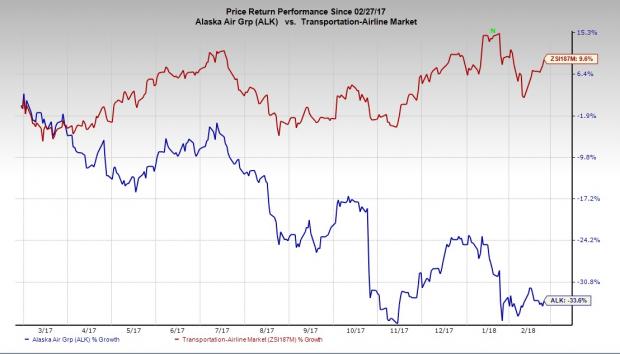

Shares of Alaska Air Group, Inc. (NYSE:ALK) have lost 33.6% in a year, significantly underperforming the industry’s gain of 9.6%.

Reasons Behind the Price Plunge

High labor and fuel costs have been hurting the company’s bottom line for quite some time. Notably, the company’s earnings declined 46.8% in the fourth quarter due to steep costs. Moreover, the carrier expects first-quarter 2018 cost per available seat mile (CASM) excluding fuel and special items to rise approximately 6% year over year. While the metric for 2018 is predicted to increase around 2.5%. Economic fuel cost per gallon is anticipated to grow 21% in the first quarter of 2018.

Passenger revenue per available seat mile (PRASM: a key measure of unit revenues) also decreased 5.1% year over year. Consequently, such below-par performance of the key metric does not bode well for the company.

The company has also been struggling with capacity overexpansion woes. In January, the company reported disappointing traffic results with load factor (percentage of seats filled by passengers) contracting 230 basis points in the month. This was because of capacity expansion (6.6%) exceeding traffic growth (3.5%).

The pessimism surrounding the company is further evident from the Zacks Consensus Estimate for current-year earnings being revised 5.4% downward in the last 30 days. Moreover, the company’s Momentum Score of D also highlights its short-term unattractiveness.

Additionally, the company’s Zacks Rank #4 (Sell) supports our negative stance regarding the stock.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Key Picks

Some better-ranked stocks in the airline space are Deutsche Lufthansa (DE:LHAG) AG (OTC:DLAKY) , Delta Air Lines, Inc. (NYSE:DAL) and Southwest Airlines Co. (NYSE:LUV) . While Deutsche Lufthansa sports a Zacks Rank of 1, Delta Air Lines and Southwest Airlines carry a Zacks Rank #2 (Buy).

Shares of Deutsche Lufthansa, Delta Air Lines and Southwest Airlines have rallied more than 35%, 13% and 12%, respectively, in the last six months.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

See This Ticker Free >>

Southwest Airlines Company (LUV): Free Stock Analysis Report

Delta Air Lines, Inc. (DAL): Free Stock Analysis Report

Deutsche Lufthansa AG (DLAKY): Free Stock Analysis Report

Alaska Air Group, Inc. (ALK): Free Stock Analysis Report

Original post

Zacks Investment Research