There seems to be a lot of misinformation being peddled on the internet about Gold and Bitcoin. One major misconception is the notion that Bitcoin will replace gold as a monetary instrument. Some analysts, once stanch precious metals advocates now turned crypto aficionados, believe in such theories that there is too much gold in the world to be used as money or that it is now just a barbarous relic. Just a year or so ago, these same supposed analysts were criticizing the Mainstream media financial network talking heads for calling gold as a barbarous relic, but now have jumped on the bandwagon.

Well, in one small way, who can blame them. It has been frustrating holding onto gold and silver patiently waiting for their inevitable rise. So, when Bitcoin and the crypto prices moved up exponentially last year, promising investors vast riches in the future, it was easy for many to drop the precious metals and move into the crypto market. The mindset today is to make lots of money doing nothing. Thus, it’s not surprising to see many fall into this delusion and way of thinking.

A few of the crypto aficionados tell their followers that gold can’t be a monetary asset because there are millions of tons of gold hidden in secret vaults or that there are billions of ounces locked away in the Grand Canyon. While this may sound like quite an interesting conspiracy, there is no sound evidence to back it up. To believe in these fanciful conspiracies defies all logic. However, with the logic being in short supply currently, I am not surprised that many believe in these fairy tales.

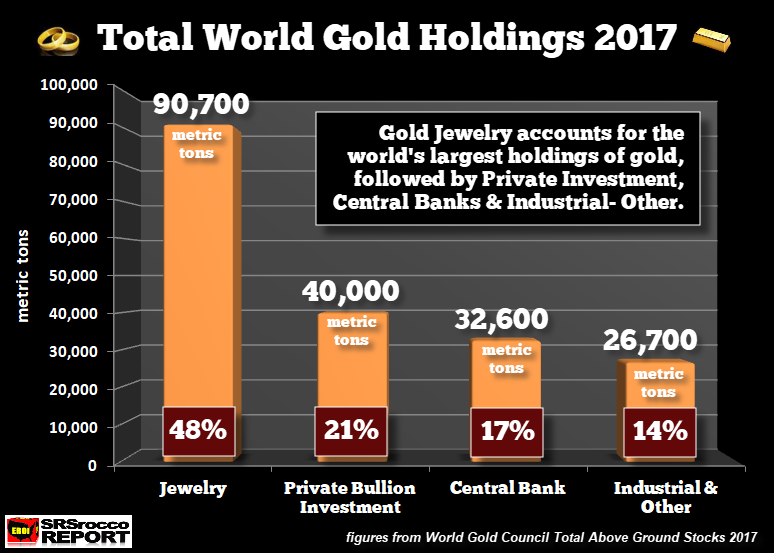

One of these ex-precious metals, now a highly qualified cryptoanalyst, suggested in a recent video that the “Gold is owned by the Bankers” so why would you want to own gold? Unfortunately, this is a false statement. While the Central banks own a lot of gold, it’s a lot less than what the private investors and jewelry owners hold. According to the World Gold Council, jewelry accounted for the largest stocks of above ground gold at 90,700 metric tons (mt), followed by 40,000 mt of private investment, 32,600 mt of Central bank holdings and 26,700 mt of Industrial usage and other:

Of the total 190,000 mt of the world above ground gold stocks, jewelry consists of 48%, private investment 21%, Central bank 17%, and Industrial and other at 14% (Source: World Gold Council – Total above-ground stocks 2017) So, if we realize that nearly half of all above-ground gold stocks are in the form of jewelry, and then another 21% is owned by private investors, Central banks DO NOT own most of the gold. Even if we compare private investment to Official holdings, private investors own more gold than Central banks.

Now, to the incorrect theory that there are millions of tons of gold in the world, can someone please tell me where all this additional gold came from?? If we understand that the increase in gold mine production paralleled the rise in silver and copper production, how could there be 10-20 times more gold than copper and silver???

