Jorgen Randers published a book in 2012 called 2052: A Global Forecast for the Next 40 Years. A note on the front says, “A report to the Club of Rome, Commemorating the 40th Anniversary of The Limits to Growth.”

If we compare the new book to the book from 40 years ago, we see some surprising differences. In 1972, the analysis suggested that serious resource depletion issues would occur about now–the first part of the 21st century. In comparison, current indications look much better. According to Randers’ current analysis, world GDP growth will continue to rise through 2050, and energy consumption will continue to grow until 2040. While a decline in oil supply will take place, it will not occur until 2025. When it does happen, it will occur sufficiently slowly and incrementally that other fuels can replace its loss, apparently without disruption. Renewables will ramp up far more rapidly in the future than to date.

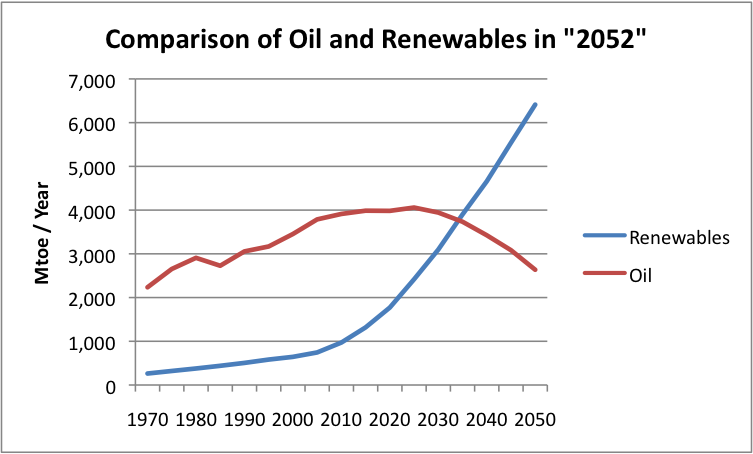

Figure 1. Comparison of oil and renewables forecast in 2052, based on spreadsheet from

A person reading the front cover of 2052 might think that the model is quite close to the model used in the original The Limits to Growth analysis. My review indicates that the current model is fairly different. The book talks very little about the workings of the model, so doesn’t let us know what changes have been made.

It is possible to do some detective work regarding how the current model is constructed. Dolores “Doly” Garcia, who worked on the model, wrote three posts published on TheOilDrum.com explaining the model. There is also a website (www.2052.info) provided by Randers giving the numerical output of the model in spreadsheet form. Together, these point to a methodology which assumes that if world oil supply declines, the decline will be slow and will be quickly offset by a rise in the use of renewables, coal, and natural gas. Changes in the model, which I will describe further in another section, are the first reason I don’t believe Randers’ Limits to Growth forecast.

A second reason why I don’t believe Randers’ forecast has to do with limitations of the original forecast. These limitations did not make much difference back in 1972, when researchers were trying to estimate approximate impacts 40 or 50 years later, but they do now, when resources are becoming more depleted. One issue omitted is from the model is a price mechanism. A related issue is that there is no true calculation of demand, based on what consumers can afford. The model also omits debt, and the role debt plays, both for investment purposes and in order for consumers to afford products made with oil and other energy products. Research regarding past collapses indicates they were financial in nature–the model should not overlook this important issue.

A third reason why I don’t believe the forecast in 2052 is because a model of this nature necessarily cannot model events that are important to ultimate collapse, but which happen on a smaller scale, and trigger cascading failures. An example might be oil depletion in Egypt, Syria, and Yemen. All of these countries were at one point oil exporters. They each now have substantial financial problems because of the loss of oil exports. The population each of these countries has now grown, so there are now many more mouths to feed. Unfortunately, without oil exports, the financial situation is such that it is not possible to provide the level of food subsidies and other benefits that an oil exporter can provide. The result seems to be serious civil disorder that threatens to spread beyond the these countries’ own borders. The 1972 Limits to Growth book warned readers that the report likely missed issues of this nature. The current book lacks such caveats.

A fourth issue is that the 2052 report is very much the work of a single individual, Jorgen Randers, while the earlier report was a committee report. Randers makes statements in the book that make it sound like he already knows the answer before he does the modeling. On page 61, he says,

I basically believe that we will see the same rate of technological and societal change over the next forty years as we have seen over the last forty years. That is because the drivers will be the same and the organization of global society is unlikely to change discontinuously.

Thus, Randers tells us he believes that he already knows that no swift change will take place. That is fine–unless the belief is based on a misunderstanding of real relationships.

On page 56, in a section called “The Deterministic Backbone,” Randers explains that some variables including population, industrial infrastructure, energy consumption, and GDP growth change very slowly, over periods of decades. With this view, methods are chosen so that none of these can change very quickly.

Oil Drum Posts by Dolores “Doly” Garcia

Dolores “Doly” Garcia published three posts on The Oil Drum related to versions of the model she was working on that ultimately was used in 2052. These posts are

A New World Model Including Energy and Climate Change Data (April 3, 2009)

New World Model – EROEI issues (Aug. 24, 2009)

An alternative version for three of the “key graphs” in IEA’s 2010 World Energy Outlook (July 7, 2011)

In these posts, especially in New World Model – EROEI issues, Garcia explains why world energy supply now falls much more slowly than in the 1972 Limits to Growth scenarios. In her words, these are the three reasons:

- Renewable energy sources

- The decline of non-renewable energy sources follows a logistic curve. The exact equation is:Increase in production = 0.2*(fraction of fossil fuel remaining-0.5)*current production. . . .

- Switching from some energy sources to others makes for a gentler, staged decline.

EROEI has only an effect on this last point, in that it’s the cause that drives the switching from one energy source to another.

