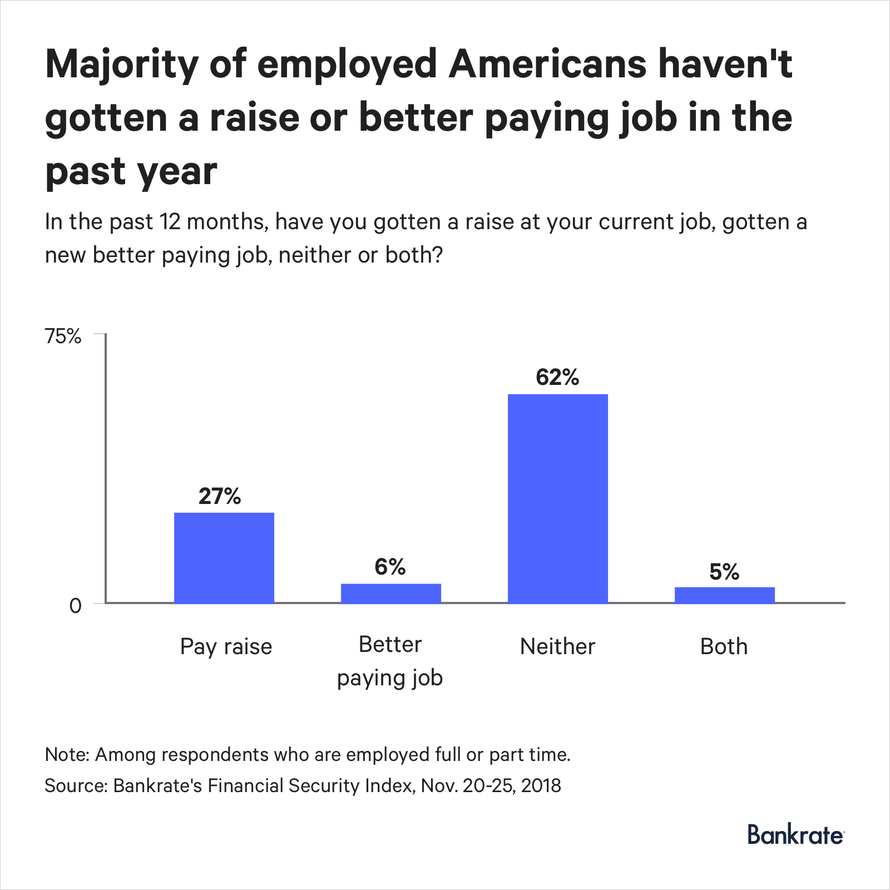

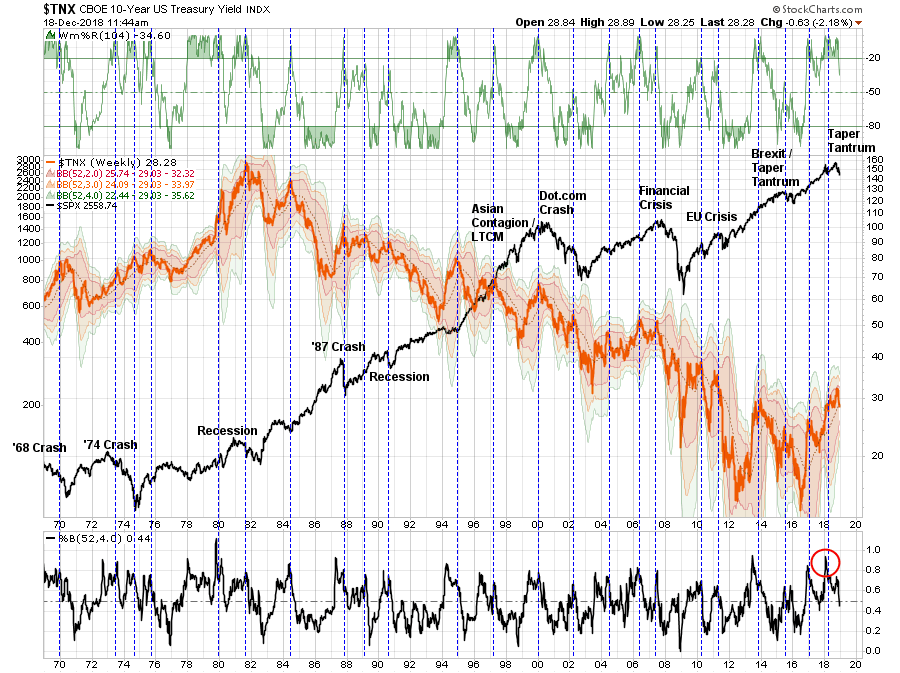

Last Monday, Jeff Gundlach, famed bond fund manager and CIO of Doubleline, made an interesting comment during an interview with CNBC when he stated that the 10-year Treasury yield would top 6% by 2020 or 2021.

6% would be the highest yield since 2000.

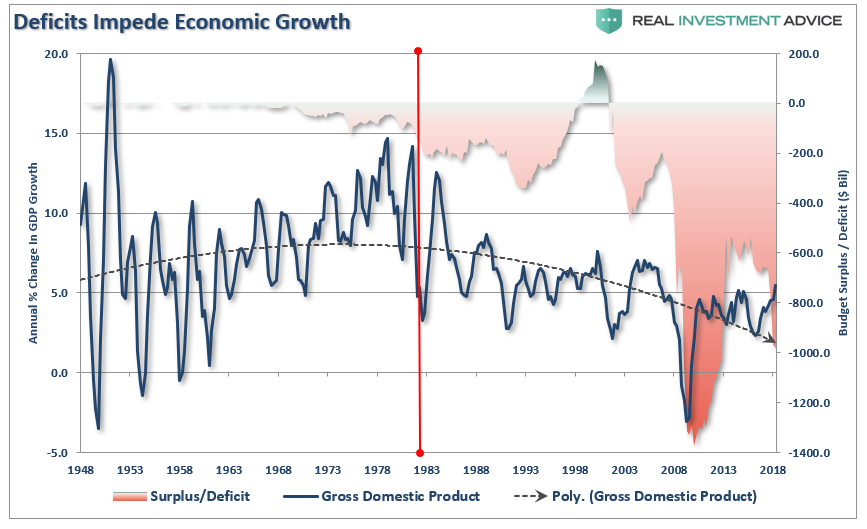

The chart below shows Gundlach’s estimated yield as compared to the long-run range of economic growth. (Note that real GDP growth was running at 5.27% in 2000 as compared to 3.0% today which is also getting weaker.)

As I discussed last week, interest rates are a function of the economy. So, while Jeff suggests that yields are rising to 6% in the next couple of years, such would suggest an extremely strong rebound in economic growth. Unfortunately, there is no evidence currently of a major upturn in economic growth due to surging deficits, debts, demographic, and employment trends. Further productivity trends mean such an upturn in economic growth could only come from a massive surge in debt. Is that likely to happen given our indebted state already?

The biggest problem with rising rates is the negative impact from higher borrowing costs. Given that consumption makes up 70% of economic growth, and that consumers are heavily indebted, a change in rates has an immediate impact to consumption. Take a look at the chart below of the Total Housing Activity Index versus 30-year mortgage rates.

But it isn’t just housing, but everything from automobiles to iPhones. When interest rates rise to a point to where the consumer can no longer afford the payment, the buy decision changes to either a lower priced product or a postponement of the purchase. More importantly, the change to the purchase mentality (either reduction or postponement) specifically slows the rate of economic growth.

