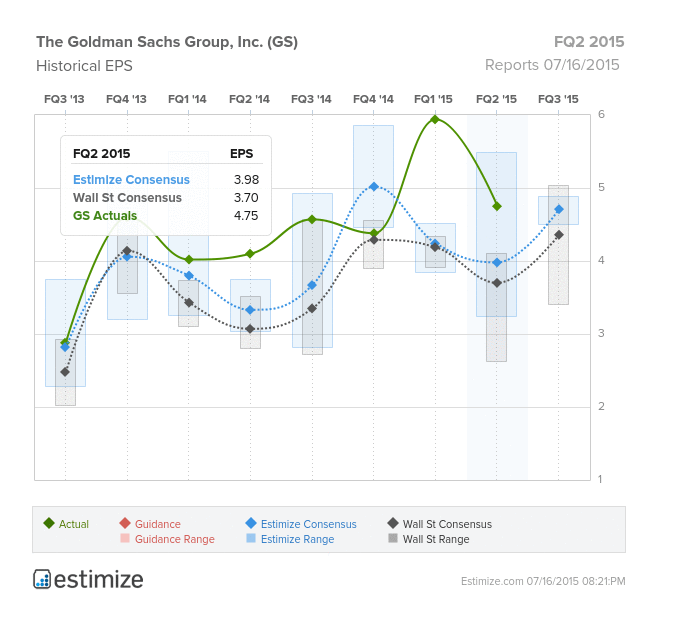

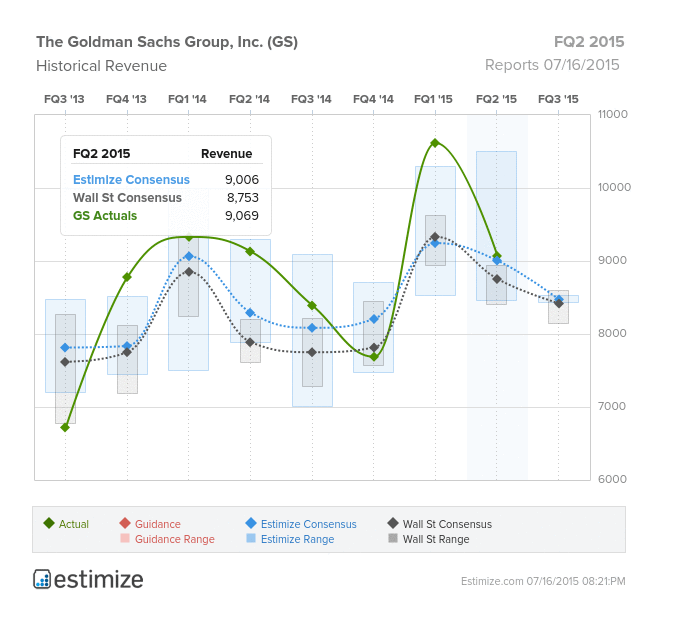

Goldman Sachs (NYSE:GS) reported this morning, on July 15th, and the results are a clear reflection of several macro events. Goldman’s EPS came in at $4.75, growing 16% YoY. The Estimize community was looking for $3.98, higher than Wall Street’s prediction of $3.70. Goldman was able to beat out both of these estimates, which they also did last quarter, when YoY growth was 48%. The company has demonstrated a pattern of positive EPS growth over the past two years. In regards to revenue, both Wall Street and Estimize predicted that revenues would decrease by at least 15% this quarter from $10.617B last quarter. Sales ended up only falling 1% QoQ, to $9.069B, beating both the Estimize consensus for $9.043B and Wall Street’s estimate of $8.753B.

While the non-GAAP results came in strong, they exclude a large litigation charge related to pre-crisis mortgage practices that lowered the GAAP result by $2.77. But this is not the only challenge the bank faced in the second quarter. The events in Greece and China impacted the equities division as investors were more cautious about trading amid uncertainties surrounding the global economies and domestic interest rate environment. Weaknesses in rates could have also led to a decline in investment banking revenues.

On the other hand, there were several positive macroeconomic factors this quarter. Specifically, there was falling unemployment, a flexible monetary policy, as well as a progressive housing sector. Moreover, on July 1st, Goldman was credited for the most M&A deals in the US and around the world (176 and 112, respectively) for the first half of 2015, giving a boost to investor confidence.Overall, the big beat from Goldman Sachs today wasn’t much of a surprise, as they typically surpass estimates by a large margin, but results did show that missteps made during the financial crisis still loom. Of the five big banks that reported this week, only Wells Fargo (NYSE:WFC) missed the Estimize EPS consensus, with Morgan Stanley (NYSE:MS) on deck for Monday.