Growth stocks can be some of the most exciting picks in the market. Not only do these types of stocks captivate investors’ attention, but they’re known for producing big gains as well. However, these types of equites can easily lose momentum when a growth story ends, so it’s vital to find companies still experiencing strong growth prospects in their business.

One company that investors should pay attention to is PayPal Holdings (NASDAQ:PYPL) . PayPal is an online payment service that lets individuals and businesses transfer money electronically; the company also owns Venmo, a mobile, peer-to-peer money transfer service similar to Square’s (NYSE:SQ) Square Cash and Alphabet’s (NASDAQ:GOOGL) Google Wallet, but with a social media spin.

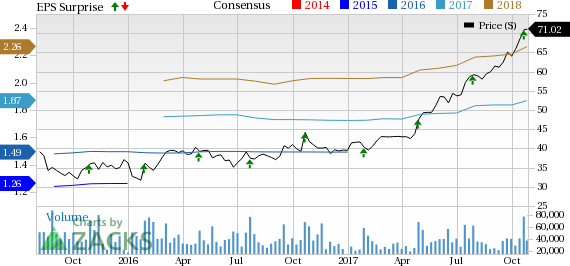

PayPal, which is in the Internet-Software industry, reported EPS growth of over 16% last year. This past quarter, earnings of 46 cents per share beat our consensus estimate and grew over 31% year-over-year; the company’s overall impressive results led to a raise in full-year guidance for both earnings and revenues.

The rest of this year looks promising, with current growth estimates for fiscal 2017 calling for about 25.5% EPS growth; PayPal expects long-term earnings growth of 17.5%. The stock has seen estimates rise over the past month for the current fiscal year by 1.14%, while 19 analysts have revised their estimates upwards for the same time compared to none lower.

Investors looking for a fast-growing stock that still has plenty of opportunities on the horizon, make sure to consider PYPL. Thanks to this rise in estimates, PayPal is a Zacks Rank #2 (Buy), further underscoring its potential. With double-digit earnings growth in its near future and an impressive Zacks Rank, this combination suggests that analysts believe even better earnings days are ahead for the thriving digital payments company.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look. See the pot trades we're targeting>>

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Square, Inc. (SQ): Free Stock Analysis Report

PayPal Holdings, Inc. (PYPL): Free Stock Analysis Report

Original post

Zacks Investment Research