The rough phase seems to be far from over for the beauty products retailer, Avon Products Inc. (NYSE:AVP) as it continues to struggle with dismal top-line and bottom-line performances. Notably, the company delivered dismal second-quarter 2017 results, lagging top-line and bottom-line estimates for four consecutive quarters now.

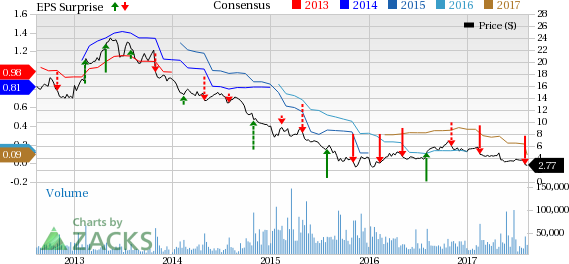

The impact of this dismal trend and the recently reported soft second-quarter 2017 results is clearly reflected in the company’s stock price. Evidently, the Avon stock has lost nearly 17.6% since reporting second-quarter results on Aug 3. Further, shares of this Zacks Rank #5 (Strong Sell) company have declined 45% year to date, while the industry has gained nearly 4.8%.

What’s Behind the Decline?

Clearly, the stock is struggling due to strained earnings and revenues, as discussed above. In the recently reported second-quarter 2017, Avon’s adjusted loss from continuing operations of 3 cents per share, compared unfavorably with the Zacks Consensus Estimate of earnings of 5 cents. Further, constant-dollar revenue dipped 4%.

Results for the quarter were mainly impacted by strong comparisons with the prior-year quarter. Additionally, results were hurt by decline in both Active Representatives and Ending Representatives across all segments, barring Ending Representatives growth in North Latin America.

While the company registered gross margin growth, operating margins were hampered by constant-dollar revenue decline resulting in deleveraged fixed expenses; higher bad debt expense, particularly in Brazil; increased Representative, sales leader and field expenses; elevated transportation costs, mainly in Russia; and investments in advertising for product launches.

Driven by second-quarter performance, the company now expects constant-dollar revenue growth for 2017 to be at the low-end of its previously provided guidance range of low-single digits growth. This led to a downtrend in the Zacks Consensus Estimate in the last seven days. Estimates for 2017 and 2018 have fallen by 6 cents and 5 cents, respectively, to 9 cents per share and 27 cents per share.

Is There Scope for Revival?

While Avon’s surprise history, stock performance and estimates trend suggest a bumpy road ahead, we believe the company’s three-year Transformation Plan, which is in its second year, could be a silver lining in these dark clouds.

Crossing the half-way mark of the plan period, the company has witnessed significant progress compared with its targets of enhancing cost structure and improving financial resilience. In 2016, the company surpassed cost saving targets, realizing cost savings of roughly $120 million and considerably improved balance sheet as it reduced debt by about $260 million and extended maturity profile. In 2017, the company targets cost savings of $230 million, including run-rate savings from 2016, along with in-year savings from current year initiatives.

With significant progress on enhancing cost structure and improving financial flexibility under the Transformation Plan, the company is now keen on the third component of the plan – investing in growth. To this end, it is focused on implementing strategies that will aid in strengthening Avon while driving profitable growth. After deliberate evaluation, the company is now focused on putting in key enablers in place. These enablers include delivering a competitive, seamless experience for Representatives; making sure the Representatives have the right product to sell; and ensuring it is expanding in the right geographies. With regard to investing in growth, management plans to invest nearly $350 million over the three-year period, including $150 million toward media and social selling; and $200 million for service model evolution and information technology. This is mainly aimed at bolstering the overall Representative experience.

Bottom Line

The stringent focus and swift progress on the Transformation Plan could be rewarding for the company. However, the dismal revenues and earnings indicate that more efforts need to be put in. We would hence prefer to stay away from the stock until the success of its Transformation Plan starts to reflect in top-line and bottom-line results.

Stocks to Consider

Better-ranked stocks in the same industry include The Estee Lauder Companies Inc. (NYSE:EL) , Inter Parfums, Inc. (NASDAQ:IPAR) and Nu Skin Enterprises Inc. (NYSE:NUS) , each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Estee Lauder has an average positive earnings surprise of 10.9% in the trailing four quarters. The stock, with a long-term EPS growth rate of 12%, has delivered a return of 30.3% year to date.

Inter Parfums has jumped nearly 17.1% year to date. Moreover, the company has delivered an average positive earnings surprise of 18.1% in the trailing four quarters and has a long-term EPS growth rate of 12.3%.

Nu Skin has grown nearly 26.7% year to date. The stock has a long-term EPS growth rate of 8.7% and has an average positive earnings surprise of 10.8% in the trailing four quarters.

5 Trades Could Profit ""Big-League"" from Trump Policies

If the stocks above spark your interest, wait until you look into companies primed to make substantial gains from Washington's changing course.

Today Zacks reveals 5 tickers that could benefit from new trends like streamlined drug approvals, tariffs, lower taxes, higher interest rates, and spending surges in defense and infrastructure. See these buy recommendations now >>

Avon Products, Inc. (AVP): Free Stock Analysis Report

Inter Parfums, Inc. (IPAR): Free Stock Analysis Report

Nu Skin Enterprises, Inc. (NUS): Free Stock Analysis Report

Estee Lauder Companies, Inc. (The) (EL): Free Stock Analysis Report

Original post

Zacks Investment Research