Investors are always looking for stocks that are poised to beat at earnings season and Canadian Pacific Railway Limited (NYSE:CP) may be one such company. The firm has earnings coming up pretty soon, and events are shaping up quite nicely for their report.

That is because Canadian Pacific Railway is seeing favorable earnings estimate revision activity as of late, which is generally a precursor to an earnings beat. After all, analysts raising estimates right before earnings—with the most up-to-date information possible—is a pretty good indicator of some favorable trends underneath the surface for CP in this report.

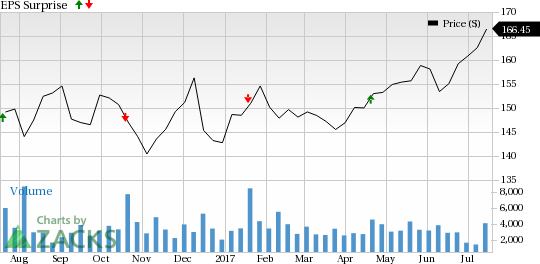

In fact, the Most Accurate Estimate for the current quarter is currently at $2.07 per share for CP, compared to a broader Zacks Consensus Estimate of $2.05 per share. This suggests that analysts have very recently bumped up their estimates for CP, giving the stock a Zacks Earnings ESP of +0.98% heading into earnings season.

Why is this Important?

A positive reading for the Zacks Earnings ESP has proven to be very powerful in producing both positive surprises, and outperforming the market. Our recent 10 year backtest shows that stocks that have a positive Earnings ESP and a Zacks Rank #3 (Hold) or better show a positive surprise nearly 70% of the time, and have returned over 28% on average in annual returns (see more Top Earnings ESP stocks here).

Given that CP has a Zacks Rank #2 (Buy) and an ESP in positive territory, investors might want to consider this stock ahead of earnings. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Clearly, recent earnings estimate revisions suggest that good things are ahead for Canadian Pacific Railway, and that a beat might be in the cards for the upcoming report.

5 Trades Could Profit "Big-League" from Trump Policies

If the stocks above spark your interest, wait until you look into companies primed to make substantial gains from Washington's changing course.

Today Zacks reveals 5 tickers that could benefit from new trends like streamlined drug approvals, tariffs, lower taxes, higher interest rates, and spending surges in defense and infrastructure. See these buy recommendations now >>

Canadian Pacific Railway Limited (CP): Free Stock Analysis Report

Original post