In college, I thought I had investing all figured out. I’d taken a handful of finance and portfolio management courses, I’d allocated real money for the University of North Florida’s student-managed fund, and I’d researched individual stocks, mutual funds, exchange-traded funds and even options.

But my confidence was crushed by a year of unsuccessful options trading when I was age 20. Nonetheless, through my 20s and into my 30s, I remained optimistic that I could earn handsome long-run returns by overweighting a few investment factors—such as smaller companies and value stocks—and by having plenty of foreign stock exposure. But that also hasn’t panned out.

Sure, U.S. large-cap performance has been robust since early 2009, making broad market benchmarks hard to beat. Still, lackluster returns among U.S. small-cap stocks, foreign-index funds and value stocks have left my portfolio below where it could have been if I’d gone all-in on an S&P 500 index fund. One example: I tried to get cute with a pair of Vanguard Group factor funds. One ceased trading in 2022, while the other has performed no better than the broad market since I purchased shares in 2018.

Chastened by this underperformance, I’ve lately been tweaking my stock portfolio, so it more closely resembles the global market. Today, at age 35, if I look across my taxable and retirement accounts, I have roughly equal amounts in U.S. and non-U.S. stock index funds. Those two geographical buckets each make up roughly 40% of my total portfolio, with another 8% in a bond market index fund and the rest in a high-yield money-market mutual fund.

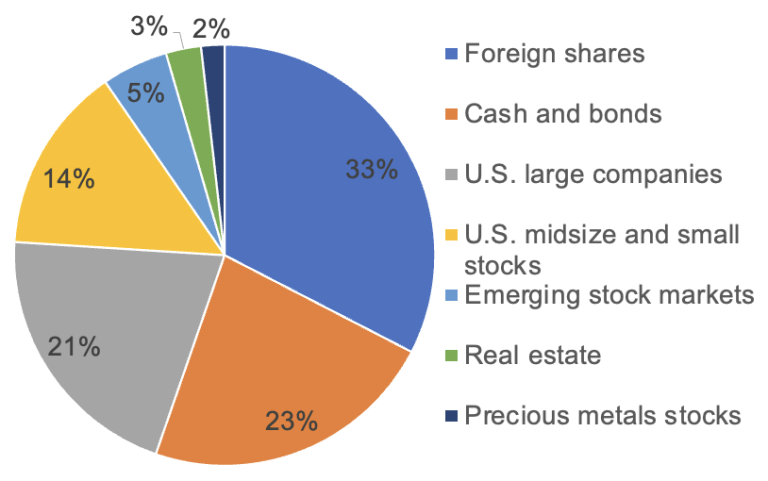

Compared to the weightings for the global stock market, I’m still overinvested in foreign shares, small-cap companies and, to a modest extent, emerging markets. Rather than selling any of these overweight positions, my new purchases simply go toward my U.S. and international total stock market index funds, which has the effect of diluting my overweight positions. The accompanying pie chart gives a snapshot of my current asset allocation.

I recently reviewed my mix of taxable account, retirement account and health savings account money. Overall, 53% of my assets are in my taxable brokerage account, consisting primarily of low-cost exchange-traded index funds (ETFs) and cash at Fidelity Investments. A third of my portfolio is in tax-deductible retirement accounts—a solo 401(k), a traditional IRA and a rollover IRA—plus I have some Publix Super Markets shares in the company’s employee stock ownership plan. This last holding is a holdover from my part-time work at Publix as a teenager and in my early 20s.

Just 11% is in the Roth bucket, though I’m aiming to increase that. This year, I made my first mega-backdoor Roth contribution, adding after-tax dollars to my solo 401(k) and then immediately converting that money to my Roth IRA. Finally, my health savings account makes up a modest 3% of my portfolio.

I admit to owning a tiny bit of a precious metals stock ETF—just 2% of my portfolio. Several years ago, in my taxable account, I purchased the fund at a fortunate time, and I’ve hung on to avoid realizing the capital gain. I also went rogue with extra emerging markets and real estate exposure, doing so using dirt-cheap index funds.

Readers might recall my 2021 venture into fringe alternative investments. I’ve since divested all my holdings, except a small sum invested in fine art through Masterworks, and I managed to do so without too much pain. I also sidestepped danger by withdrawing my stablecoin holdings before last year’s turmoil in the cryptocurrency market.

That’s a lot of drama for what I claim to be—a boring index-fund investor focused on increasing my net worth over the long haul. Indeed, I fear my money journey has been marked by too much excitement and hubris. Going forward, I plan to maintain an 80% stock-20% bond mix, all via index funds. Moreover, rather than having accounts scattered among several brokerage companies, I’ve made an effort to consolidate everything at Fidelity for easier tracking and fewer tax headaches.

I played the account bonus game for a few years, moving my investments from one brokerage firm to another to score some free money. But simplification is my new financial mantra. I brought my many taxable accounts home to Fidelity over the past two years. Now, my year-end goal is to consolidate my traditional and rollover IRAs into my solo 401(k), leaving just nondeductible contributions in my IRA, which I’ll then convert to a Roth IRA—what’s called a backdoor Roth conversion.

For me, it’s a huge psychological victory to take advantage of tax-savvy strategies, while also consolidating my numerous financial accounts. Another bonus: It’s now a breeze to refresh my net worth and asset allocation spreadsheet.

Thanks to my prodigious savings rate since I was a teenager, my investments today afford me financial independence by just about any measure, even though I’m still three decades’ away from the typical retirement age. But despite my net worth, my human capital remains my most valuable asset, and I have no plans to stop working. Indeed, continuing to engage in meaningful work is crucial not just to my wealth, but also to my health.

Disclaimer: This article was first published on The Humble Dollar