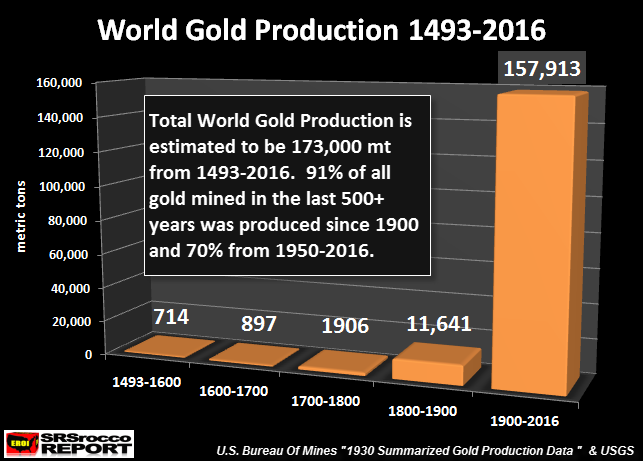

First, most of the gold ever mined was produced after 1900:

According to the best data, we can get our hands on, 91% of all gold mined since 1493 was produced after 1900. Limited records of gold produced before 1493 suggest that wasn’t more than 10,000-15,000 mt.

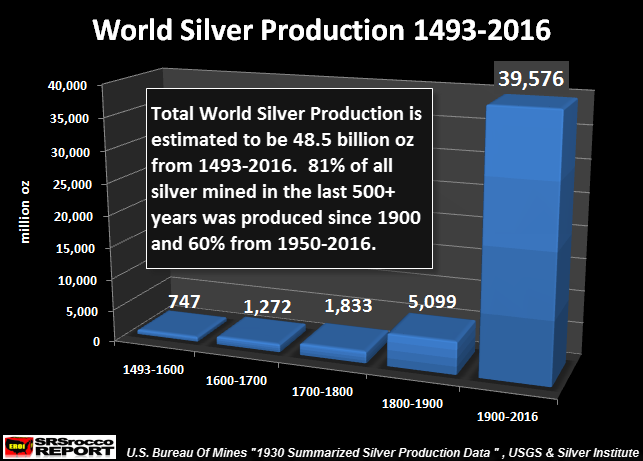

Secondly, if we look at historical world silver production, we see the same pattern:

Of the total 48.5 billion oz of silver mined in the world between 1493 and 2016, 81% of it was produced after 1900. Also, the amount of silver mined annually compared to gold has been about 10 to 1. Assuming that total historical silver production was approximately 55 billion oz compared to 5.7 billion oz of gold, it turns out to be nearly a 10/1 ratio.

For there to be just 1 million tons of gold in above-ground stocks in the world, that would equal 32 billion oz of gold. Considering a 10/1 ratio of silver to gold production, then we should have mined 300+ billion oz of silver, not the 55 billion oz stated by the world authorities.

So, if we understand the logic here, why on earth do people continue to believe in the LOUSY CONSPIRACY that there are millions of tons of gold in the world?? Why, because lousy conspiracies sell a hell of a lot more newsletters and subscriptions than those that put out the facts and fundamentals.

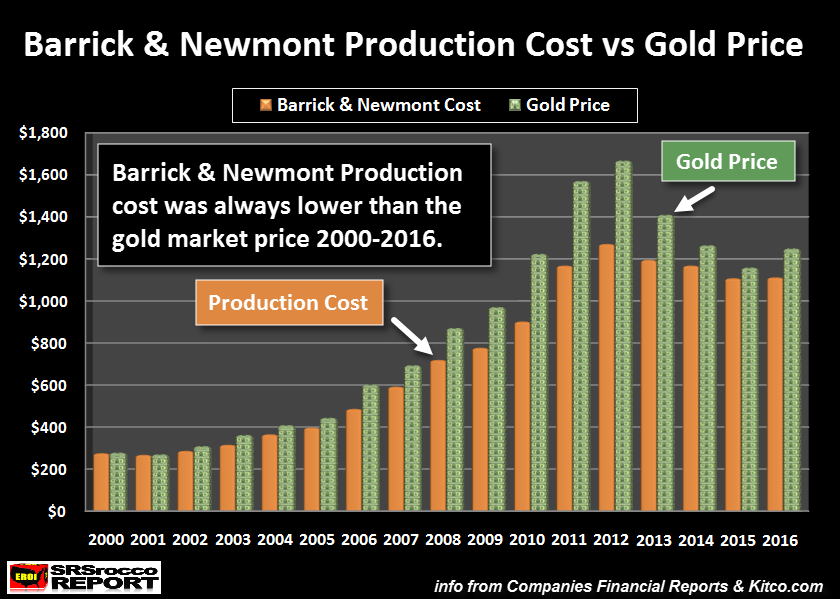

Regardless, Central banks own less gold than above ground jewelry stocks or private investors. While Central banks are controlling the gold and silver prices by funneling 99%+ of investors into stocks, bonds, real estate and cryptos, they cannot manipulate the price of precious metals too far below their cost of production.

