In 2015, hungry consumers spent more money dining out at bars and restaurants than they spent on groceries. It was the first time this had ever happened.

Many thought it was the start of a major trend - a byproduct of rising consumer confidence. Then... the trend reversed.

Same-store sales, the metric restaurants use to track sales growth at locations that have been open for at least a year, fell 2.4% in 2016.

Same-store traffic, the number of restaurant visitors, also declined. And that drop accelerated in the last three months of the year. Traffic fell 4.6% during the fourth quarter.

People are dining out less. As a result, many restaurants are struggling to grow revenue.

It’s easy to see why...

Eating Out Got More Expensive

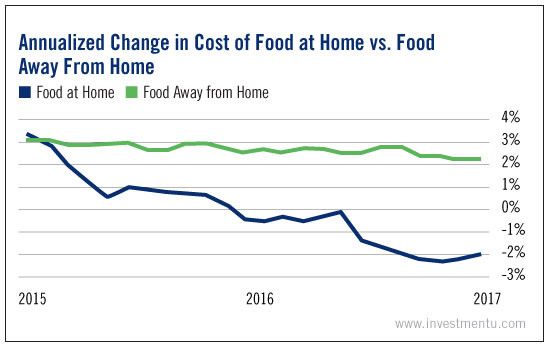

As this week’s chart shows, the gap between the cost of dining out and the cost of eating at home has grown wider over the past two years.

For one thing, grocery prices have significantly dropped, falling 2% in 2016 alone.

But even though the price of food is getting cheaper, restaurant costs are soaring. Labor is one of the biggest expenses. And 21 states are increasing their minimum wages in 2017.

Rents are rising also, even as restaurant chains hustle to open new locations to counteract falling sales at existing ones. Restaurants have no choice but to continue raising their prices.

The bad news for restaurant stocks is that traffic is expected to be sluggish this year, too.

For many Americans, it’s becoming harder and harder to justify the additional expense of dining out. But when they do decide to splurge, they opt to pay for the experience - not just food.

For this reason, there are still some strong plays in the restaurant sector. You just need to know where to look.

A Restaurant Recession Winner

Dave & Buster’s Entertainment (NASDAQ:PLAY) is one twist on the traditional dining experience that’s thriving in today’s challenging environment.

The “eatertainment” venue serves up video games, interactive simulators and sports on TVs - all alongside an array of food and drinks.

Its slogan, “Eat, Drink, Play, Watch,” sums up the chain’s success. Dave & Buster’s isn’t just a restaurant... it’s a destination. And once there, its guests spend money on credits to play games as well as on food and drinks.

In the third quarter of 2016, Dave & Buster’s grew its revenue by 18.6% to $228.7 million versus the same period in 2015. The company also posted same-store sales growth of 5.9% during the quarter.

The impressive sales growth of Dave & Buster’s shows that its unique business model is working. And it’s proof that Americans are willing to pay up for a dining and entertainment package.

As restaurants fight for our dining dollars, the ones that deliver one-of-a-kind dining experiences will come out on top... and so will their shareholders.