Similar to wise buying decisions, exiting certain underperformers at the right time helps maximize portfolio returns. Selling off losers can be difficult, but if both the share price and estimates are falling, it could be time to get rid of the security before more losses hit your portfolio.

One such stock that you may want to consider dropping is Core-Mark Holding Company, Inc. (NASDAQ:CORE) , which has witnessed a significant price decline in the past four weeks, and it has seen negative earnings estimate revisions for the current quarter and the current year. A Zacks Rank #5 (Strong Sell) further confirms weakness in CORE.

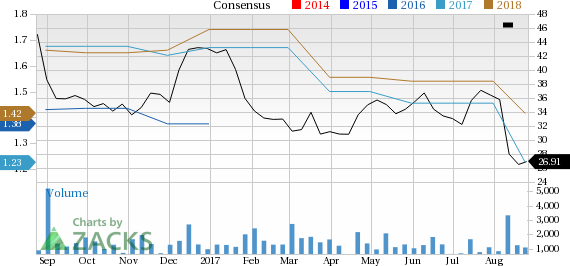

A key reason for this move has been the negative trend in earnings estimate revisions. For the full year, we have seen two estimates moving down in the past 30 days, compared with no upward revisions. This trend has caused the consensus estimate to trend lower, going from $1.46 a share a month ago to its current level of $1.23.

Also, for the current quarter, Core-Mark has seen two downward estimate revisions versus no revisions in the opposite direction, dragging the consensus estimate down to 43 cents a share from 51 cents over the past 30 days.

The stock also has seen some pretty dismal trading lately, as the share price has dropped 27.5% in the past month.

So it may not be a good decision to keep this stock in your portfolio anymore, at least if you don’t have a long time horizon to wait.

If you are still interested in the Business - Services industry, you may instead consider a better-ranked stock - PFSweb, Inc. (NASDAQ:PFSW) . The stock currently holds a Zacks Rank #1 (Strong Buy) and may be a better selection at this time. You can see the complete list of today’s Zacks #1 Rank stocks here.

4 Surprising Tech Stocks to Keep an Eye On

Tech stocks have been a major force behind the market’s record highs, but picking the best ones to buy can be tough. There’s a simple way to invest in the success of the entire sector. Zacks has just released a Special Report revealing one thing tech companies literally cannot function without. More importantly, it reveals 4 top stocks set to skyrocket on increasing demand for these devices. I encourage you to get the report now – before the next wave of innovations really takes off.

PFSweb, Inc. (PFSW): Free Stock Analysis Report

Core-Mark Holding Company, Inc. (CORE): Free Stock Analysis Report

Original post

Zacks Investment Research