The relative strength of the primary U.S. benchmarks -- the Dow Industrials and the S&P 500 -- distorts the true picture for risk assets today. In fact, we do not even need to look closely to see the cracks all along the wall.

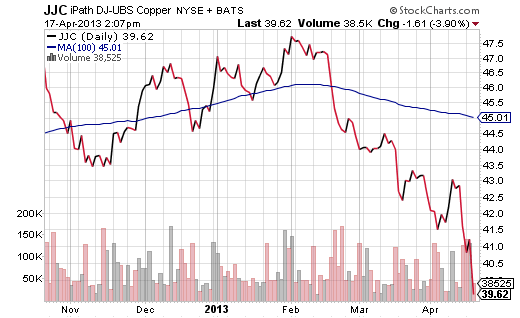

Copper

For example, the most important metal to the world’s economy appears destined for a bear market. Not only is iPath DJ Copper (JJC) well below its 100-day moving average, but the price is nearly 20% below its February peak.

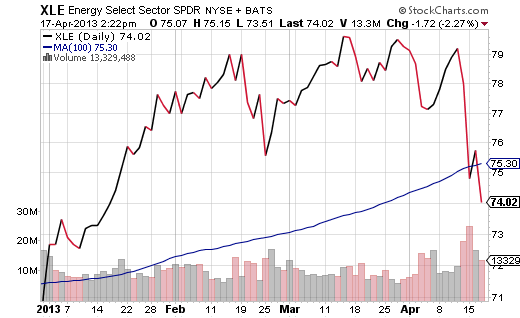

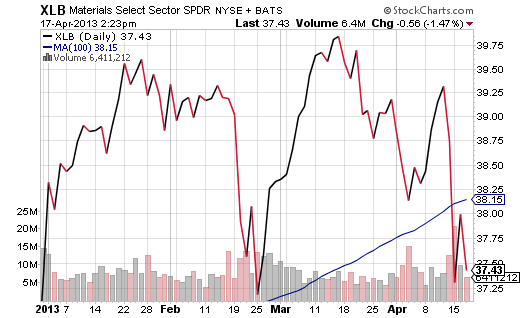

Dr. Copper -- the metal with a PhD in Economics -- may not have the same impact on stock price direction as in previous decades. Yet it is difficult to make a case that global central bank easing can bolster risk assets in perpetuity. In the U.S., SPDR Select Sector Energy (XLE) as well as SPDR Select Sector Materials (XLB) have both dropped below intermediate-term (100-day) trendlines on higher-than-normal volume.

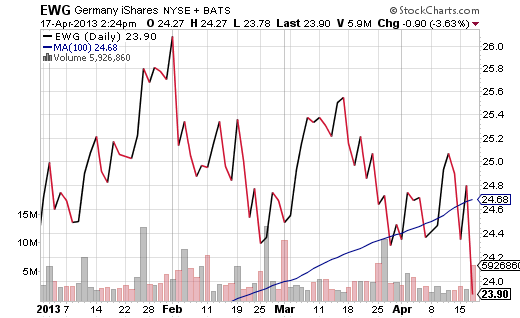

Germany

As if to make matters worse, Jens Weidmann, head of Germany’s Bundesbank, suggested that recovering from the euro-zone debt crisis could take 10 years. The iShares MSCI Germany Fund (EWG) is below intermediate-term trendline support, is negative on its year-to-date returns and sits at its lowest level for 2013.

Minus The U.S.

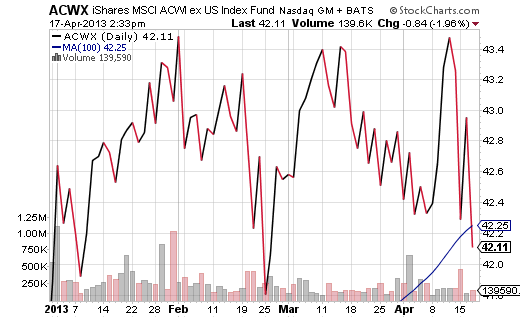

Simply stated, an all-world stock index that excludes the U.S. demonstrates that equities are standing on shaky ground. The iShares All-World excl. U.S. Fund (ACWX) is barely positive for the current year.

I am not predicting the end of the bull nor the start of a bear. I do not believe that labeling an environment nor pigeon-holing a money manager moves a discussion forward. Instead, I choose to evaluate circumstances as well as make decisions on courses of action.

Here are the circumstances and some potential moves that one could make:

- Investment-grade corporate credit bonds are hitting new 52-week highs. Preferred shares and short-term high yield bonds are doing the same. If you do not own funds like iShares Intermediate Corporate Credit (CIU), iShares Preferred (PFF) or PIMCO 1-5 Year High Yield Corporate (HYS), it is not too late to utilize the income producers in your portfolio.

- Central banks can artificially manipulate interest rates and create a subsequent wealth effect through higher home prices and higher stock prices. However, five years of central bank bailouts, rate manipulation and bank stabilization mechanisms have not created jobs or rising incomes or capital reinvestment. That makes price-dependent, cyclical stocks more vulnerable. Invest in non-cyclical dominant standouts like WisdomTree Equity Income (DHS) and iShares High Dividend Equity (HDV).

- The world still likes the greenback in challenging economic times. At least in the near-term, hedge against the falling euro and falling yen. Use WisdomTree Europe Hedged Equity (HEDJ) or WisdomTree Japan Hedged Equity (DXJ) if you choose to invest internationally. Right now, I would not recommend either investment without a bounce higher off of a respective 100-day moving average.