A product, technology or energy source that is both cost-effective and bankable will scale, and this is the key to victory. The good news for photovoltaics is that nothing scales like silicon, except maybe enthusiasm on Wall Street, which is highly correlated to the amount of money being printed (and it seems, for now, that there are no limits to that process). However, Silicon Valley is not called Germanium Valley for a reason, though it could have been.

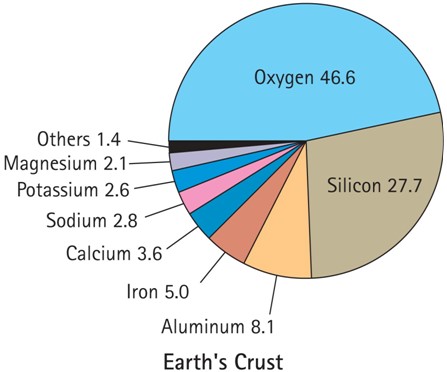

On February 6, 1959, Jack Kilby, a Texas Instrument’s engineer, filed U.S. Patent 3,138,743 for “Miniaturized Electronic Circuits.” It was the first integrated circuit, the steam engine of the information age. He made it with Germanium. Robert Noyce, later to become Intel’s founder and mentor to Steve Jobs, followed soon after with another IC (U.S. Patent 2,981,877); this one was based upon silicon, which is not only easier to work with (especially at high temperatures), but is highly abundant since the earth’s surface is covered with it.

Source: Solarbuzz

The earth’s silicon supply is virtually infinite. The price of PV made from Silicon is virtually free, needing little more than tracks or brackets, labor and wires to feed power to your home or the grid and miles to your car; it is, quite literally, dirt cheap. It is also the premier technology when it comes to scaling down as well as up, although oil production also scales down. Many tight oil wells produce only a few barrels a day, the other end of the production spectrum from Saudi Arabia’s majestic Ghawar which produces 5 million barrels every day.

Related: This Week In Energy: Rout Begins As WTI Can’t Stand The Pressure

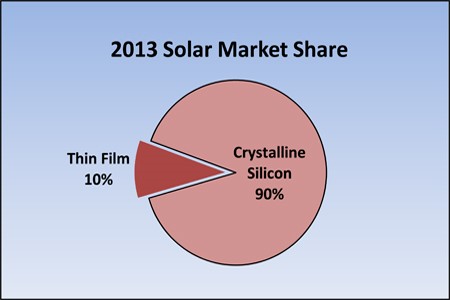

Not all PV modules are created equal. First Solar (NASDAQ:FSLR) makes them from so-called thin films and the basic materials are Cadmium and Tellurium. The problem for First Solar, other than Cadmium’s toxicity, is that all the Tellurium produced every year worldwide is not sufficient to produce enough cells to make thin film PV more than a niche product. Other thin film manufacturers use Indium which suffers from the same limitation. Silicon is by far the market share leader and should continue to hold, if not build upon, its advantage. (It has the added virtue of being more efficient, requiring less land or roof space for the same output.)

More good news from the PV front reaffirms that financing is not a problem. On July 14, Deutsche Bank (XETRA:DBKGn) put out a report stating, “YieldCo vehicles [are] publicly traded companies created for the purpose of owning operating assets that will predictably produce cash flow. This predictable cash flow primarily comes from long-term contracts. Not all income investors are aware of this asset class, but according to [analyst Vishal] Shah, ‘The YieldCo phenomenon is global, growth rates are likely to be much faster than MLPs and size of the market is likely to be much larger than the oil and gas sector’."

On July 20, (the anniversary of the Apollo 11 moon landing), “Sunedison Semiconductor Ltd (NASDAQ:SEMI) announced plans to acquire Vivint Solar Inc (NYSE:VSLR), America's second-biggest residential PV installer, for $2.2 billion in cash, stock and convertible notes. The acquisition will give SunEdison . . . a 523-megawatt portfolio of rooftop solar projects. . . . Those solar projects will be dropped into SunEdison's YieldCo, TerraForm Power, adding $81 million in unlevered cash flow for investors,” according to Stephen Lacey, senior editor at Greentech Media.

“With a roughly $9-billion market cap, SunEdison is a fraction of the size of the biggest oil companies. But the company's YieldCo structure is allowing it to expand at a record-setting pace. It now has 53 gigawatts of projects under development or completed -- nearly equaling the generation fleet of Duke Energy (NYSE:DUK), the biggest electric utility in the U.S.”

Peter Varadi, the author of Sun Above the Horizon, was a co-founder of Solarex in 1973, by coincidence the year that the world came to the end of ‘free’ oil, i.e. the year of the Arab Oil Embargo. He extols the virtues of YieldCos in a recent article on EnergyPost.eu, whose editor proclaimed: The solar revolution meets Wall Street.