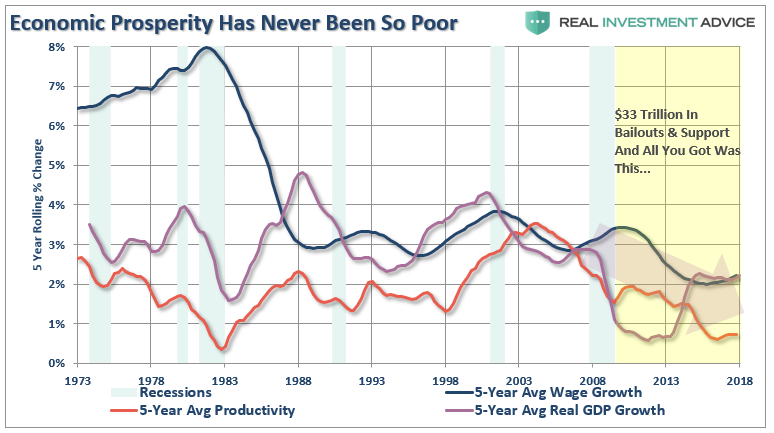

Given the structural backdrops to the economy, there is an inability to substantially increase rates of productivity, output, wage growth, savings, or consumption, which would lead to stronger rates of economic growth. In fact, we are currently running some of the weakest rates of economic growth, productivity, and wages on record.

The annual rate of economic growth back in the late 70s, early 80s, was between 6 and 8 percent. Today, the long-run outlook for the economy is closer to 2% which is the terminal result of a 40-year long debt-driven expansion. Given that long-run projections of economic growth are between 1.5-2.5%, such means that the 10-year Treasury should run at about the same level. It is simply not feasible for rates to levitate to 4, 5, or 6% when economic growth is unable to support higher rates. Inflation, interest rates, wages, and economic growth are all tied to the consumer.

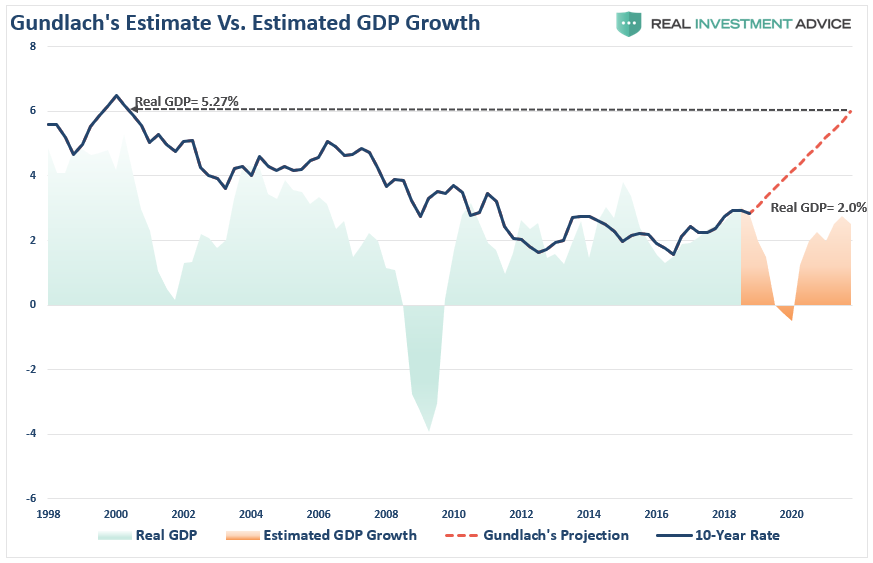

And the consumer is pretty much tapped out as credit card debt hits all-time highs and most Americans say they didn’t get a pay raise at their current job, or start a better paying job, in the last 12 months, according to a Wednesday survey from Bankrate.com.

“According to the poll, 62% of Americans report not getting a pay raise or better paying job in the past year – up from 52% last surveyed last year. That said, just 25% of respondents in this year’s survey said they would look for a new job in the next year.”

It’s The Deficit

So, if economic growth is going to remain weak, then what other reason would cause rates to rise?

Jeff made a valid point about the issue of the deficit suggesting such will ultimately be the catalyst for rates to rise.

