A month has gone by since the last earnings report for Arconic Inc. (NYSE:ARNC) . Shares have lost about 1.9% in that time frame, underperforming the market.

Will the recent negative trend continue leading up to the stock's next earnings release, or is it due for a breakout? Before we dive into how investors and analysts have reacted of late, let's take a quick look at the most recent earnings report in order to get a better handle on the important drivers.

Arconic’s Earnings, Revenues Beat Estimates in Q2

Arconic logged profit, as reported, of $212 million or $0.43 per share for the second quarter of 2017. The results in the reported quarter include $47 million of special items that includes a gain on debt-for-equity exchange of shares of Alcoa (NYSE:AA) Corp.

Barring one-time items, earnings came in at $0.32 per share for the reported quarter, marginally down from $0.33 per share a year ago. The results topped the Zacks Consensus Estimate of $0.27 . Arconic gained from its cost-saving actions in the quarter and all units delivered higher volumes.

Arconic reported revenues of $3,261 million, up around 1% year over year. The figure surpassed the Zacks Consensus Estimate of $3,234 million. Revenues were driven by improved volumes across all segments and higher aluminum prices.

Segment Highlights

EPS – Revenues from the division came in at $1.5 billion in the second quarter, up about 1% year over year. Adjusted EBITDA declined 5.8% year over year to $310 million in the quarter, as volume gains and net cost savings (which exclude costs related to engine ramp-up) were more than offset by unfavorable mix and pricing.

GRP – The division recorded sales of $1.3 billion in the quarter, down 4% year over year. Adjusted EBITDA inched up 0.6% year over year to $164 million, driven by strong automotive volumes and benefits of cost saving actions which partly offset reduced airframe destocking, aerospace wide-body build rates and pricing pressure in regional specialties.

TCS – The segment logged sales of $501 million, up 7% year over year. Adjusted EBITDA increased around 7.9% to $82 million in the quarter on the back of higher volumes and net cost savings, more than offsetting the pricing pressure in the heavy-duty truck market.

Financial Position

Arconic ended the quarter with cash and cash equivalents of roughly $1.8 billion. Long-term debt was reduced by around $1.25 billion since the beginning of the year.

Outlook

Arconic delivered a strong performance in the second quarter as it continues to cut cost and boost margins. The company has also revised the full year guidance on the back of higher volumes, higher aluminium prices and stronger net cost savings. The company now expects revenues in the range of $12.3–$12.7 billion (up from $11.8–$12.4 billion) and adjusted earnings of $1.15–$1.20 per share (up from $1.10–$1.20 per share) for 2017.

How Have Estimates Been Moving Since Then?

Following the release, investors have witnessed a downward trend in fresh estimates. There has been one revision higher for the current quarter compared to three lower.

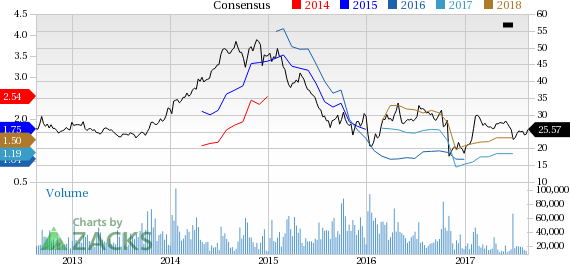

Arconic Inc. Price and Consensus

VGM Scores

At this time, Arconic's stock has an average Growth Score of C, though it is lagging a lot on the momentum front with an F. However, the stock was allocated a grade of B on the value side, putting it in the second quintile for this investment strategy.

Overall, the stock has an aggregate VGM Score of B. If you aren't focused on one strategy, this score is the one you should be interested in.

Our style scores indicate that the stock is more suitable for value investors than growth investors.

Outlook

Estimates have been broadly trending downward for the stock. The magnitude of this revision also indicates a downward shift. Notably, the stock has a Zacks Rank #3 (Hold). We expect in-line returns from the stock in the next few months.

Arconic Inc. (ARNC): Free Stock Analysis Report

Original post

Zacks Investment Research