Satellite TV operator DISH Network Corp. (NASDAQ:DISH) , which also commands a strong portfolio of wireless spectrum, received a shot in the arm yesterday. A federal appeals court ordered the U.S. telecom regulator -- Federal Communications Commission (FCC) -- to review the case of two firms affiliated with DISH in an airwaves auction. The FCC had earlier determined that these two firms were ineligible for small-business discounts.

Soon after the news spread in the market, shares of DISH Network jumped 4.6% in Nasdaq, finally settling an increase of nearly 2% at the end of the day. However, the industry researchers have mixed views on the final outcome.

In January 2015, the FCC concluded its AWS-3 spectrum auction which registered a record-breaking bid value of $44.89 billion. Notably, AT&T Inc. (NYSE:T) emerged as the top bidder, spending $18.2 billion followed by DISH’s $13.3 billion, Verizon Communications Inc.’s (NYSE:VZ) $10.4 billion and T-Mobile US Inc.’s (NYSE:T) $1.8 billion.

Interestingly, DISH participated in the auction via three designated entities (DE) – American AWS-3 Wireless, Northstar Wireless LLC., and SNR Wireless LicenseCo LLC. Immediately after the FCC declared the names of the auction winners on Feb 2, 2015, DISH claimed that it is eligible for a 25% discount on the total value of its winning bids, under FCC's “DE” program. This implies that DISH will have to pay just around $10 billion to acquire all licenses it has won.

On Aug 17, 2015, the FCC unanimously voted against DISH’s claim of a $3.3 billion discount. The regulatory body argued that the DE program is aimed at encouraging the participation of small wireless operators in the airwave auction which DISH has unduly taken advantage of. This, undoubtedly, was a major setback for the company.

Notably, DISH is the second largest satellite TV operator in the U.S. with annual revenues of almost $15 billion. The company already holds a strong portfolio of wireless spectrums and a significant 85% stake in both Northstar Wireless and SNR Wireless. Despite this, the two companies have appealed for the small-business discount, which according to the final verdict of the FCC, largely violates the morale of the DE program.

Meanwhile, yesterday’s development generated mixed response among industry stalwarts. Some researchers believe that if the FCC reverses its verdict and consequently the AWS-3 bidding credits are reinstated to the two DEs affiliated by DISH, then the company will get around $3.3 billion of incremental value which will boost its bottom line.

However, the bigger question is, will the FCC reconsider its earlier decision. Notably, the person who was most vocal against DISH’s argument about DE was Mr. Ajit Pai, who was a commissioner of the regulatory body. After Donald Trump’s presidential win, Pai has become the Chairman of the FCC. A lot will depend on the FCC’s policy on DE practice under Ajit Pai.

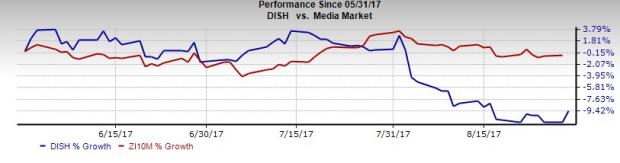

Price Performance of DISH Network

DISH Network’s shares have declined 9.41%, underperforming the industry’s loss of a mere 0.58% in the last three months. The company currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

4 Surprising Tech Stocks to Keep an Eye On

Tech stocks have been a major force behind the market’s record highs, but picking the best ones to buy can be tough. There’s a simple way to invest in the success of the entire sector. Zacks has just released a Special Report revealing one thing tech companies literally cannot function without. More importantly, it reveals 4 top stocks set to skyrocket on increasing demand for these devices. I encourage you to get the report now – before the next wave of innovations really take off.

See Stocks Now>>

AT&T Inc. (T): Free Stock Analysis Report

Verizon Communications Inc. (VZ): Free Stock Analysis Report

DISH Network Corporation (DISH): Free Stock Analysis Report

T-Mobile US, Inc. (TMUS): Free Stock Analysis Report

Original post