It has been about a month since the last earnings report for Alliance Data Systems Corporation (NYSE:ADS). Shares have lost about 6.5% in that time frame, underperforming the market.

Will the recent negative trend continue leading up to the stock's next earnings release, or is it due for a breakout? Before we dive into how investors and analysts have reacted of late, let's take a quick look at the most recent earnings report in order to get a better handle on the important catalysts.

Alliance Data Q2 Earnings Beat Estimates, Tweaks View

Alliance Data’s operating earnings of $3.59 per share in the second quarter of 2017 surpassed the Zacks Consensus Estimate of $3.47. Earnings improved 4.3% year over year.

All the segments – Epsilon, LoyaltyOne and Card Services delivered a solid performance in the quarter.

Behind the Headlines

Alliance Data’s revenues came in at $1.82 billion, up 4% year over year. The top line missed the Zacks Consensus Estimate of $1.84 billion.

Operating expenses increased 2.9% year over year to $1.5 billion, primarily due to a rise in provision for loan losses. Operating income improved 9.6% year over year to $351.4 million.

However, adjusted earnings before interest tax depreciation and amortization (EBITDA) were $499 million, up 6% year over year.

Segment Update

LoyaltyOne: Revenues totaled $280 million, down 21% year over year. Adjusted EBITDA declined 28% to $56.7 million. AIR MILES’ saw its reward miles issued decreased 1% while redeemed declined 13%.

Epsilon: Revenues were $543.3 million in the quarter, up 5% year over year. Adjusted EBITDA increased 4% year over year to $106.8 million. The quarter witnessed growth in core product offerings revenues (Auto, CRM, Agency).

Card Services: Revenues came in at $1 billion, up 13% year over year. Adjusted EBITDA was $305 million, up 11% year over year. Average credit card receivables, excluding amounts reclassified as assets held for sale, advanced 17% year over year to $15.7 billion. Net principal loss rates for the reported quarter were 6.2%, up 110 basis points year over year, chiefly due to lower recovery rates.

Financial Update

As of Jun 30, 2017, cash and cash equivalents were $1.96 billion compared with $1.86 billion as of Dec 31, 2016.

At the end of the quarter, debt climbed 12.5% from 2016-end to $6.4 billion.

Capital expenditure at Alliance Data decreased 8.5% year over year to $116.8 million in the first half of 2017.

Guidance

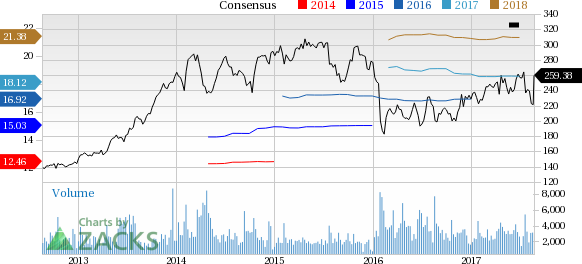

Alliance Data projects 2017 core earnings to be $18.10 per share, lowered from $18.50 per share, guided earlier. Revenues of $7.8 billion are raised from $7.7 billion, guided earlier.

For 2018, the company expects a core EPS of $21.50 on revenues of $8.7 billion. While bottom line reflects a 19% year over year growth, top line represents a 12% increase over 2017.

How Have Estimates Been Moving Since Then?

Following the release, investors have witnessed a downward trend in fresh estimates. There has been one revision lower for the current quarter. In the past month, the consensus estimate has shifted lower by 7.8% due to these changes.

VGM Scores

At this time, Alliance Data's stock has a nice Growth Score of B, though it is lagging on the momentum front with a D. However, the stock was allocated a grade of A on the value side, putting it in the top quintile for this investment strategy.

Overall, the stock has an aggregate VGM Score of A. If you aren't focused on one strategy, this score is the one you should be interested in.

Our style scores indicate that the stock is more suitable for value investors than growth investors.

Outlook

Estimates have been broadly trending downward for the stock. The magnitude of this revision also indicates a downward shift. Notably, the stock has a Zacks Rank #3 (Hold). We expect in-line returns from the stock in the next few months.

Alliance Data Systems Corporation (ADS): Free Stock Analysis Report

Original post

Zacks Investment Research