Summary

- The High-yield bond sector has been thrown into turmoil because of falling oil prices. High yield Bond spreads are at a multi-year high.

- Mainly “oil related companies” and certain areas in the emerging markets are at risk. However the entire sector is being dumped indiscriminately.

- I will provide in this article 5 strong reasons why certain Junk Bonds offer a “great opportunity to buy”.

- I will also highlight 5 Criteria to keep in mind when looking to invest in high yield Junk Bond Closed-End Funds (CEFs).

Situation in the High-Yield Bond Sector

Sentiment towards high-yield debt has deteriorated this month after sliding for much of last year. The market has been unable to escape this month's pronounced decline for equities and oil dropping below $30 a barrel. Popular high-yield junk bond ETFs have fallen to their lowest levels since July 2009, including iShares iBoxx $ High Yield Corporate Bond (N:HYG)), and SPDR Barclays) High Yield Bond ETF (N:JNK). HYG yields today around 5.95% while JNK yields around 6.62%.

Five Good Reasons Why Some Junk Bonds Offer a Good Opportunity to Buy

The following are 5 reasons why certain Junk Bonds at current price levels offer a great entry point:

1- Not All Junk Bonds are Alike

Today, the main risk in the Junk Bond space is related to oil companies who have taken large amounts of debts and to certain emerging markets, including China which is experiencing market turmoil. However, investors, who are being risk averse, have been selling indiscriminately their high-yield bond holdings irrespective of the risk involved. Today, the average yield of energy exposed bonds is an incredible 12.6% above comparable government bonds, reflecting a high risk nature.

2- Current Unwinding in the Junk Bond Space is mostly unleveraged

During the 2007-2008 global credit crunch which started with the fall of Northern Rock, in August 2007, and turned out to be just the starting point for big financial landslides, it was not unusual for funds to be 10 times or more leveraged. In fact the main reason that the Bear Stearns hedge fund collapsed so quickly in 2007 was that they had so much debt financing that had to be repaid as prices fell, triggering more forced selling. Today the vast majority of credit funds, including the mutual funds that suspended redemptions recently are not leveraged. While the 2007-2008 credit was in part an unwinding of over-leveraged credit investors, the situation does not look the same today.

3- Risk Awareness and Appetite

Most investors during the 2007-2008 global crisis, including investors of the Bear Stearns credit funds, thought they had a low risk investment. At the time, many of these funds carried, what turned out to be bogus AAA credit ratings from the major ratings agencies. As investors woke up to the fact that their positions were in fact highly risky, panic selling started which eventually led to the collapse of the US housing market. It is not obvious that high yield investors today think of their Junk Bond holdings as quality investments. After the last housing market crisis, both financial institutions and investors have become much more risk sensitive. Having developed a new awareness-based culture, they know well the nature of their investments' risk-reward profile.

4- No apparent Asset Bubble

There is no apparent asset bubble in the US that is ready to crash, similar to the housing and stock market bubbles in 2007.

- US house prices are on very solid foundations as they are well supported by homeowners' income. In the bubble, many people get in a situation where they commit to either home they cannot afford or to mortgage terms that are impossible to honor. Home ownership in the USA is at its lowest since 1967. Stricter mortgage loan regulations adopted by banks after the last financial crisis have contributed to financial stability. Large banks have largely pulled back from mortgage lending to those with weak credit histories.

- US stock market prices are slightly overpriced today, but not by much. The current S&P forward 12-month P/E ratio is 15.65. The historical average of the S&P P/E ratio is 15.5, with the last ten year averaging at 13.5.

- Commodity prices are at a multi-year Low, contributing to deflationary effect across the world. The Bloomberg Commodity Index, a measure of returns from 22 raw materials, from eggs to natural gas, is at its lowest since at least 1991, extending the agony of energy, industrial metals and agricultural commodities producers.

5- Aggressive Quantitative Easing (QE) across the World

With Europe, Japan, and China all facing deflation and lower growth, they are all likely to increase their continued aggressive Quantitative Easing (QE), by further easing money supply and lowering interest rates. This will keep supporting demand for high yield products, including dividend stocks and Junk Bonds. Furthermore global growth concerns, financial markets volatility and downward pressures on inflation will likely result in the Federal Reserve to keep interest rates at very low levels for the foreseeable future. US Treasury yields have recently tumbled, with the 10-year Treasury yield currently around 2.0 %, being around its lowest level since October 2014. Unattractive Treasury yields returns will keep demand for high-yield products strong, especially for income-hungry investors, baby boomers, and retirees.

Five Criteria to keep in mind when looking to invest in "high-yield" Junk Bond Closed-End Funds (CEFs)

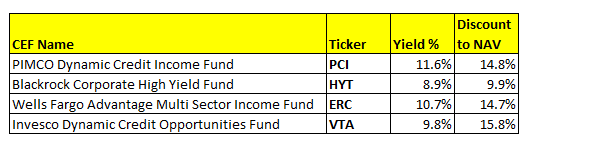

Closed-End Funds (CEFs) currently offer one of the best way to enter the Junk Bond sector, as discount to Net Asset Value (NAV) is running high, thus providing some of the highest dividend yields. The following is a small list of such CEFs with their corresponding yield and discount to Net Asset Value:

Naturally, not all the Junk Bond space is safe. If an investor is looking to invest in high yield today, I would suggest looking for a

Closed-End Fund with the following 5 criteria in mind:

- Little or no exposure to the oil and gas sector.

- Low exposure to the lowest-grade CCC bonds, which are much riskier with higher default risk.

- Low exposure to China and other Asian emerging markets.

- A fund with an active management strategy that avoids high-risk areas.

- A high discount to "Net Asset Value" (NAV) providing an opportunistic buying opportunity.