About a month has gone by since the last earnings report for The Boeing Company (NYSE:BA) . Shares have added about 1.6% in that time frame, outperforming the market.

Will the recent positive trend continue leading up to the stock's next earnings release, or is it due for a pullback? Before we dive into how investors and analysts have reacted of late, let's take a quick look at the most recent earnings report in order to get a better handle on the important drivers.

Boeing Beats on Q2 Earnings, Raises ‘17 EPS Guidance

Boeing reported adjusted earnings of $2.55 per share for second-quarter 2017, beating the Zacks Consensus Estimate of $2.32 by 9.9%. In the year-ago quarter, the company had incurred a loss of $0.44.

On a GAAP basis, Boeing reported earnings of $2.89 per share against loss of $0.37 per share in the year-ago quarter.

Revenues

The company's revenues amounted to $22.74 billion in the reported quarter, missing the Zacks Consensus Estimate of $23.01 billion by 1.2%. The reported figure also declined 8.1% year over year.

Total Backlog

Backlog at the end of the second quarter was up to $482.2 billion from $479.5 billion at the end of first quarter. Reported backlog included $27 billion of net orders during the quarter.

Quarterly Segment Results

Commercial Airplane Segment: The segment saw a 10% decline in revenues to $15.71 billion. Operating margin for the quarter expanded 1560 basis points (bps) year over year to 10%.

Boeing reported commercial deliveries of 183 planes during the reported quarter, which was down due to lower 737, 777, 787 and 767 jet deliveries. Sequentially, the numbers reflected an 8.3% growth.

Delivery of the single-aisle 737 jet declined to 123 from 127 a year ago. This reduction was due to Boeing’s greater involvement in the production of a newer version of its most popular plane, the 737 MAX.

Shipments of the 777 and 787 Dreamliners were 21 and 33 compared with 28 and 38 in the year-ago period, respectively. The company delivered three 767 jets compared with four in the year-ago quarter. However, shipments of 747 were three compared with two in the year-ago period.

A look at Boeing’s second-quarter order details reveals that the company booked 183 net commercial orders (accounting for cancellations). This reflects an increase from the year-ago figure of 171. The figure included 95 orders for the 737, 64 for the 787, and 24 for the 777 jets.

Boeing Defense, Space & Security (BDS): The segment witnessed an approximate 4% year-over-year decrease in second-quarter revenues to $6.89 billion. Revenues at all of the three sub-segments – Boeing Military Aircraft (BMA) and Network & Space Systems (N&SS) and Global Services & Support (GS&S) – recorded year-over-year deterioration of 2.5%, 7.5% and 3.2%, respectively.

Operating margin for the quarter expanded 460 bps to 12.9%.

Backlog at BDS was $58 billion, 37% of which comprised orders from international clients.

In the defense and space business, Boeing’s deliveries totaled to 45 in the second quarter, in line with the year-ago figure. However, the reported figure was up from 42 in the preceding quarter. Total deliveries consisted of 17 AH-64 Apache (NYSE:APA) helicopters (both new and remanufactured) and 11 Chinook helicopters (new and renewed). In addition, the company delivered six F/A-18s, five P-8 models, four F-15s, and two Commercial and Civil Satellites.

Boeing Capital Corporation (BCC): Boeing Capital reported quarterly revenues of $72 million, compared with $84 million in the year-ago quarter. The segment’s earnings were $25 million compared with $18 million a year ago.

At the end of the second quarter, BCC's portfolio balance was $3.9 billion.

Financial Condition

Boeing exited the second quarter with cash and cash equivalents of $8.74 billion and short-term investments of $1.59 billion. At year-end 2016, the company had $8.80 billion of cash and cash equivalents and $1.23 billion of short-term investments. Long-term debt was $10.06 billion in the second quarter, up from $9.57 billion at 2016 end.

Boeing generated $7.04 billion of operating cash flow in the second quarter, up 57.8% year over year. Free cash flow was $4.51 billion in the second quarter compared with free cash of $2.52 billion in the year-ago quarter.

Guidance

Boeing’s adjusted or core earnings per share expectation for 2017 are in the range of $9.80–$10.00, up from the prior guided range of $9.20–$9.40. GAAP earnings are now projected to be in the range of $11.10–$11.30 per share compared with the previous range of $10.35–$10.55.

The company still expects 2017 revenues in the range of $90.5-$92.5 billion.

Commercial Airplanes' 2017 delivery expectations are reiterated in the band of 760−765 airplanes with revenues projected in the range of $62.5−$63.5 billion. Operating margin is now anticipated to be more than 10.0% compared with the prior guidance in 9.5–10.0% band.

The company reaffirmed its projection of 2017 defense revenues in the $28.0–$29.0 billion range with operating margin of approximately 11.5%.

Boeing Capital Corp. expects the aircraft finance portfolio to remain stable. The company still anticipates its segment revenues to be approximately $0.3 billion.

Boeing's 2017 R&D forecast has been reiterated at approximately $3.6 billion. Capital expenditures for 2017 are now expected to be approximately $2.0 billion compared with the previous guidance of $2.3 billion.

How Have Estimates Been Moving Since Then?

Following the release, investors have witnessed an upward trend in fresh estimates. There have been three revisions higher for the current quarter in the past month. The consensus estimate has shifted by 5.4% due to these changes.

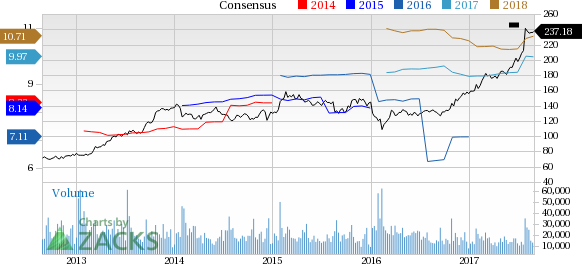

The Boeing Company Price and Consensus

VGM Scores

At this time, Boeing's stock has a strong Growth Score of A, though it is lagging a lot on the momentum front with a D. The stock was allocated a grade of C on the value side, putting it in the middle 20% for this investment strategy.

Overall, the stock has an aggregate VGM Score of A. If you aren't focused on one strategy, this score is the one you should be interested in.

Based on our scores, the stock is primarily suitable for growth investors and to a lesser degree for value investors.

Outlook

Estimates have been trending upward for the stock. The magnitude of these revisions also looks promising. It comes with little surprise that the stock has a Zacks Rank #2 (Buy).

Boeing Company (The) (BA): Free Stock Analysis Report

Original post

Zacks Investment Research