From Invesco: US gross domestic product (GDP) rose only slightly in the first quarter, but this result was in line with Invesco Fixed Income’s expectations and we still expect solid growth this year.

While output grew by only 0.7% annualized between January and March, we believe the underlying details of the data were supportive of stronger growth in the coming quarters.1

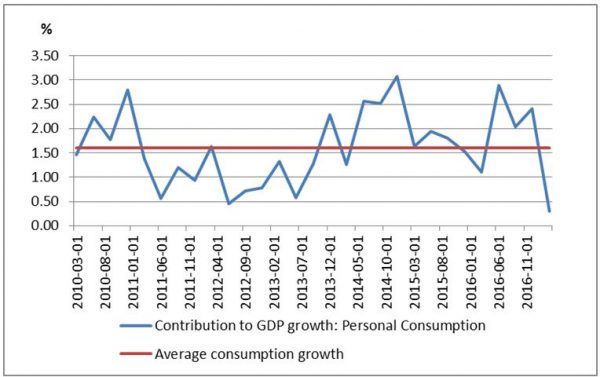

As shown in the chart below, consumption was the big disappointment, expanding by only 0.3%, versus averaging around 1.6% growth since 2009. However, we believe the current high level of consumer confidence, above average employment growth and rising pay suggest that consumption is likely to bounce back. Also, initial GDP releases have tended to misread consumption. Gathering consumption data has become more challenging as the bulk of consumption shifts away from easier-to-measure sectors, such as autos, toward harder-to-measure ones, such as services. So, it’s possible we may get a positive upward revision.

Consumption’s contribution to growth disappointed in the first quarter

Source: Federal Reserve Economic Data (FRED), quarter-over-quarter, annualized, Oct. 1, 2009 – Jan. 1, 2017

Investment activity could bolster future growth

While the initial consumption figures were a detractor, the first-quarter expansion in investment activity was encouraging. Residential and non-residential investment showed signs of strength, growing 13.7% and 9.4%, respectively.1 If investment and consumption stabilize at the levels we expect, we believe trend GDP growth will likely end up in the mid-to-high 2% range this year.

Invesco Fixed Income believes the latest set of GDP data increases, rather than decreases, the odds of a June Federal Reserve rate hike. We also believe these data raise the probability that the next several GDP reports will be above-trend.

The SPDR S&P 500 ETF Trust (AX:SPY) closed at $238.08 on Friday, down $-0.52 (-0.22%). Year-to-date, SPY (NYSE:SPY) has gained 6.51%.

SPY currently has an ETF Daily News SMART Grade of A (Strong Buy), and is ranked #1 of 109 ETFs in the Large Cap Blend ETFs category.