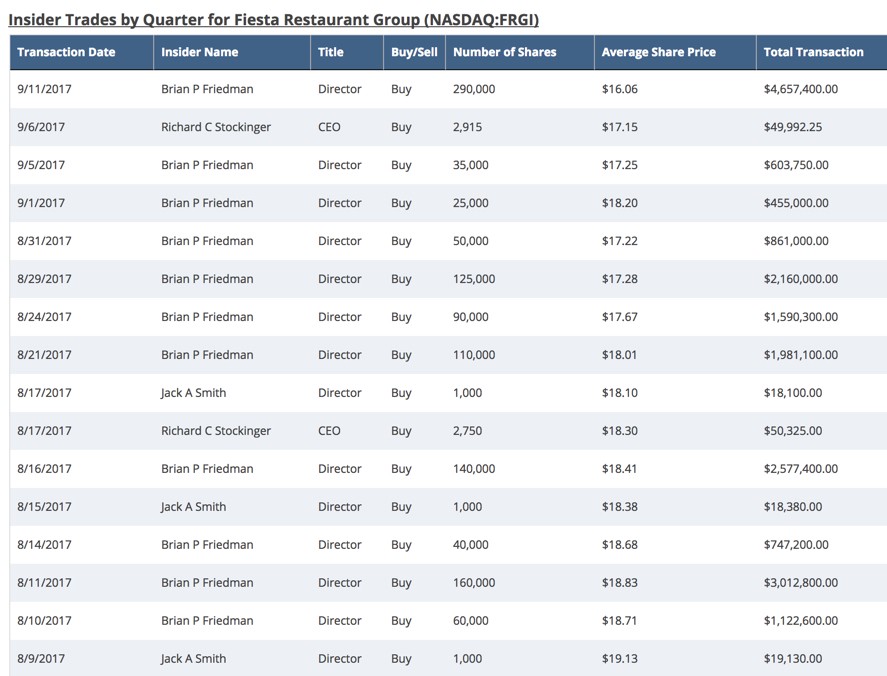

Brian Friedman, a board member of Fiesta Restaurant Group (NASDAQ:FRGI), bought 290,000 shares of the company worth a total of $4.7 million on Monday, September 11th. Friedman, through Leucadia National Corp (NYSE:LUK) where he serves as President, now owns 2,406,295 shares Fiesta Restaurant Group worth approximately $40.8 million.

According to Market Beat, company insiders have bought roughly $20 million worth of shares since August 9th (approximately 4.5% of the company’s current market capitalization).

Shares Fiesta Restaurant Group last traded at $17.35 as of Tuesday, September 12, approximately 51.9% of its 52 week high. The stock is down 45% year-to-date, 35% over the last year and 66% over the last three years. More recently, shares of the company have been hit by Hurricane Harvey as 27% of the company’s Taco Cabana restaurants are located in Houston. While shares of the company have performed poorly, could the insider buying activity signal a promising road ahead?

The Fiesta Restaurant Group owns, operates, and franchises fast-casual restaurants. It operates its fast-casual restaurants under the Pollo Tropical and Taco Cabana brand names. The company’s Pollo Tropical restaurants offer various Caribbean inspired food, and Taco Cabana restaurants offer a selection of Mexican food. As of January 1, 2017, it had 177 company-owned Pollo Tropical restaurants, 166 company-owned Taco Cabana restaurants, and 29 franchised Pollo Tropical restaurants in the United States and abroad. The company was incorporated in 2011 and is headquartered in Dallas, Texas.

Analysts covering the stock often compare the company to a peer group that includes Biglari Holdings Inc (NYSE:BH), BJs Restaurants Inc (NASDAQ:BJRI), Bojangles Inc (NASDAQ:BOJA) and El Pollo Loco Holdings Inc (NASDAQ:LOCO). Analyzing Fiesta Restaurant Group’s valuation metrics and ratios provides further insight into why insiders may be buying shares.

Potential Reasons For Insider Buying

We define fundamental metrics and present charts below that may help explain why insiders are buying shares.

