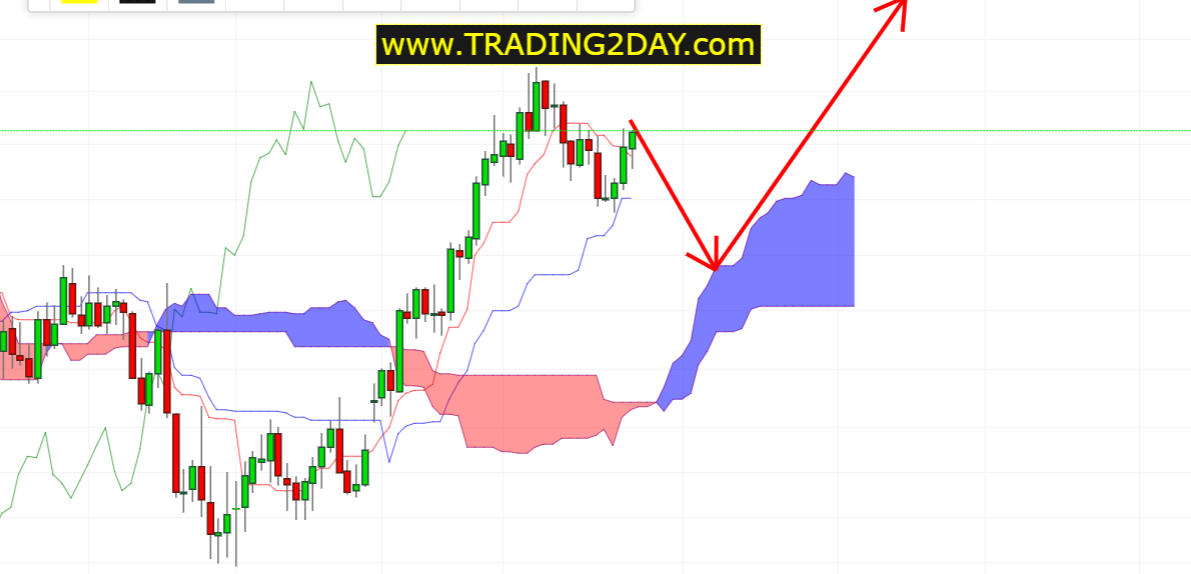

Through my daily analysis in the Dollar Index I have been calling for a reversal while price was testing the 95 price level. Now that the index has fallen back to 93, my alternative wave scenario that the rise from 91 to 95 was only wave A and the move to 93 is wave B, has been moved up to be my primary preference wave scenario. This means that I believe the downward move in the Dollar Index should soon reverse to the upside. Both the index and its major component have made impulsive wave structures favoring the dollar. So the counter trend move against the dollar is part of the corrective phase, but another wave of dollar strength should follow.

The Dollar Index could push lower towards the 61.8% Fibonacci retracement of the entire rise, before reversing higher. This is not necessary but overall I see high probabilities in the bullish dollar scenario so dollar bears should be very cautious from now on. I expect the Dollar Index to reach at least the 38% Fibonacci retracement of the entire decline.

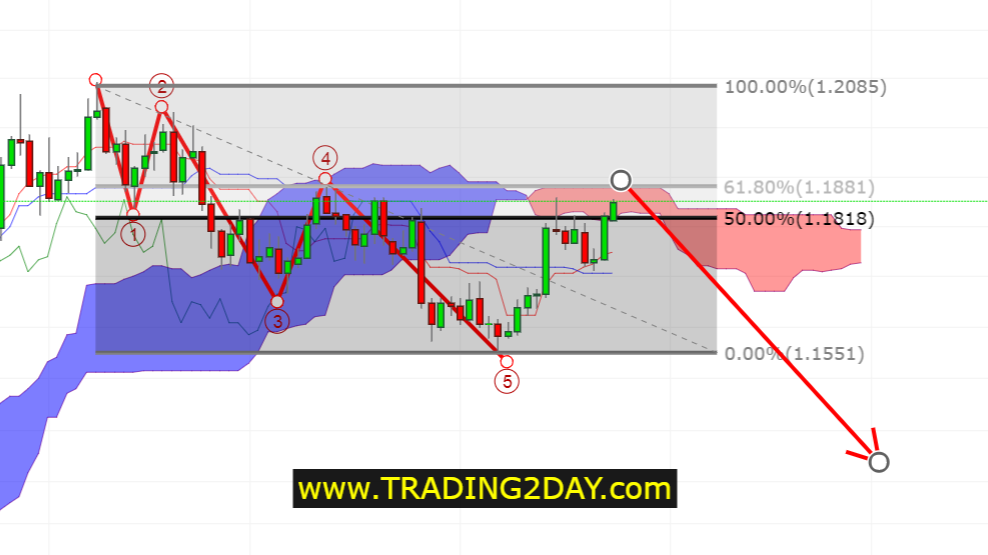

The major component of the Dollar Index is the EUR/USD pair. Price formation in this pair is very similar to the Dollar Index and I believe we can see a move lower towards 1.14-1.13 from around 1.1850-1.1950.

So I’m starting to position myself in favor of the dollar. The only pair where I do not favor the dollar is the USD/CAD where I’m short since 1.28.

Disclosure: None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that June be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions.