This last week, we took an important step for client portfolios by eliminating a low-volatility ETF that we have held for over two years now. It was actually one of my favorite positions to own. Not for the fact that it performed above our expectations, but because it allowed us the freedom to stay invested through all the mini-crises that arose during this period.

The iShares MSCI USA Minimum Volatility ETF (NYSE:USMV) is everything I could ask in a core portfolio holding. It is low-cost, liquid, diversified, and most importantly low beta. It was designed to access a subset of stocks from a broad universe with historically smaller price fluctuations than their peers.

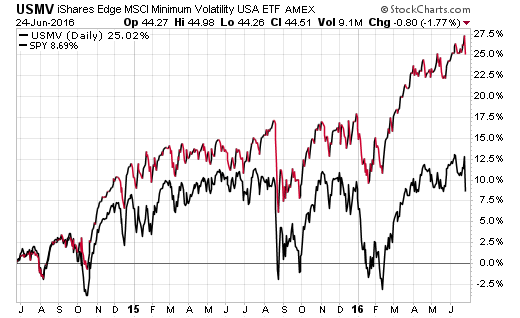

I can say with confidence that this objective has been consistently achieved through real-world experience in the time that we owned it. Furthermore, its performance has far surpassed that of the SPDR S&P 500 ETF (NYSE:SPY) over the last two years.

That fact alone has been its greatest achievement and may ultimately be its Achilles heel.

The divergence in USMV versus the benchmark has become so pronounced that it has pushed the price/earnings (P/E) ratio of this fund to 25.15 as of June 23. That’s a significant premium above the 19.50 P/E of SPY.

We all know that valuations are only part of the story. Things can continue to get more expensive for an indeterminate amount of time as long as they continue to be bid higher. However, it’s a key component in our systematic analysis that can’t be overlooked.

USMV is also currently the third largest U.S.-listed ETF for inflows this year, with $5.8 billion in new money. That has allowed the fund to nearly double its total assets under management to $13.7 billion. There is now a much deeper pool of wealth involved that has owned this fund for a very short period of time.

Additionally, USMV and its peers have now become something of a mainstream topic in financial circles. It is regularly discussed on CNBC, The Wall Street Journal, and Barron’s. Those who love low volatility stocks compare them to bonds or some other risk-adverse asset class. Those who have missed out on this trend scoff at the lofty valuations and decry the performance as unsustainable.

It’s almost as if USMV and its peers have turned into more of a momentum and sentiment trade than a true low volatility option.

In my opinion, the combination of sentiment, fund flows, and valuations means that this fund is less attractive from an intermediate-term performance standpoint. USMV may even be susceptible to enhanced volatility or weak relative correlation if the recent inflows become “hot money” that is quick to head for the exits as they realize they are late to the party.

This may end up something like the “currency hedged” phenomenon of 2013-2015. Everyone piles into a hot trend near the peak, only to realize that 90%+ of the cycle has already occurred. Such are the perils involved in chasing recent performance and why many investors end up with undesirable results.

Rather than wait for this fund to start underperforming our expectations, we have opted to sell it during a period that it is still acting admirably versus traditional stock indices. This allows us to pivot our asset allocation to a combination of more cash and a new fundamentally attractive ETF opportunity.

Even though the new fund may offer higher price volatility in the near-term, it can be mitigated through smaller position sizing and strategic asset allocation choices. This is particularly true for my most conservative income clients.

I would rather be a little early to sell this low volatility fund and miss out on a small period of continued goodwill than have to make a snap decision as its brilliance begins to diminish. In fact, we have been contemplating this move for quite some time and painstakingly weighed the pros and cons of the decision.

A structural change of this nature can’t be quickly executed in good conscience without proper consideration of risk and opportunity.

Lastly, it’s important to remember that I have the flexibility to return to this position at any time in the future. It will always be on my watch list for potential inclusion at a later date and I reserve the right to add it back when everyone hates it.

Lessons Learned:

- All smart-beta, factor, or niche ETFs will experience periods of relative performance distinction.

- We were lucky to share in the performance of low volatility stocks while it lasted.

- Changes of large positions must be properly analyzed to ensure the pros outweigh the cons.

- Don’t fall in love with any investment in your portfolio.

- Don’t chase recent performance – a counter-intuitive mindset is your greatest ally.

Disclosure: FMD Capital Management, its executives, and/or its clients June hold positions in the ETFs, mutual funds or any investment asset mentioned in this article. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities.