We have seen the perfect storm come down on gold and silver this past week with the Fed taper, Congress agreement on the budget for two years and higher than expected GDP, but there is another reason why gold and silver prices are falling. This stems from the year-end tax moves that the big players in the precious metals market, Hedge Funds, Mutual Funds, Banks and Professional Traders, are doing by locking in dollar-for-dollar their losses against gains. The good news is, individuals who own the ETFs such as the SPDR Gold Trust, (GLD) and the iShares Silver Trust, (SLV) can lock in those loss deductions too and convert those paper assets to real wealth by acquiring the physical metal. First, let’s look at what’s going on in the precious metals market.

Gold is experiencing its worst year in 32 years. The media, especially CNBC, loves to harp on gold as much as they can. They ignored the last 12 years straight of gold moving higher, and jump on the bandwagon of gold haters with any downturn. What will they say about gold in the future when it begins to take off again and stocks decline? What would cause such a scenario to occur again? See here.

The “perfect storm” I speak of was the following:

1. The Fed is doing a $10 billion taper beginning in January ($5 billion cut on mortgage buybacks and $5 billion cut in longer term Treasury purchases).

2. The Senate voted 64-36 on Wednesday to send a government spending plan to President Barack Obama, who has signaled his support.

3. An increase of 4.1% in GDP growth as reported for the 3rd quarter.

Fed Taper of $10 Billion

In my last article I said the Fed might do a token $10 billion taper if rates were low enough.

Is there a chance the Fed may do a token taper to make the market think they still have control of the situation? Sure. Especially if the stock market is out of control and interest rates are low enough. But it won’t be much at all. Probably like the $10 billion that the market thought the Fed would do last time they met.

Fed Chairman Bernanke is retiring and he wanted to go out on top or at least the perceived top before hitting the talk circuit like his predecessor Alan Greenspan did (the guy who didn’t see the 2008 Financial Crisis coming). Maybe Bernanke will be knighted by England like Greenspan was before the next financial blow up in the years ahead caused by unprecedented Federal Reserve action and abuse of their once solid balance sheet.

If we had a good balance sheet in America, then Congress wouldn’t have had to pass TARP or the Fed wouldn’t have had to implement Quantitative Easing (QE). But that’s not the case with a ballooning National Debt of over $17 trillion that represents the elephant in the room. All the Fed said in their latest statement regarding the future is this:

The Committee now anticipates, based on its assessment of these factors, that it unlikely will be appropriate to maintain the current target range for the federal funds rate well past the time that the unemployment rate declines below 6-1/2 percent, especially if projected inflation continues to run below the Committee’s 2 percent longer-run goal.

Only one member of the Fed disagreed with Bernanke and the other Board members, Eric S. Rosengren, who “believes with the unemployment rate still elevated and the inflation rate well below the target changes in the purchase program are premature until incoming data more clearly indicate that economic growth is likely to be sustained above its potential rate.” This is a more realistic view of the economy. The taper was premature.

In fact, in the aftermath of the decision, Bernanke was on television saying how they have to keep interest rates low. This is the problem the Fed has with any tapering because any perceived strength in the economy, higher interest rates on the National Debt are sure to follow. This higher debt payment has to come from somewhere, and with trillion dollar deficits already adding to the National Debt, and small reductions in the budget, isn’t resolving the overall issue of what effect higher interest rates will have on the budget. Congress can’t think that far ahead and neither does the Fed. That is why if there is any uptick in rates, it will surely be followed by more QE. It’s all the Fed knows how to do; destroy their own balance sheet and “hope” the economy improves.

Senate Approves Bipartisan Budget Plan

The second whammy put on gold this past week was the Senate passing a bipartisan budget proposed for the next two years. This budget includes continuation of the current sequester that helped reduce the budget deficit. While reducing a budget deficit is good, it can be compared to the savings the individual had in the following video where a man goes to a banker and asks for an Increase his Debt Limit), telling the banker that he cut $380 out of his $17,000 a year deficit on a $21,000 a year income.

This is truly an incredible video and the numbers used correlate to the actual budget and National Debt from a few years ago, when the debt was only $14 trillion. Today we are over $17 trillion and we should congratulate congress on saving a few billion on a trillion dollar debt? When you watch the video, keep in mind that the banker does give the man more money, despite the fact that he knows too well that it can never be paid back on the income he currently makes. Does anyone else see the lunacy in this type of thinking?

This is how Congress works, but you only see the lunacy when it is put on a scale of an individual trying to do the same thing as this excellent video portrays. This is what you should be talking about at Christmas to wake people up and prepare for what’s to come.

From this list you can choose the next Republican candidate for President (among those like Christ Christie and others who may be running), not from the Republican Senators who voted for this spending bill including Senator Ryan who helped draft the bill. Why? Because the one’s who voted for it are supporting what the banker is doing in this video. They are not solving any of the problems that are plaguing our country, they are contributing to future problems. They are simply kicking the can down the road until their own retirement, hiring by the corporations that supported them or book tours as they like the kings and queens we tax payers have made them by supporting them. They don’t have our best interest at heart. Their votes are good for gold and silver however as time will show. Unfortunately at the expense of the many. And this spending is not a Republican vs. Democrat issue. They both are guilty as charges. The Bush administration expanded the debt and with Bernanke’s Fed, the Obama administration is like the Bush administration on steroids.

Increase in GDP Growth

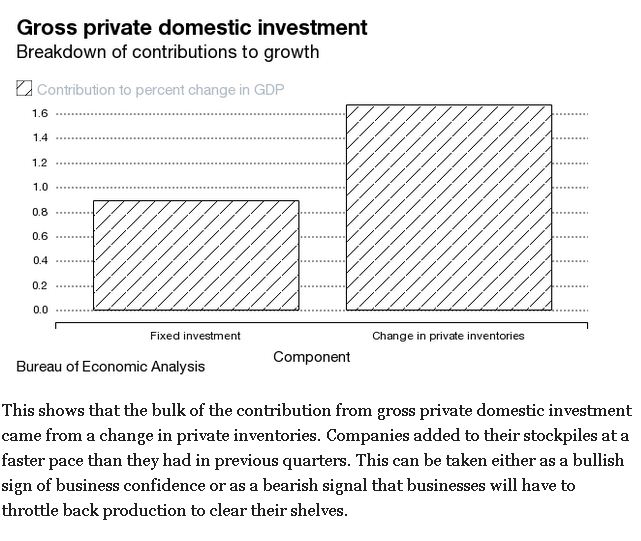

When looking at the 4.1% growth number, we must note that a good percentage of that number comes from Consumer Spending (the last to know of any crisis) and Change in Inventories, which could be considered bullish OR bearish.

There is growth in some parts of the country. I have clients tell me of the buying of homes on the East Coast in the area where John Kerry has a home and they are buying more than one home as investments. But this is eerily similar to the 2006 era where many were buying second and third homes, only to be ultimately disappointed with the eventual crash. Perhaps we are not quite there yet, but in due time. Just look at what’s going on in Florida and Nevada again. When these cash buyers disappear as banks run out of repossessed inventory, coupled with any potential rise in interest rates, which we are seeing come to fruition now, look out below.

What Gold Investors Sitting on Heavy Losses Can Do Now

While all this euphoria on the economy and stock market breaking to new highs continues, and with a dollar that doesn’t seem to want to break much below 80 on the Index, gold is taking it on the chin. I expect this to continue and I do expect 52 week lows in precious metals in the near future.

To complete this perfect storm against gold, Hedge Funds, Mutual Funds and Professional Traders have the luxury to write off 100% of their losses and I believe they have been doing so with the outflow of shares from ETFs like GLD and SLV.

But the professionals are not the only ones who can take advantage of the Internal Revenue Code (IRC). Individuals too can take advantage of the IRC section that allows them to write of up to $3,000 a year in losses of their investments.