Unfortunately, the crypto aficionados do not understand energy or the cost of production as a FLOOR for the gold and silver prices. Which means, the Central banks cannot push the price of gold and silver anywhere they please. What the Central banks CAN DO, is that they can BAMBOOZLE the public in putting their funds into the biggest Ponzi Schemes in history. By funneling the public’s money into stocks, bonds, and real estate, this caps the gold and silver price. This is the manipulation.

Now, the notion that Bitcoin will replace gold as the King Monetary Asset is patently false because Bitcoin fails several important tests. First, Bitcoin trading volatility is too high to be used as a currency. I have heard from several people that using Bitcoin as a payment method is very frustrating because the price can fluctuate $1,000 in a very short time, thus making it a very stressful transaction for both buyer and seller.

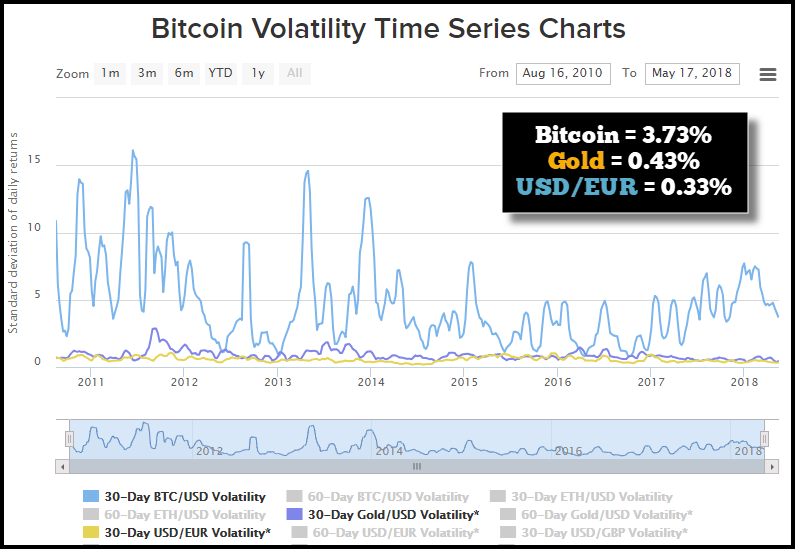

If we compare the volatility of Bitcoin versus gold and fiat currencies, Bitcoin is the clear loser:

Bitcoin’s 30-day volatility of 3.73% is nearly 9 times more gold and 10 times more than the USD/EUR. While Bitcoin’s volatility could continue to decline in the future, it still needs a very high-tech electronic system to allow trade and payment.

Secondly, Bitcoin and cryptos will not function well as the EROI of energy continues to fall, destroying the ability to scale up or maintain high technology. I recently watched a documentary about the Dark Ages on the history channel. After the fall of the ancient western Roman Empire (5th century), people who lived around the once great city in the 6th and 7th century knew that life was better in the past because they saw all these massive buildings and structures, but were now living mostly a peasant’s life.

In just 3-4 generations, people no longer remembered what it was like to live in Rome during its heyday. The great culture, technology, food, and trade of the ancient Roman Empire were gone for good. Most Americans today have no idea what life is like after a collapse of society.

Not only will Bitcoin and the cryptos not survive the coming Falling EROI energy collapse, either will most of the advanced technology. Sure, some technology will be around, but it will claim the same fate as the ancient Roman Empire. For this reason, gold will always remain the KING MONETARY METAL and asset.

Unfortunately, the crypto aficionados do not understand the Falling EROI of energy as they mislead their followers into investing in just another fly-by-night bubble.