USD/JPY" title="USD/JPY" width="651" height="618">

USD/JPY" title="USD/JPY" width="651" height="618">

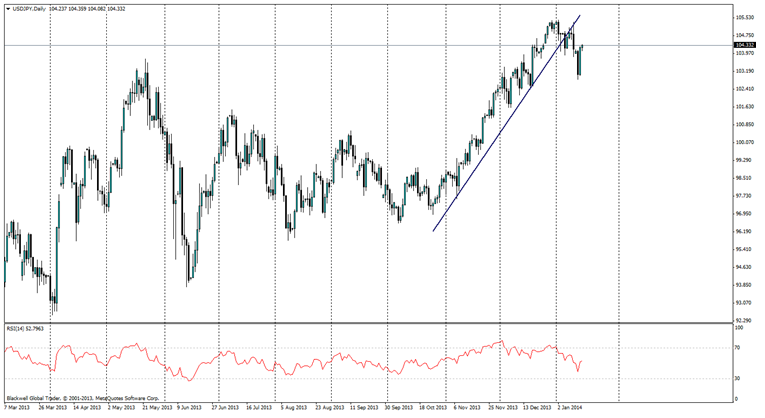

As many market pundits would have noticed in the recent days, the USD/JPY has been jumping around frantically and making big moves on the back of volatile US results, as market forecasts turn out to be off the mark, heavily. Despite all of these movements, it has remained clear though that the USD/JPY pair is up there with one of the most popular trades as of late, in line with GBP/USD and AUD/NZD.

There are several reasons why the USD/JPY is such a popular trade, and that is because of the battle between traders and investors, over whether the USD/JPY is going to push higher in the near term or fall back and consolidate a bit, after such a heavy bull run in the past month.

For the most part, there is a strong belief that it will go higher and there is a lot of credibility to it. The first point is the strong USD as of late. It took a bit of beating on the last nonfarm payroll data release when it came out to 75k, but I believe that is far too low and will likely be restated next month as being higher. With this data, it looked certain we would see a weaker USD, as people expected a weakening to tapering, however, last night we saw the results of retail sales which were predicted to be weaker. Retail sales came in at +0.7%,despite the fears around unemployment that weren’t necessarily true, and it's likely there will be no slow down of tapering.

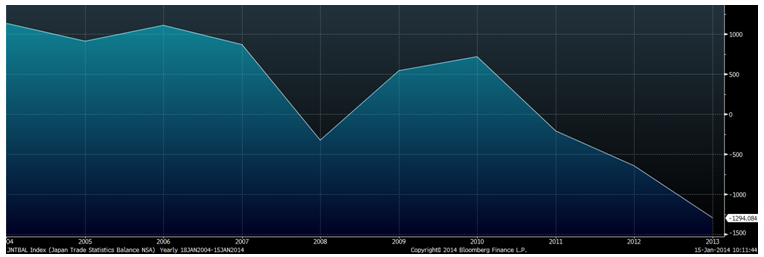

The Yen is a safe haven for many investors and major traders, however in recent months, it has become somewhat more speculative – in part to Abenomics and its effects. But the changes are indeed massive and can be clearly seen. Recently, Japan’s trade balance recorded its largest ever deficit in history as exports were no match for imports. This in turn led to a devaluation in the Japanese Yen, and it's likely we will continue to see such large deficits in the long run as marketsreact to Abenomics.

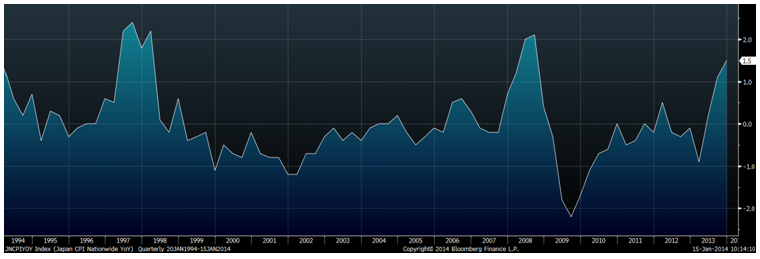

The CPI argument is a strong one for the Yen as well, but looking at data from the last 20 years, we can see that CPI spikes have not been sustained - though extreme effects look to be the only catalysts for past spikes. However, recent data has shown a strong rise in CPI for the Japanese economy, though the real test will be the introduction of tax reforms required to help maintain fiscal responsibility and this will come in the form of a sales tax. Countering this though has been talk that the Japanese government will likely spend the extra revenue on the economy, and that the Bank of Japan is likely to help provide additional stimulus to help with the process of applying the tax.

The overall long term outlook looks likely to be more talk from the government of Japan, and additionally more stimulus from the Bank of Japan to help boost the economy further in the largest economic experiment this year, with this in mind, the point we are at now is certainly not the high we should expect, and in reality highs of 110-120 are more realistic in the near future given how markets have picked up after the New Year break.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Why I’m Still Long USD/JPY

Published 01/15/2014, 07:02 AM

Updated 05/14/2017, 06:45 AM

Why I’m Still Long USD/JPY

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.