Despite yesterday’s sharp losses in the broad market, the model ETF trading portfolio of our newsletter had a great day. We are currently holding four open ETF positions, three of which we were already holding going into yesterday, while the fourth ETF triggered for buy entry on yesterday’s open. Because we have been focused on both ETFs with a low correlation to the direction of the stock market (commodity and fixed-income ETFs), as well as inversely correlated “short ETFs,” all four of our open ETF positions moved higher and in our favor yesterday.

Direxion 20 Year Treasury Bull 3x (TMF) was our biggest gainer, as the ETF convincingly gapped above its 50-day moving average and printed a 5.4% gain. ProShares UltraShort Real Estate ETF (SRS) gained 1.0% and Global X Silver Miners (SIL) rose 0.8%. The ProShares UltraShort Basic Materials ETF (SMN), which was first pointed out for potential trade entry in our November 5 commentary and subsequently triggered for buy entry on yesterday’s open, cruised 4.0% higher on the day. However, because our buy trigger for entry was above the November 5 high, well above the November 6 close, the ETF closed near the price level where we bought it. Nevertheless, SMN is now technically poised for further gains because it broke out above resistance of its five-month downtrend line.

It’s pretty nice when all four of our open ETF positions move higher on a day when the main stock market indexes all swooned more than 2%. However, please realize this was not by accident. As you may recall, our market timing model shifted from “buy” mode into “neutral” mode on October 5, as stocks bounced off their swing lows and peaked near resistance of the prior highs. Then, on October 12, our objective, rule-based market timing system shifted from “neutral” into “sell” mode. This meant we were then required to become focused on any combination of the following: sitting in cash, selling short (including buying “short ETFs”), or only buying ETFs whose underlying portfolios had a low correlation to the direction of the US stock market (international, currency, commodity, or fixed income ETFs).

We initially got knocked out of our swing trades in CurrencyShares Euro Trust ETF (FXE) and US Natural Gas Fund (UNG), both of which failed to follow through to the upside with their consolidation patterns. However, the unrealized gains in our open ETF positions are now making up for that. Herein lies the benefit of having a disciplined system for timing the stock market that is objective and rule-based, rather than one that is based on emotion or pure speculation. When our model for market timing gives us the necessary signals to buy, sell short, or be neutral, we simply follow it because it is based on a proven track record of 10 years of success.

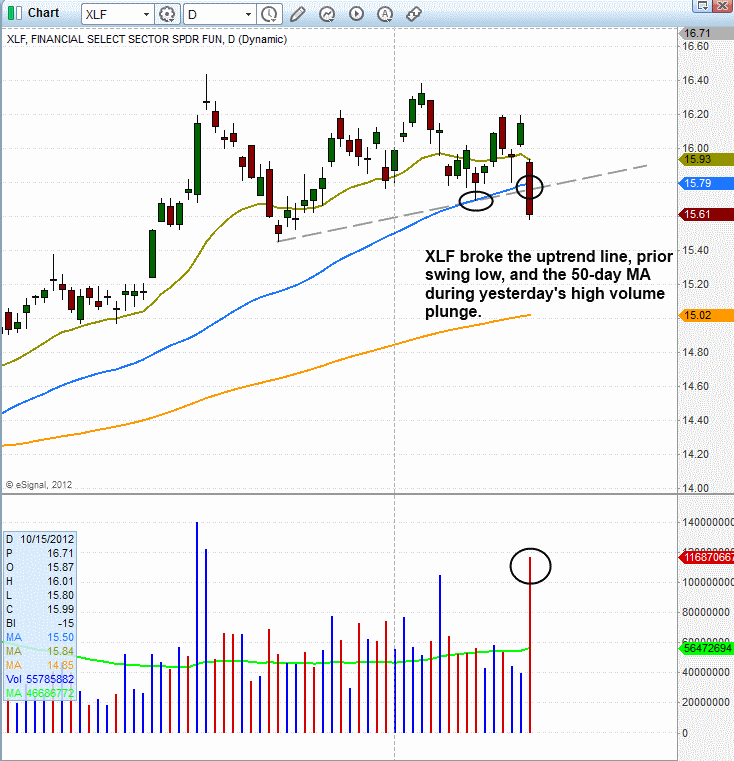

Until yesterday, nearly every industry sector in the broad market was exhibiting a bearish chart pattern. The one exception was the financial sector, which was showing relative strength and forming a bullish pennant pattern near its highs. However, the financial sector finally broke down below support yesterday as well, causing the bulls to give up what was possibly the last bastion of hope for sector leadership in the US markets.

On the chart below, notice that the Select Sector Financial SPDR ETF (XLF), a highly traded ETF proxy for the overall financial sector, fell 3.3% yesterday, while convincingly breaking below its prior swing low, 50-day moving average, and lower channel support of its bullish “pennant” in the process:

The chart of XLF above is a good example of what we mean when we recently stated in our daily broad market and ETF analysis that it doesn’t pay to buy any stocks or stock-based ETFs when our market timing model is in “sell” mode. In such conditions, even the individual stocks and ETFs showing relative strength to the broad market will eventually collapse with enough pressure from the broad market, thereby enabling oneself to quickly dig a hole. Simply put, it never makes sense to fight against the direction of the dominant market trend because there is much lower risk and greater profitability to be had by trading in the same direction of the stock market’s current trend. Rather than being opinionated and letting subjective bias determine which side of the market to be on, we always try to maintain objectivity based on technical analysis. This keeps us out of trouble and puts the odds of success in our favor by always trading in the direction of the dominant market trend.

Yesterday, a subscriber e-mailed to ask why we were targeting Market Vectors Coal ($KOL) for potential swing trade buy entry. Specifically, this individual asked why we were looking at buying KOL when “Obama hates coal.” Our reply was two-fold. First, we reminded him that our swing trading system is based on technical analysis of price action, rather than news events. Although it is a common conception that stocks are driven by news, this is rarely the case; rather, the price action typically occurs first, while the financial media subsequently comes up with whatever reason they can think of to justify the reason the stock went up or down for the day. But more importantly than this, the second part of our reply to the subscriber was a friendly reminder that KOL did not even hit our trigger price for swing trade buy entry (above the intraday high of November 6). This was a great reminder of the danger of jumping the gun in trading by buying a stock or ETF before it actually hits its trigger price. Since our trigger prices for buy entry of swing trades are based on technical levels of near to intermediate-term support or resistance, trying to save a few pennies by entering a trade before it actually trades through our trigger price is a foolhardy mistake that can easily be avoided by checking your greed at the door.

Given that KOL tumbled sharply yesterday, it has simply been removed from our watchlist as a potential buy candidate. No harm, no foul. Always staying grounded in reality, rather than “hope” mode, is the key to being a consistently profitable trader over the long-term. Although active traders who are patient, disciplined, and grounded in reality will NOT make profits every single month, they will consistently end up with a better performance than the overall stock market over the long-term because they will miss the substantial losses of the big down years. A good example of this is when we actually made a small profit on our ETF and stock trade picks during 2008, at a time when the major indices fell more than 30%.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Why Disciplined Traders Are Consistently The Biggest Winners

Published 11/08/2012, 04:52 AM

Updated 07/09/2023, 06:31 AM

Why Disciplined Traders Are Consistently The Biggest Winners

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.