This is a topic I have discussed much previously:

“While the markets have been the beneficiary of the tax cut legislation, which gave a short-term boost to corporate profitability, the economy has enjoyed a boost from the massive increases to spending from what should have been more aptly termed the ‘Bipartisan Non-Budget Act of 2018.’ Notice in the chart below the pickup in economic activity has coincided with a surge in the deficit. Spending on natural disasters and defense spending increases ‘pull forward’ future economic growth which is an illusion of an economic turn.”

“Importantly, surges in budget deficits as a percentage of GDP, are normally associated with ‘recessionary’ activity in the economy. As noted, the increases in Federal spending create a temporary boost to economic growth which supports higher asset prices. Currently, the government is running one of the largest deficits, in both dollar terms, and as a percentage of GDP, in history. This is occurring at a time when the economy is ‘booming’ and deficits should be reduced for the next ‘rainy day.’”

“Furthermore, with sequester-level budget caps returning next year, the budgetary issues in Washington will become even more complicated. The last time budget-caps came into play Ben Bernanke launched QE-3 to offset the economic drag from expected reductions in government spending. However, given the recent track record of the ‘conservative’ Congress, it is highly likely spending will be increased further in the months ahead. Look for an even larger ‘C.R.’ in December when the current resolution runs out.”

Jeff’s point is one that has been made many times previously by others. The basic premise is that as the deficit expands, it will require more debt to be issued. The problem comes when the demand to purchase that debt does not keep up with the supply. Up to this point, America has been fortunate to maintain its role as the world’s reserve currency which means foreign nations hold Treasuries in their reserve accounts. But, as Jeff states, there are many countries now looking for an alternative. The problem for America comes as the status of “reserve currency” diminishes.

I both agree and disagree with Jeff on this point.

I agree that other countries are looking for alternatives to the dollar as a reserve currency. However, there are two primary reasons why this will likely not be a real threat soon:

- If you are any other country where are you going to store your reserve currency: China, Russia, India, Brazil, the Eurozone? Many of these economies are corrupt, weak, too small, or a combination of all three.

- When global investors are seeking “safety” from “risk,” where are they going to go?

Both of these reasons have the same foundations:

- Liquidity: the U.S. Treasury market is vastly deep and can support billions in transactions without a major dislocation.

- Safety: despite all of the flaws in the U.S., it is still the safest country in the world to conduct business with. While there are certainly many issues, the “rule of law” in the U.S. still provides a relative level of safety for storing capital not found in other countries.

- Return: the rate on U.S. Treasuries is high enough to attract capital from other areas as a “safe” store of value.

- Dollar Value: the rising U.S. dollar is attracting capital flows from weaker currencies and economies.

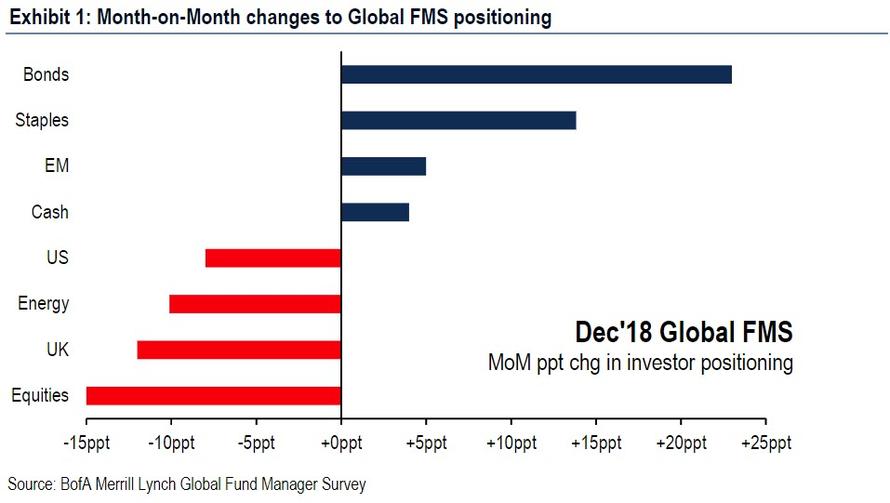

I have repeatedly stated that when the market rout gets bad enough, money will flow into the “safest of havens” – the U.S. Treasury. Over the past month, this is exactly what happened.