Now may be a good time to sell your paper related gold investments like GLD and SLV and lock in those losses as deductions on your income tax return against gains for years to come. It is of course important to know the rules of doing so and the fact that most of the time you can’t buy the same or like asset back within 30 days. As for those with physical gold and silver in their possession, if you are sitting on major losses, especially in silver, you may want to consider locking in those $3,000 deductions.

From a business stand point, I don’t have anyone selling. There may come a time when you want to sell because you are so tired of the price falling, but this isn’t 1980 where all of a sudden CD’s are going to start paying you 10% or more on your investment. Can you imagine what a rate of 10% on Fed paper would do to the economy with the increased interest payment on the National Debt? We would simply go bankrupt. Even at 6%, which is exactly where interest rates were a few years ago, we couldn’t handle the increased debt burden. Also, this isn’t the time to sell and put your money in a stock market that is breaking to new highs. The stock market can continue higher, but proper asset allocation says to take from those gains and put it into what has been beaten down; gold and silver. If the stock market experienced its worst year in 32 years, would you be a buyer?

Individuals too can take advantage of the IRC section that allows them to write of up to $3,000 a year in losses of their investments. A wash rule may apply where a seller might have to wait 30 days before buying back substantially identical shares or risk losing the write-off. Check with your tax advisor before doing such a transaction.

A wash sale is a sale of stock or a security at a loss where the taxpayer acquires a “substantially identical” share or security (or option thereon) within 30 days before or after the date of the sale. Under the wash sale rules, the taxpayer’s loss is disallowed, and the loss amount is added to the basis of the acquired stock or security (or option).

1091(a) Disallowance Of Loss Deduction

In the case of any loss claimed to have been sustained from any sale or other disposition of shares of stock or securities where it appears that, within a period beginning 30 days before the date of such sale or disposition and ending 30 days after such date, the taxpayer has acquired (by purchase or by an exchange on which the entire amount of gain or loss was recognized by law), or has entered into a contract or option so to acquire, substantially identical stock or securities, then no deduction shall be allowed under section 165 unless the taxpayer is a dealer in stock or securities and the loss is sustained in a transaction made in the ordinary course of such business. For purposes of this section, the term “stock or securities” shall, except as provided in regulations, include contracts or options to acquire or sell stock or securities.

Personally, in a court of law if I were ever called to be an expert on Precious Metals, I feel I could make the case that gold is not “substantially identical” to silver and that paper ETFs like GLD and SLV are not “substantially identical” to physical gold and silver. Not even close. You can’t take possession from those ETFs of your metal. You can’t insure your GLD or SLV. GLD and SLV are proxies to gold and silver and do not represent real wealth ownership, but a substitute for ownership. But again, your tax advisor would have the final word on this. I tried to get KPMG and Deloitte to provide answers on this the last month and the best I could get from Deloitte was a referral to the Bureau of National Affairs where I was able to find some information. It is possible one might need a Private Letter Ruling from the IRS to accomplish the above transactions. Either way, check with your tax advisor and know that the sell does not have to occur in 2013 to get the write off. It can be done at any time.

Worse case scenario, you wait 30 days to buy the metal back again. Gold and silver aren’t going to shoot up dramatically in the next 30 days, but I do expect January to be a good month for the metals.

Gold and Silver Prices

August 27th when gold was $1,420 an ounce, I wrote an article Sticking With Stronger Dollar and Weaker Gold Through End of Year and we indeed have lower prices with gold presently hovering around $1,200 an ounce. I didn’t need Elliott Wave Theory to make this kind of a call. I know how Market Makers work, how the Fed is still somewhat relevant (for now) and how statistics can be construed any way the government wants them to by changing the way things are calculated, hence the most recent good GDP data. I also know how tax loss selling works and what the big players in the market are capable of doing to gold and silver prices. The precious metals market is not the DOW, S&P, or NASDAQ in size and scope. It is a small market that can easily be pushed around. In fact, in 1980, two brothers named Hunt did just that without a computer by cornering the market.