Related: The Middle East Nuclear Power Play No One Is Talking About

Mr. Varadi explains: “We envisioned a ‘Solar Breeder.’ The idea was that we would manufacture solar cells and modules which would be mounted on the roof of our production facility to produce electricity which would then be used to produce solar cells and modules. . . . [In] those days to power the entire production of a solar cell and module production facility would have been prohibitively expensive. The idea went dormant. [Amoco, later to become part of BP (LONDON:BP), bought Solarex in 1983].

“The new ‘Solar Breeder’ idea is to utilize the income generated by selling PV systems to finance the production of more solar cells and modules to build the next PV systems. The new ‘Solar Breeder’ concept is called ‘YieldCo.’ It is transforming the solar power sector. . . . YieldCo is basically the adaptation of the REIT program to Renewable Energy (RE), by forming an independent power producing (IPP) corporation to operate primarily RE (water, wind and solar) assets. The company is publicly traded, ‘yields’ a predictable cash flow, and distributes its income to the shareholders.”

This Is Where We will See The Next Shale Boom And The Saudis Are Very Worried

There's an incredible energy development we've been keeping track of for you over the past year... It's the reason Saudi Arabia is acting in desperation... depressing oil prices... and even risking internal unrest. Their (and OPEC’s) very survival is being threatened.

“The basis of the success of the YieldCos is manifold:

• Because they are on the stock market, the possibility of relatively small investment by mutual funds and by private citizens opens the pocket book of millions.

• Liquidity: one can get money out when needed.

• Relatively stable cash flow: for example the electric yield of PV systems is predictable for at least 20 years, and is not affected by political or financial crises, which puts YieldCos, in terms of risk limitation, ahead of REITs or MLPs.

“[In] 2014/2015 all of the three major U.S. PV manufacturers [SunEdison, First Solar and SunPower, which is owned by the French oil giant Total] established their first YieldCo. The announcement by Neo Solar Power Corporation (NSP) of Taiwan that it is planning to establish a YieldCo in 2015 indicates that the YieldCo idea has spread to the Asian PV manufacturers. It is now only a matter of time before the many Chinese, Korean and Indian PV manufacturers will see the light and establish YieldCos as well. The money to be raised for PV systems by this approach will dwarf Warren Buffett’s U.S. $2.5 billion which his company invested in the Antelope Valley Solar Projects in California.”

Related: What Miniature Nuclear Reactors Could Mean For The World

Mr. Varadi believes that PV will come to dominate the YieldCo space because “PV systems . . . can be established in most parts of the Earth where people live.” The same cannot be said for windmills, dams, geothermal plants, or large scale solar thermal concentrators. Furthermore, “the YieldCo has a contract with the technology ‘sponsor’ (originator) to be able to obtain assets that the ‘sponsor’ is developing. This ensures a pipeline for future assets and a ‘right to first offer’ (ROFO) for the assets…The idea behind this is that the YieldCo should have an assured path to new assets…PV applications are ubiquitous and can be installed quickly.”

What’s not to like? Given these factors, it is logical to assume that solar energy, PV in particular, is destined to drive Wall Street’s next big inning, where ‘animal spirits’ never run dry for long.

PV will also be at the heart of distributed energy, i.e. putting the generation “where people live.”

Conventional power plants are large because fixed costs are high; ‘economy of scale’ ironically means that bigger is better. Distributed energy is generally small in scale since it is closer to, and sometimes right at, the point of use. The electric power grid, like the old mainframe computer model, is built on brute force.

The New Energy grid will be made up of many small islands, interconnected but able to isolate themselves in the case of outages, much the same way that the world’s computer networks are now widely distributed. It would be foolish to bet against distributed energy. It is more secure, more reliable, more scalable, cheaper and less risky since there is no fuel to fuss with, nor foreign supply lines to be cut.

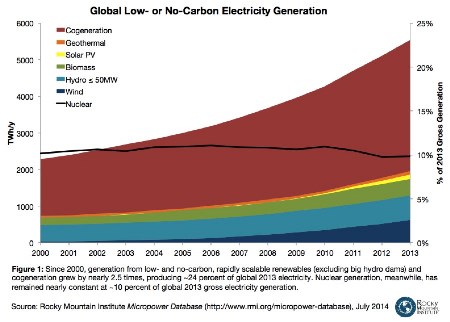

According to the Renewables 2015 Global Status Report, renewables accounted for more than 59 percent of all new electricity generating capacity installed worldwide during 2014. “By year’s end, renewables comprised an estimated 27.7percent of the world’s power generating capacity, enough to supply an estimated 22.8percent of global electricity.”