Earlier this week the Fed raised short-term interest rates to a range of 1.00 to 1.25%. To many of us, that's still a very low level. In fact you have to go back to October 2008 to find a higher level in the Fed Funds target rate. The move from a 0.75 to 1.00% range is significant, a 25% change. But at such low levels, does it even impact investment decisions around capital allocation or borrowing?

The Fed worked hard to talk up the target-rate increase and had the market pricing in a 99.6% chance that it would happen the morning of the meeting. It was not a surprise to anyone when it happened. But when the tone of the statement suggested continued vigilance, suddenly traders were up in arms complaining.

Why?

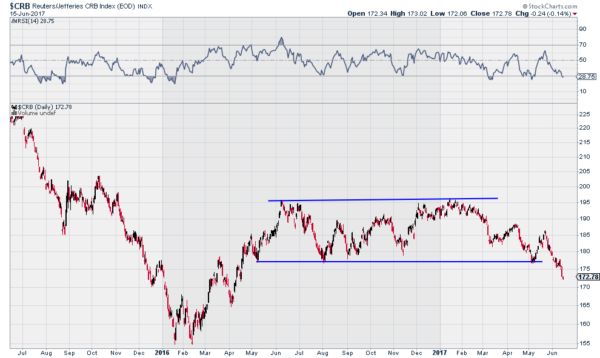

One reason is inflation, or rather lack of it. The chart above shows one proxy for inflation, the CRB Index. It measures mainly commodity inflation and as you can see it is falling hard. There is no inflation beast to tame. And with employment as strong as ever, the view from bond traders is that the economy cannot sustain employment growth and that the economy will crater.

I’ll suggest that maybe bond traders have no idea what is going on. Many prominent traders have been dead wrong about the macro picture and the impact on the equity markets for a year or more. This does not mean they are no longer smart or lack insight. But it might mean that the tide is changing.

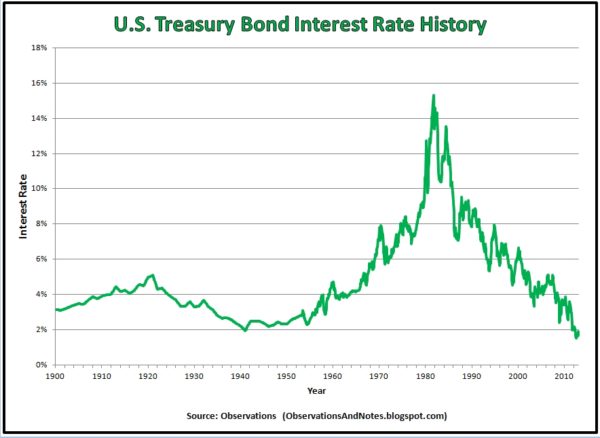

These kings of the bond world have been living in a 36-year bull market for bonds. This has created many correlations that they have come to rely upon. Many are second nature. And most have never seen a bear market in bonds. When I entered the markets in 1986, long-term interest rates were around 11% on the way down from a peak of over 15% in 1981. Any bond trader or manager under the age of 60 has never seen anything other than a bull market in bonds. It may continue but the last 12 months might also be the beginning of a reversal.

This creates a bias that is ingrained and permanent. And it will take a long time to change that bias. And it will not take a reversal in interest rates killing the bull market to require a change of perspective. A simple sideways motion in rates for years could also do the trick. When a reversal or sideways motion does happen, it is quite possible that all historical correlations get thrown out the window. Whether traders change their expectations is a different story. Those that can adapt will survive. Those that do not, will perish. And equity markets, bond markets and inflation expectations will just keep doing their thing.