“As a result of this pre-deflationary deluge, investors have flooded into bonds and out of stocks, while within equities there were large moves into defensives via energy and tech into staples and utilities. More importantly, this month’s survey found the biggest ever one-month rotation into bonds class as investors dumped equities around the globe while bond allocations rose 23ppt to net 35% underweight….”

Jeff’s premise is that with all of the new debt needing to be issued by the government to fund their ongoing fiscal largesse, there is a risk that “our neighbors” will not be “gracious lenders” in the future. As such, the “dollar funding” issue causes rates to soar higher until “buyers” can be found.

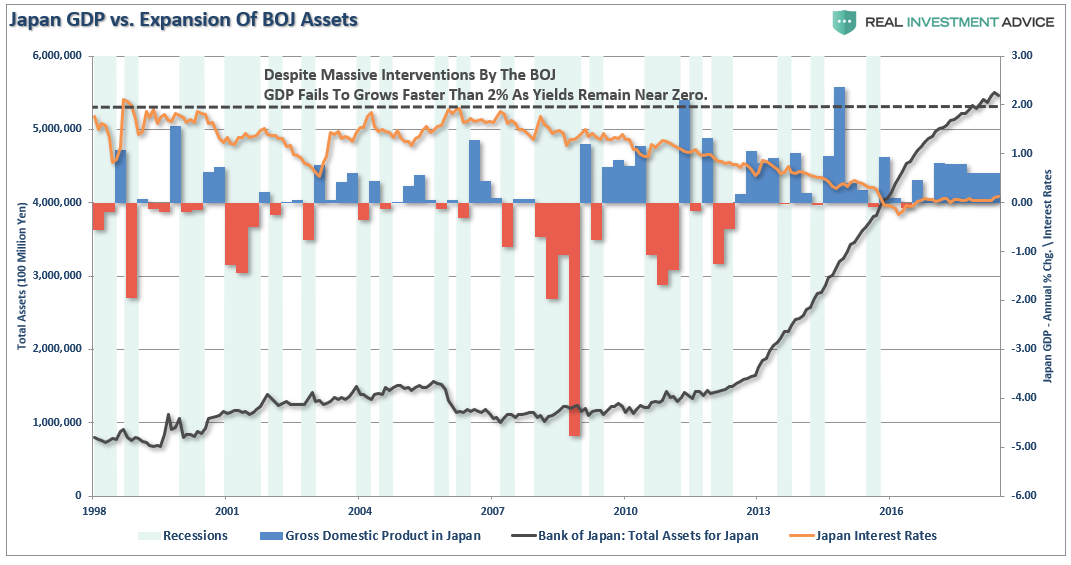

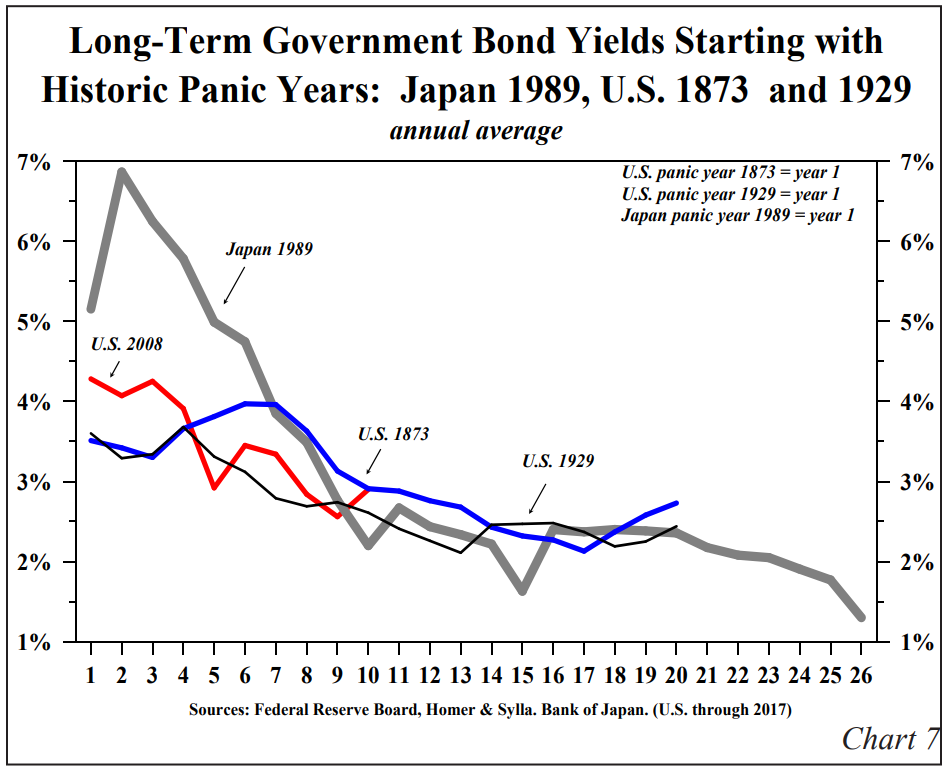

While I am certainly not denying such is indeed the risk. There isn’t a lot of historical precedents that such is the case with a mature, strong, industrialized country. Japan, as an example, is vastly indebted with a soaring budget deficit, weak economic growth, and does not maintain a “reserve” currency status. Yet, after 30-years, interest rates have failed to rise.

Notice that since 1998, Japan has not achieved a 2% rate of economic growth.

Even with interest rates still near zero, economic growth remains mired below one-percent, providing little evidence to support the idea that inflating asset prices by buying assets leads to stronger economic outcomes, or that rising budget deficits means higher rates.

The real risk to the domestic economy is that Jeff is right.

If interest rates do rise sharply it is effectively “game over” as borrowing costs surge, deficits balloon, housing falls, revenues weaken and consumer demand wanes. It is the worst thing that can happen to an economy that is currently remaining on life support.

Japan, like the U.S., is caught in an on-going “liquidity trap” where maintaining ultra-low interest rates are the key to sustaining an economic pulse. The unintended consequence of such actions, as we are witnessing in the U.S. currently, is the ongoing battle with deflationary pressures. The lower interest rates go – the less economic return that can be generated. An ultra-low interest rate environment, contrary to mainstream thought, has a negative impact on making productive investments and risk begins to outweigh the potential return.

More importantly, while there are many calling for an end of the “Great Bond Bull Market,” this is unlikely the case for two reasons.