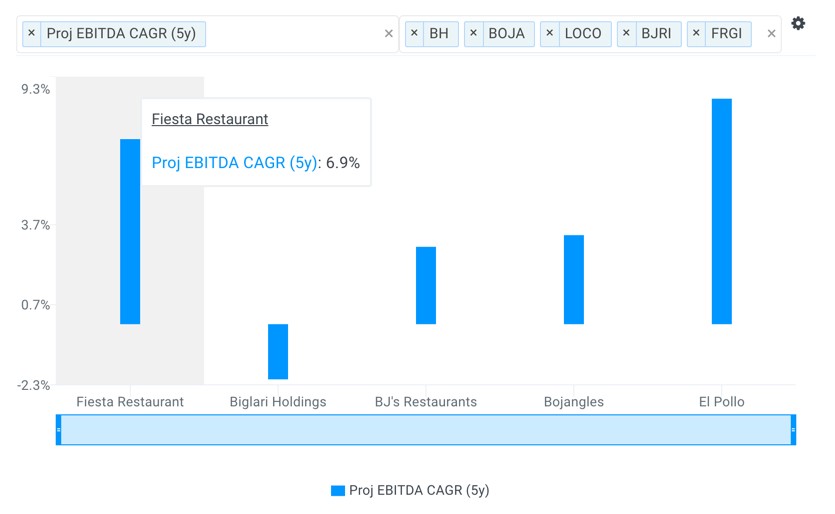

EBITDA is defined as Earnings before Interest, Taxes, Depreciation, and Amortization. It is a commonly used metric in valuation as a proxy for operating profitability because it provides a cleaner picture of overall profitability, especially when benchmarking against comparable companies. This is because it ignores non-operating costs that can be affected by certain items such as a company’s financing decisions or political jurisdictions.

Projected 5-year EBITDA CAGR is the average annual growth rate of EBITDA over a five year period. It’s calculated as follows: 5yr CAGR = [ EBITDA FY+5 / EBITDA FY ] ^ (1/5 years) - 1. The chart below plots the five year EBITDA compounded annual growth rate for Fiesta Restaurant Group and its peers.

source: finbox.io

Going forward, analysts forecast that Fiesta Restaurant Group,’s EBITDA will reach $85 million by fiscal year 2021 representing a five-year CAGR of 6.9%. The company’s projected 5-year EBITDA CAGR is slightly below LOCO (8.4%) and well above BH (-2.1%), BJRI (2.9%) and BOJA (3.3%).

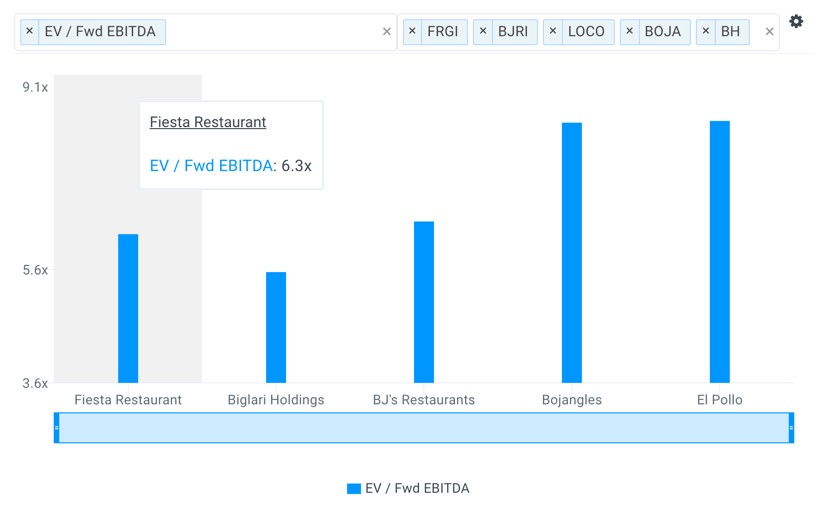

Typically, companies expected to grow at a higher rate relative to their peers will also trade at higher valuation multiples. However, Fiesta Restaurant Group’s forward EBITDA multiple of 6.3x is only above BH (5.7x) and below BJRI (6.4x), BOJA (8.2x) and LOCO (8.1x) as illustrated below.

source: finbox.io

The fundamental charts above indicate that the company’s stock may be trading at a discount while insiders are likely adding shares while the company’s valuation is relatively low compared to its peer group. Value investors may want to look further into Fiesta Restaurant Group.