What Doly Garcia is writing about is not exactly the model that is used in 2052–in fact she gives a range of outputs. But looking at the data from the spreadsheet associated with 2052, it is clear that some approach similar to this is being used. Using the revised approach, oil supply now declines relatively slowly, from an assumed peak in 2025 (Figure 1 and 2) and other fuels (coal, natural gas, renewables) rise in consumption relatively more quickly than in reports published by other forecasters (IEA World Energy Outlook, BP Energy Outlook, Exxon Mobil- A view to 2040). As noted in Figure 1 above, renewables ramp up very quickly.

Figure 2. Energy Consumption to 2050, based on spreadsheet data from

Assuming that oil supply will follow the logistic curve on the down-slope, as well as assuming easy switching among fuels and a rapid ramp-up of renewables is basically assuming a best-possible outcome. It is basically assuming that a shortfall of oil won’t be a problem, because there will be a way around it–substitution and new fuel sources, until investment capital runs short.

I recently wrote a post recently called Stumbling Blocks to Figuring Out the Real Oil Limits Story, in which I talked about the common (incorrect) belief of many that M. King Hubbert claimed the downslope of world oil supply would follow a slow curve, such as the logistic. As far as I know, he claimed no such thing. When population has risen because of the use of these resources, even a slowdown in supply is a huge problem, as we recently witnessed with the Great Recession that accompanied the 2008 run-up in oil prices.

There are some situations where such a logistic curve might be appropriate, for example, if we can make electric-plug in cars as cheaply as oil powered cars, and we don’t need to change over to plug-in electric cars until the oil-powered cars wear out, so we don’t have extra costs. But in general, there is no reason to expect a logistic curve on the decline. What I said in the post linked above is

If there is not a perfect substitute for oil or fossil fuels, the situation is vastly different from what Hubbert pictured. If oil supply drops (perhaps in response to a drop in oil prices), the world economy must quickly adjust to a lower energy supply, disrupting systems of every type. The drop-off in oil as well as other fossil fuels is likely to be much faster than the symmetric Hubbert curve would suggest.

In the above discussion, Doly Garcia mentions that the distribution of energy is determined based upon Energy Return on Energy Invested (EROEI). These are values calculated by Dr. Charles Hall and various others, with respect to the amount of energy needed to create new energy, with the idea that the types of fuels that need relatively less energy for new production will be exploited first.

The danger in using this approach is that a person can push off assumptions into variables in models without any real analysis as to whether such increases make sense in the real world. For example, hydroelectric is mostly built out in the US, and it is our largest source of renewable energy. Unless analysis is done using disaggregated data, with some tests for reasonableness, one can get very much overstated renewable energy estimates.

Financial Issues that the Model Misses

The model, when it was originally constructed in 1972, was more a model of amounts of industrial production and amounts of pollution, and numbers of population. It did not include much of an analysis of the economy, other than investment and depreciation, and these may have in fact been in units of production, rather than as monetary amounts. The new model has something called GDP (which Doly Garcia says she added), and something which is called “demand,” based on an estimate of the quantity of energy products which people might use, but which does not correspond to what people can actually pay for, (which is likely quite different).

Recent research (Secular Cycles, by Peter Turchin and Surgey Nefedof) suggests that when civilization collapsed in the past, it was generally for financial reasons. A shortage of resources per capita led to increasing wage disparity, with falling wages for the common worker. The government was called upon to provide more and more services (such as bigger armies), leading to a need for higher taxes. The increasingly impoverished workers could not pay these higher taxes, and it was this clash between needed taxes and ability to pay these taxes that brought about the collapse. In such a situation, there was more of a tendency toward resource wars and revolutions, leading to deaths of workers. Workers weakened by poor nutrition because of inability to afford adequate food also had higher death rates from disease.

The fact that we seem to be reaching very similar symptoms gives a hint that resource depletion may, in fact, already being playing a role in the economic problems we are seeing today. Perhaps analyses today should be examining the financial health of countries–the ability of countries to find enough jobs for potential workers, and the ability of these workers to earn adequate wages.

Labor Productivity

Randers assumes that Labor Productivity will continue to grow in the future, but that it will grow at a slower and slower rate, following a linear pattern. It seems to me that this linear pattern in optimistic, once oil starts reaching limits. Human productivity reflects a combination of (a) human effort, (b) the amount of capital equipment people have to work with, and (c) the amount of energy products at the disposal of humans. If there is a shortfall at all in the energy products, we could see a big cutback in labor productivity. Already, countries with intermittent electricity are finding that their production drops as electricity availability drops.

Liebig’s Law of the Minimum

A strong case can be made that a shortage of one energy product will have cascading effects throughout the economy, which is closer to what the original Limits to Growth model assumed. We often talk about Liebig’s Law of the Minimum being a problem. This law says that if a particular process is missing some essential ingredient, it won’t happen. Thus, if delivery trucks don’t have oil, the effects will cascade throughout the system, causing what will look like a major recession. All types of fuel uses will drop simultaneously.

The effect of Liebig’s Law of the Minimum is difficult to model. The existence of this issue is a major reason why models assuming rapid substitutability are likely optimistic.

Conclusion

When reasonable forecasts don’t look good, it is hard to publish anything. A person doesn’t want to scare everyone to death.

We don’t know exactly what thought process went through Jorgen Randers head in putting together this projection. Is this truly Randers best estimate, based on an optimistic view of substitutability, rapid ramp up of renewables, and assumption that no unforeseen problems will come along? Or did he not understand how optimistic the forecast was, perhaps because he was unaware that one cannot count on energy declines to follow a logistic curve? Ugo Bardi instead talks about the Seneca Cliff.

Or did Randers pick his estimate from a range of estimates, knowing full well that it is optimistic, but feeling that this is all the American public can be told? Stranger things have happened in the past.