It has been about a month since the last earnings report for American Airlines Group, Inc. (NASDAQ:AAL) . Shares have lost about 12.9% in that time frame, underperforming the market.

Will the recent negative trend continue leading up to the stock's next earnings release, or is it due for a breakout? Before we dive into how investors and analysts have reacted of late, let's take a quick look at the most recent earnings report in order to get a better handle on the important catalysts.

Second Quarter Earnings

American Airlines' second-quarter 2017 earnings (adjusted) of $1.92 per share surpassed the Zacks Consensus Estimate by $0.05. Moreover, quarterly earnings improved 8.47% on a year-over-year basis. Results were aided by higher revenues.

Revenues of $11,105 million also improved 7.16% from the year-ago figure. Quarterly revenues edged past the Zacks Consensus Estimate of $11,086.7 million. Strong demand for air travel coupled with improving yields drove the top line in the quarter under review. Total revenue per available seat miles (TRASM: a key measure of unit revenue) improved 5.7% in the reported quarter.

Consolidated yield improved 4.3% . Passenger revenue per available seat miles improved 5% . While traffic (measured by revenue passenger miles) was up 2.1%, capacity (measured by average seat miles) was up 1.4%. In fact, consolidated load factor (percentage of seats filled by passengers) improved as traffic growth outpaced capacity expansion. Load factor improved to 83% compared with 82.5% a year ago.

Total operating expenses climbed 11.1% year over year to $9.6 billion primarily backed by rise in fuel costs. Expenses pertaining to salaries and benefits were up 12.5%. Consolidated operating costs per available seat miles (CASM: excluding special items) increased 6.8%. Furthermore, the carrier declared a dividend of $0.10 per share that will be paid on Aug 28 to shareholders of record as of Aug 14.

Meanwhile, it remains focused on introducing new aircraft and retiring old ones from its fleet. In fact, keeping in with its aim to modernize its fleet, the carrier took delivery of 16 new mainline aircraft and four regional ones during the second quarter of 2017. Also, the company invested $1.1 billion toward a new aircraft during the reported quarter. Going forward, it aims to shell out $4.1 billion in 2017 for the same purpose.

Outlook

TRASM is expected to increase in the band of 0.5% to 2.5% for the third quarter of 2017 on a year-over-year basis. Pre-tax margin, excluding special items, is projected in the range of 10% to 12%. Consolidated CASM (excluding special items and fuel) is expected to increase 5%. The metric is also anticipated to increase approximately 5% in 2017. Capacity (system) in 2017 is projected to increase 1.5%.

How Have Estimates Been Moving Since Then?

Following the release, investors have witnessed a downward trend in fresh estimates. There have been three revisions lower for the current quarter. In the past month, the consensus estimate has shifted by lower by 6.1% due to these changes.

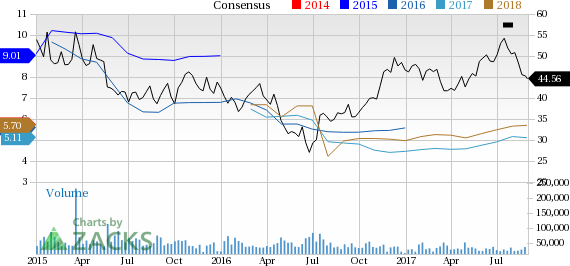

American Airlines Group, Inc. Price and Consensus

VGM Scores

At this time, American Airlines' stock has a nice Growth Score of B, though it lags a bit on the momentum front with a C. The stock was allocated a grade of A on the value side, putting it in the top quintile for this investment strategy.

Overall, the stock has an aggregate VGM Score of A. If you aren't focused on one strategy, this score is the one you should be interested in.

Based on our scores, the stock is more suitable for value investors than those looking for growth and momentum.

Outlook

Estimates have been broadly trending downward for the stock. The magnitude of this revision also indicates a downward shift. Notably, the stock has a Zacks Rank #3 (Hold). We expect in-line returns from the stock in the next few months.

American Airlines Group, Inc. (AAL): Free Stock Analysis Report

Original post

Zacks Investment Research