Growth stocks can be some of the most exciting picks in the market, as these high-flyers can captivate investors’ attention, and produce big gains as well. However, these can also lead on the downside when the growth story is over, so it is important to find companies which are still seeing strong growth prospects in their businesses.

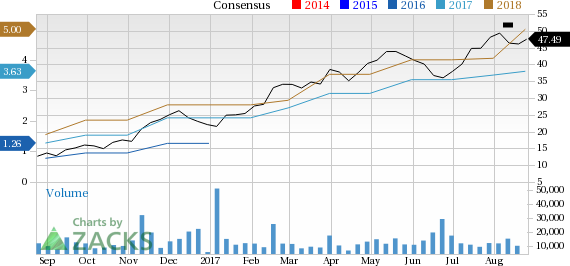

One such company that might be well-positioned for future earnings growth is The Chemours Company (CC). This firm, which is in the Chemical-Diversified industry, saw EPS growth of 29.1% last year, and is looking great for this year too.

In fact, the current growth estimate for this year calls for significant earnings-per-share growth. Furthermore, the long-term growth rate is currently an impressive 15.5%, suggesting pretty good prospects for the long haul.

And if this wasn’t enough, the stock has actually seen estimates rise over the past month for the current fiscal year by about 3.7%. Thanks to this rise in earnings estimates, CC has a Zacks Rank #1 (Strong Buy) which further underscores the potential for outperformance in this company. You can see the complete list of today’s Zacks #1 Rank stocks here.

So if you are looking for a fast growing stock that is still seeing plenty of opportunities on the horizon, make sure to consider CC. Not only does it have double digit earnings growth prospect, but its impressive Zacks Rank suggests that analysts believe better days are ahead for CC as well.

4 Surprising Tech Stocks to Keep an Eye On

Tech stocks have been a major force behind the market’s record highs, but picking the best ones to buy can be tough. There’s a simple way to invest in the success of the entire sector. Zacks has just released a Special Report revealing one thing tech companies literally cannot function without. More importantly, it reveals 4 top stocks set to skyrocket on increasing demand for these devices. I encourage you to get the report now – before the next wave of innovations really takes off.

Chemours Company (The) (CC): Free Stock Analysis Report

Original post

Zacks Investment Research