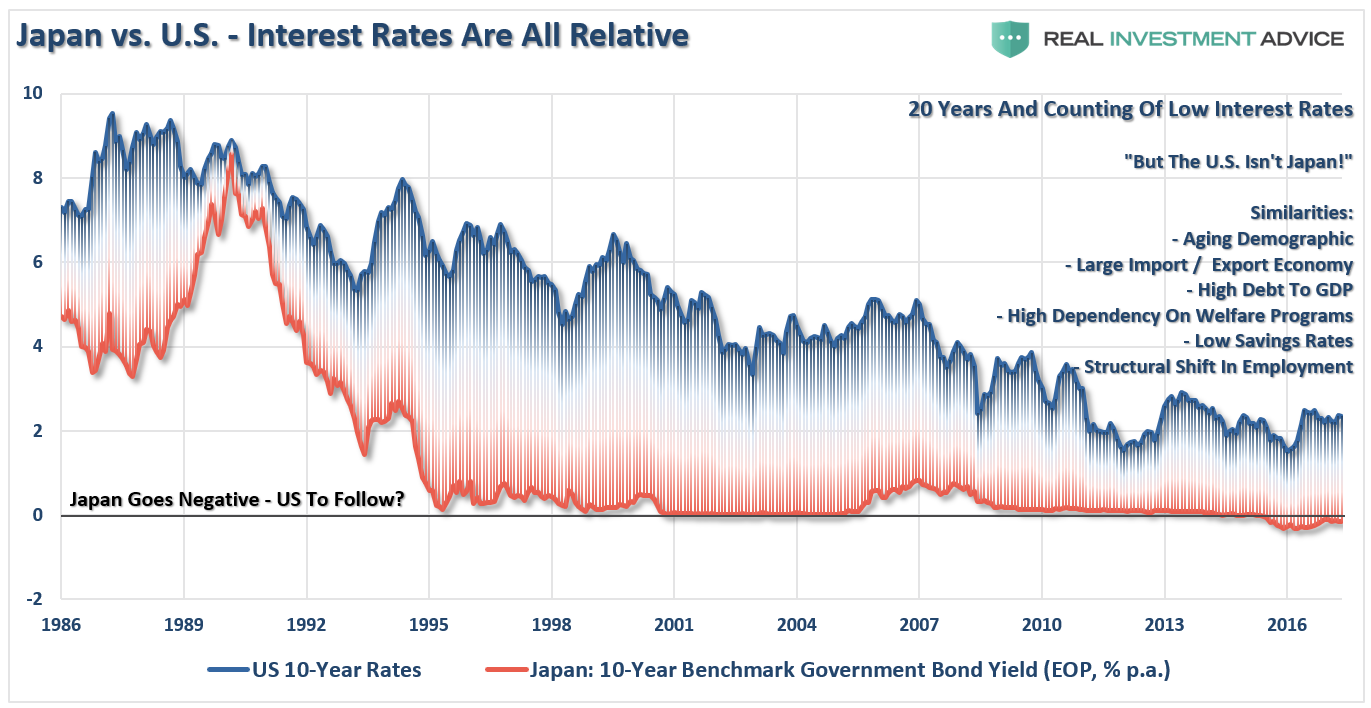

- As shown in the chart below, interest rates are relative globally. Rates can’t rise in one country while a majority of global economies are pushing low to negative rates. As has been the case over the last 30-years, so goes Japan, so goes the U.S.

- Increases in rates also kill economic growth which drags rates lower. Like Japan, every time rates begin to rise, the economy rolls into a recession. The U.S. will face the same challenges.

Unfortunately, for the current Administration, the reality is that cutting taxes, tariffs, and sharp increases in debt, is unlikely to change the outcome in the U.S. The reason is simply that monetary interventions, and government spending, don’t create organic, sustainable, economic growth. Simply pulling forward future consumption through monetary policy continues to leave an ever-growing void in the future that must be filled. Eventually, the void will be too great to fill.

Where Are Rates Headed In 2019

So where are rates headed. Dr. Lacy Hunt of Hoisington Investment Management had a good take:

“The U.S. economy appears to be on a steadily declining path to recession and disinflation/deflation. This may seem improbable in the face of record year-over-year growth in nominal GDP over the past decade.

Significantly, U.S. monetary restraint has caused a similar slowdown in local currency money growth around the world. Additionally, velocity in Japan, the Euro area and China has been declining secularly since the late 1990s, as debt has become increasingly less productive. Since money times velocity (i.e. its turnover) determines GDP in all countries, this cumulative global economic slowdown should impact U.S. economic activity.

From the standpoint of an investment firm that started in 1980, when 30-year bond yields were close to

15%, the current 30-year treasury rate at 3% seems ridiculously low. In the near future, at 1.5%, the 3% yield will seem generous ”

I agree.

Currently, interest rates are at a level that has historically led to some sort of event. Whether it was economic, financial, or both, there is no real precedent which suggests rates could rise another 3% from here without severe ramifications. Of course, as the market declines, the demand for “safety” would ultimately push rates lower.

At some point, the Federal Reserve is going to step back in and reverse their policy back to “Quantitative Easing” and lowering Fed Funds back to the zero bound.

When that occurs, rates will not only go to 1.5%, but closer to Zero, and maybe even negative.