% year over year, as the company’s new refined strategy gained momentum. Custom analog grew 9% year over year and SPB segment saw growth of 7% from the year-ago quarter.

Revenues from Asia were up 18% year over year, making it the highest contributor.

Strong adoption continued for Palladium Z1, given the company’s recent partnership with HiSilicon. Moreover, Rohm, a Japanese electronics part manufacturing company adopted Cadence’s ISO 26262 compliant functional safety verification solution. Its customer base saw the addition of an advanced driver assistance system (ADAS) company.

In the second quarter, the company also released Virtuoso system, a platform to optimize design integration between chip, package and board flows. The company also extended its partnership with Mathworks to help modify mixed signal designs.

Management noted that Vinovus and Tensilica are gaining accelerated traction with high adoption rate. Customer reception of Protium S1 FPGA-based prototyping system was also positive.

Meanwhile, stringent cost control helped operating margin (including stock-based compensation) expanded 210 bps on a year-over-year basis to 17.9%.

However, research and development spending increased 7.4% compared with the year-ago quarter.

Balance Sheet

Net cash from operating activities was $162.1 million compared with $92.4 million in the previous quarter. Cadence ended the quarter with cash and short-term investments of $655.9 million, better than $547.6 million at the end of first-quarter 2017.

Guidance

For the third quarter of 2017, Cadence expects total revenue to be in the range of $475 million to $485 million and non-GAAP earnings in the range of $0.33 to $0.35 per share.

For the 2017, the company raised its guidance. Revenues are now expected to be in the range of $1.91 billion to $1.95 billion; non-GAAP operating margin is expected to be approximately 27% and non-GAAP earnings are guided in the range of $1.36 to $1.42.

The lower end of both revenues and earnings per share guidance was raised, leading to a rise in the mid-point. Operating cash flow is anticipated to be in the range of $430 million to $470 million.

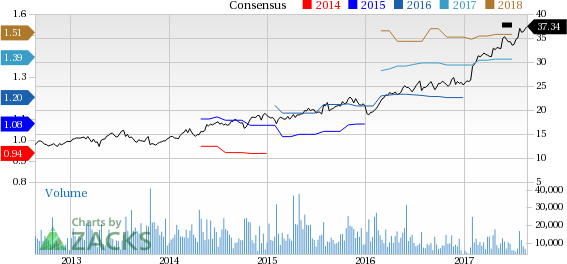

How Have Estimates Been Moving Since Then?

Following the release, investors have witnessed a downward trend in fresh estimates. There have been three revisions lower for the current quarter.

VGM Scores

At this time, Cadence Design's stock has a great Growth Score of A, though it is lagging a lot on the momentum front with a C. Charting a somewhat similar path, the stock was allocated a grade of D on the value side, putting it in the bottom 40% for this investment strategy.

Overall, the stock has an aggregate VGM Score of B. If you aren't focused on one strategy, this score is the one you should be interested in.

Our style scores indicate that the stock is more suitable for growth investors than momentum investors.

Outlook

Estimates have been broadly trending downward for the stock. The magnitude of this revision also indicates a downward shift. Notably, the stock has a Zacks Rank #3 (Hold). We are expecting an inline return from the stock in the next few months.

Cadence Design Systems, Inc. (CDNS): Free Stock Analysis Report

Original post

Zacks Investment Research