Realty Income Corp. (NYSE:O) is scheduled to report fourth-quarter and 2017 results after the market closes on Feb 21. The company’s funds from operations (FFO) per share are likely to remain stable whereas its revenues are anticipated to witness a rise year over year.

Last quarter, this monthly-dividend-paying real estate investment trust (REIT) reported better-than-expected performance, in terms of FFO per share. Results indicated higher-than-expected growth in revenues.

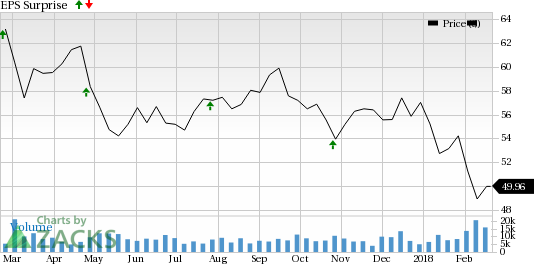

However, Realty Income has a mixed surprise history. The company surpassed estimates in three occasions and met in one, over the trailing four quarters, resulting in an average positive surprise of 1.33%. This is depicted in the graph below:

Realty Income Corporation Price and EPS Surprise

Let’s see how things are shaping up for this announcement.

Factors to Consider

Realty Income’s portfolio is well diversified with respect to tenant, industry, geography and property type. It targets well-located, free-standing, single-tenant and net-lease commercial properties. The company generates the majority of its annualized retail rental revenue from tenants with a service, non-discretionary and/or low-price point component to their business. Thus, such businesses are less susceptible to economic recessions, as well as competition from Internet retailing.

However, the retail real estate market remained turbulent amid retailer bankruptcies and store closures. Moreover, competition remained solid in the quarter. In addition, the company has substantial exposure to single-tenant assets which raises its risks associated with tenant default.

Amid these, growth in same-store rent is likely to be modest. In fact, the Zacks Consensus Estimate for rental revenues for the to-be-reported quarter is currently pegged at $297 million, reflecting around 1.4% increase from the prior quarter.

Realty Income’s activities during the quarter failed to gain analysts’ confidence. Consequently, the Zacks Consensus Estimate for fourth-quarter FFO per share remained unchanged at 77 cents over the last 30 days.

The Zacks Consensus Estimate for fourth-quarter revenues is pegged at $307.3 million, indicating a year-over-year rise of 6.8%.

For full-year 2017, the Zacks Consensus Estimate for revenues is $1.20 billion, reflecting a rise of 9.1% year over year. The consensus estimate for FFO per share is $2.99, reflecting a year-over-year increase of 3.82%. Management expects core FFO per share in the range of $3.03-$3.07.

Realty Income has lost 13.7% of its value in the past six months underperforming the 8.8% growth recorded by the industry.

Earnings Whispers

Our proven model does not conclusively show that Realty Income will likely beat estimates this season. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. However, that is not the case here as you will see below.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks ESP: The Earnings ESP, which represents the percentage difference between the Most Accurate estimate and the Zacks Consensus Estimate, is -0.73%.

Zacks Rank: Realty Income has a Zacks Rank #3. Although a favorable rank increases the predictive power of ESP, we need to have a positive ESP to be confident of an earnings beat.

Stocks That Warrant a Look

Here are a few stocks in the REIT space that you may want to consider, as our model shows that these have the right combination of elements to deliver a positive surprise this time around:

Host Hotels & Resorts, Inc. (NYSE:HST) , slated to report quarterly numbers on Feb 21, has an Earnings ESP of +0.25% and a Zacks Rank of 3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Outfront Media Inc. (NYSE:O) , scheduled to release quarterly numbers on Feb 27, has an Earnings ESP of +0.90% and a Zacks Rank of 3.

Gramercy Property Trust (NYSE:GPT) , slated to release fourth-quarter results on Feb 28, has an Earnings ESP of +2.49% and a Zacks Rank of 3.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Zacks’ Best Private Investment Ideas

In addition to the recommendations that are available to the public on our website, how would you like to follow all Zacks' private buys and sells in real time?

Our experts cover all kinds of trades… from value to momentum . . . from stocks under $10 to ETF and option moves . . . from stocks that corporate insiders are buying up to companies that are about to report positive earnings surprises. You can even look inside exclusive portfolios that are normally closed to new investors. Starting today, for the next month, you can have unrestricted access.

Click here for Zacks' private trades >>

Realty Income Corporation (O): Free Stock Analysis Report

Host Hotels & Resorts, Inc. (HST): Free Stock Analysis Report

Gramercy Property Trust (GPT): Free Stock Analysis Report

OUTFRONT Media Inc. (OUT): Free Stock Analysis Report

Original post

Zacks Investment Research