Most of the top 50 economies in the world have engaged in one form or another of monetary stimulus since the start of 2009. Halfway through 2014, most still endeavor to keep interest rates low to encourage borrowing by consumers and businesses; nearly all of those countries or regions also hope to fuel exports with modestly depreciating currencies.

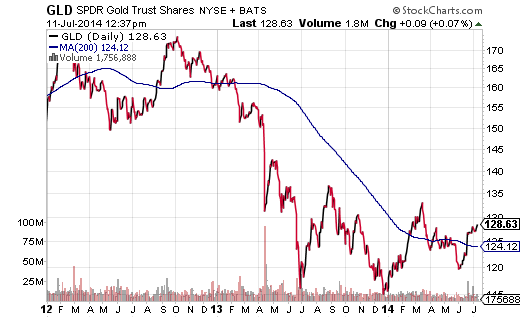

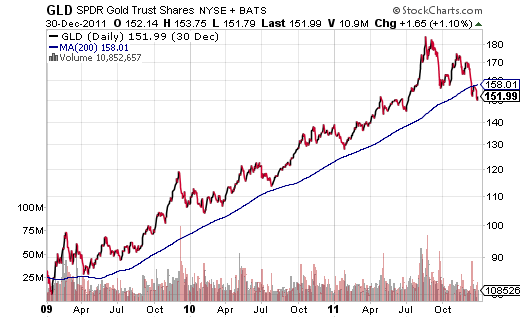

Theoretically, tactics designed to devalue a currency as well as push borrowing rates into the basement should strongly benefit precious metals like gold. And in the first three years of ultra-accommodative policies (e.g., zero-percent overnight lending, quantitative easing, etc.), the SPDR Gold Trust (ARCA:GLD) roughly doubled in price.

Lost on the average precious metals advocate, however, was a three-pronged reality at the onset of 2012. First, China had hit a monumental wall in its growth trajectory, and its demand for metals of all colors began to decline rapidly. In essence, one of the largest pieces of the supply-demand equation had started to bow out.

Second, from the moment that the president of the European Central Bank, Mario Draghi, declared it would do “whatever it takes” to preserve the euro — coupled with the Federal Reserve’s willingness to serve up “open-ended” bond buying with no pre-announced end date — investors overwhelmingly chose risk assets over perceived safer haven assets like gold. Even with the Fed’s tapering, easy money policies will still be in place for years to come, particularly in Japan and Europe.

Third, GLD broke below a long-term moving average at the tail end of 2011. Ever since, the exchange-traded yellow metal tracker has struggled to reassert itself.

Perhaps ironically, if you look back at analyst commentary when the spot price of gold had been closing in on $2000 per ounce, there were far more bullish comments on gold than bearish ones. After 2012’s lackluster showing and 2013’s decimation, though, bearish gold commentary has become the norm. Today, more “cow bell” monetary stimulus has become synonymous with piling into riskier assets. Meanwhile, Fed tapering of its bond purchasing program is now viewed by the majority as confirmation of a robust economy as well as de facto tightening that strengthens the dollar while weakening gold.

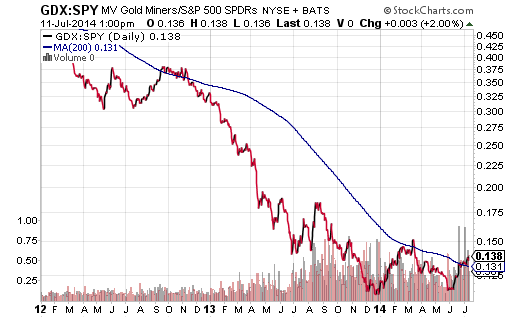

I see things differently. Whereas many believe that China and other emerging markets are unable to get their collective ducks in a row, I anticipate an increase in demand for the yellow metal from emerging regions of the world. Second, the increase in geopolitical tensions from the Russia-Ukraine conflict to the Israeli-Palestinian bloodshed to Syria/Iraq is likely to create greater demand for gold by institutional and individual investors. Third, I look to the gold miners for hints about the future direction of the underlying commodity. And right now, the Market Vectors Gold Miners (ARCA:GDX):SPDR S&P 500 (ARCA:SPY) price ratio is particularly bullish. The double bottom that GDX:SPY experienced — with low points at the end of 2013 and in June of 2014 — tells me that the once-maligned precious metals mining segment is likely to build on its momentum.

The case for junior miners may be even more impressive. For one thing, many carry much lower debt levels than the biggest names. For another, the big boys have been cleaning up their balance sheets to make a run at acquiring the more speculative mining companies. It should also be noted that valuations for miners in Market Vectors Junior Gold Miners (ARCA:GDXJ) are as attractive as they have ever been. (Note: One might also want to pay particular attention to the sharp increase in volume of shares traded since 2014 began.)

You do not need to be a gold bug to appreciate the probability that the gold mining segment may be ready for a sharp upturn; you do not have to be a precious metals proponent to believe that the tide may be shifting on a prized commodity. Perhaps you need little more than a desire to diversify with non-correlated assets. The six month correlation coefficient between GDX and SPY – as well as GDXJ and SPY – is about 0.1%. That’s about as close to a non-correlated asset as one will ever find.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.