With this end of year tax loss selling, I did expect some further declines in the precious metals market and still do. I have been telling many clients to hold off on purchases and many bought with the most recent push down in price we had on Thursday. I still recommend dollar cost averaging into a position as the best way to play the market and I have not yet decided to write my “all-in” article.

We are close to breaking the 52 week closing low in gold at $1,192 and do think we break the 52 week lows in both gold and silver and push toward $1,000 now in gold. It is even possible that Market Makers will push gold below the $1,000 mark into the $900′s, on one or two panic sell days. When we do get the final smack down which I have been patiently waiting for, I will be writing my all-in article. For now, I see an up month in gold for January. The one’s doing the selling for tax reasons today will reestablish their positions in the metals in January to take advantage of the coming break to higher highs. But I do expect that one more smack down. Patience will be rewarded. Those who haven’t sold haven’t lost a thing. Those that want to get some tax loss advantages by selling and buying back may want to do so.

Predictions for 2014

No more taper (the Fed can’t handle any higher interest rates with the 10 year already pushing 3% again).

Higher gold and silver prices (I think we are within a 6 month period of bottoming out).

My book “Illusions of Wealth” will have good timing in preparing investors for the future (due out in a few months).

Premiums for gold and silver will go higher (those that buy at the lower prices will benefit from paying lower premiums today and in the next few months).

January we will see shortages in Silver Eagles again as unscrupulous gold dealers buy them up, have them graded and sell the story that they are worth twice as much because they are newly 2014 minted coins. This is silly. Silver is silver and you don’t need to pay more for a pretty coin. This shortage should cause the premiums on Silver Eagles to rise. A good alternative will be the Canadian Maple Leaf one ounce Silver coins.

The National Debt will keep going higher (isn’t it funny how this is never addressed by the financial media, especially CNBC? Even Congress? It is truly the elephant in the living room).

Yellen will be a Bernanke clone and implement more QE if interest rates rise above 3% on the 10 year (she will be blamed for everything Bernanke has done at some point).

Republicans won’t have a leg to stand on come November and possibly in 2 years as they passed a budget this week that gave the Democrats all they wanted (thank you Paul Ryan who begged Congress to pass TARP and claimed taxpayers would get their money back. Meanwhile Senator Ryan; U.S. exits GM stake, taxpayers lose $10.5 billion.

The fight over Obamacare won’t do anything to help the Republicans – instead of this nightmare of a program to implement, we only needed to do 6 things to solve the health care problem; 1. allow individuals portability of their health coverage; 2. allow competition of health insurers across state lines; 3. get the patient involved in determining what are fair prices to pay and negotiate with hospitals to only pay this amount (see here, here and here) – it’s a racket and it needs to be controlled; 4. practice more preventative care rather than cure with health insurance companies involvement; 5. implement higher deductibles as the odds are for most American’s, you don’t need to use your insurance that often, but go in with a group and put money in a fund for the payment of the higher deductible should someone in that group need it (this fund can be invested and grow); and finally, 6. clamp down on fraud. There is one other area that needs to be addressed on #3 above, but insurers need to limit what is paid in conjunction to what hospitals want to charge. This agreement has to be done for all services prior to any patient coming to the hospital. The days of $5 or $10 aspirins are over.

2016 Prediction

Hillary Clinton will be the next President unless we bottom out first, then it will be a dog fight for Republicans as to who will best represent the People. What will cause this bottoming out? We shall see. It’s a matter of “when” not “if.” We have seen how fast things can deteriorate with the 2008 financial crisis. The economy can turn on a dime and at some point it will.

One Last Note

I will also be coming out with another new book this year called “We the Serfs!” that I have been working on for the past 8 years. It is meant to bring the nation together for a brighter future, not divide, which it seems most in the media and the two political parties themselves want to do. It will bring about an awareness of how we can accomplish a better society and economic growth with less government dictation and crony capitalism, less IRS code, less debt, more freedom and more love for one another. The solutions will be like none you have seen before.

Below you may find the video.