A little over a week ago, the Fed announced it wasn’t raising rates. Our next chance of a hike is October... more likely, December.

Perhaps you breathed a sigh of relief when you heard the news. But we ask... Would an increase be so awful?

Most people think a hike is bad news. It will kill our sluggish economy, they argue. But if and when rates get lifted, these folks will miss out on a big opportunity to profit. You only have to look at the past to see why.

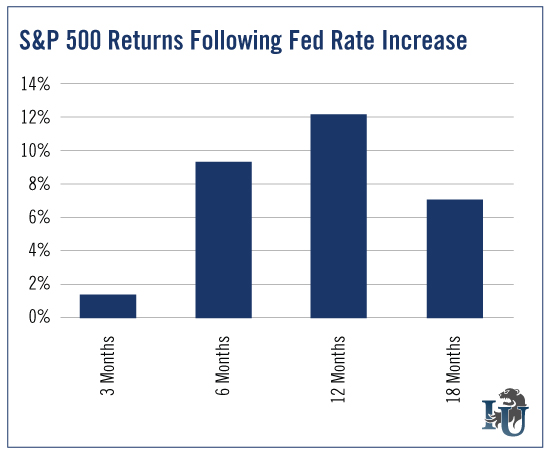

This week’s chart takes a look at how the market reacted the last six times the Fed increased rates. To make this comparison as accurate as possible, we only looked at increases that came after a rate decrease.

As you can see, history shows that the anxiety surrounding higher rates - and its supposed negative impact on the markets - is unwarranted.

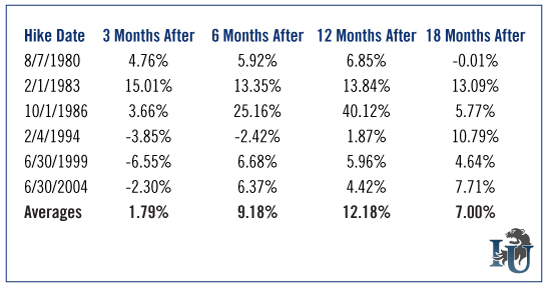

The numbers are broken out in the table below.

In the three-, six-, 12- and 18-month periods after a rate hike, the S&P has averaged positive returns. In fact, a year out, the index is showing more than a 12% gain. So while the initial market drop may seem unnerving, history has shown that it’s followed by a strong rebound.

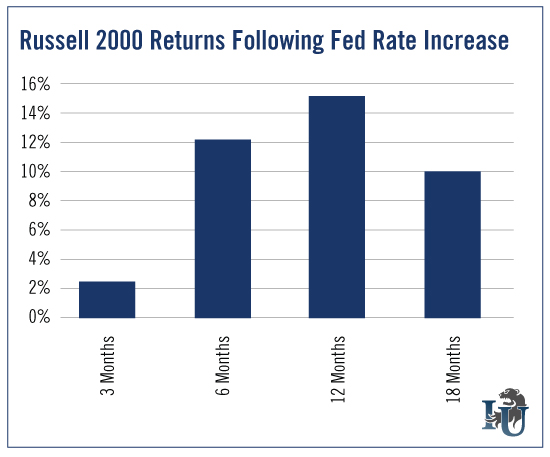

Assuming Yellen is serious about raising rates before year’s end, now is the time to create your shopping list of stocks to buy if there’s a dip. We crunched the numbers, and it looks like small caps may provide the most bang for your buck.

To illustrate our point, we present - you guessed it - another chart.

This one shows the performance of the Russell 2000, which tracks the performance of small cap stocks following a rate hike. You can play it directly through the Vanguard Russell 2000 ETF (NASDAQ:VTWO). Amazingly, one year after a Fed increase, you’re looking at an average return of 15.60%.

Of course, no one can know for sure what the next rate hike will bring. But at Investment U, we prefer to use history as our guide. And right now, history tells us a rate hike wouldn’t be all that bad - especially if you know how to play it.