It has been about a month since the last earnings report for Armstrong World Industries Inc (NYSE:AWI) . Shares have lost about 3.4% in that time frame.

Will the recent negative trend continue leading up to the stock's next earnings release, or is it due for a breakout? Before we dive into how investors and analysts have reacted of late, let's take a quick look at its most recent earnings report in order to get a better handle on the important catalysts.

Armstrong World Q2 Earnings & Revenues Beat, Hikes Guidance

Armstrong World posted adjusted earnings of $0.73 per share in second-quarter 2017, which increased 30% year over year. Earnings also beat the Zacks Consensus Estimate of $0.69. The improved performance was driven by higher global volumes, improvements in AUV and lower manufacturing and input costs. These factors helped offset higher SG&A expenses.

Including one-time items, the company reported earnings per share of $0.77 compared with the $0.29 in the prior-year quarter.

Operational Update

Net sales increased 6.5% year over year to $330 million. Excluding the unfavorable impact from foreign exchange of $3 million, net sales increased 6.1% attributed to increased volumes as well as higher average unit values (AUV).

Revenues beat the Zacks Consensus Estimate of $329 million. Cost of sales declined 1.4% year over year to $220 million. Gross profit improved 26% to $110 million in the quarter.

Selling, general and administrative (SG&A) expenses decreased 6% year over year to $52.4 million. Adjusted operating income improved 20% year over year to $73 million driven by higher volumes globally, improvements in AUV and lower manufacturing and input costs. These factors helped offset higher SG&A expenses.

Segment Performance

Americas: Net sales at the Americas segment grew 5% year over year to $226 million. Adjusted operating income increased 24% to $80 million in the quarter from $64 million in the prior-year quarter.

EMEA: The EMEA segment’s sales increased 4.7% year over year to $68.7 million from $65.6 in the year-ago quarter. The segment posted loss of $1.8 million compared to a loss of $5.3 million in the prior-year quarter.

Pacific Rim: Net sales in the reported quarter climbed 8% year over year to $36.5 million. Operating profit came in at $0.3 million, an improvement from the operating loss of $2.1 million in the last quarter.

Financials

Armstrong World reported cash and cash equivalents of $80 million as of Jun 30, 2017, compared with $99.4 million as of Jun 30, 2016. The company recorded cash flow from operations of $42.4 million in the first half compared with usage of $55.4 million in the prior year comparable period.

Outlook

Backed by healthy sales growth in the first half of the year and expectations for improving performance in our international markets for the balance of the year, Armstrong World increased its guidance for 2017. The company now projects year over year sales growth of 6-9%, up from the prior expectation of 5-7%. Sales are consequently projected to be in the $1.31–$1.34 billion range, compared with the prior $1.29–$1.32 billion range.

Adjusted earnings per share are estimated to lie in the band of $2.65–$2.75. The company had earlier projected a range of $2.60–$2.70. Free cash flow is now anticipated to be between $140 and $155 million, increased from the prior guidance of $130 to $145 million.

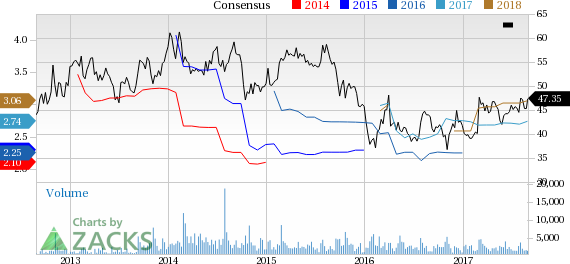

How Have Estimates Been Moving Since Then?

It turns out, fresh estimates flatlined during the past month. There has been one revision higher for the current quarter compared to one lower. While looking back an additional 30 days, we can see even an upward momentum. There have been two moves up in the last two months.

VGM Scores

At this time, Armstrong World's stock has an average Growth Score of C, though it is lagging a bit on the momentum front with a D. The stock was allocated a grade of C on the value side, putting it in the middle 20% for this investment strategy.

Overall, the stock has an aggregate VGM Score of C. If you aren't focused on one strategy, this score is the one you should be interested in.

Zacks' style scores indicate that the company's stock is suitable for value and growth investors.

Outlook

Notably, the stock has a Zacks Rank #3 (Hold). We expect in-line returns from the stock in the next few months.

Armstrong World Industries Inc (AWI): Free Stock Analysis Report

Original post

Zacks Investment Research