U.S. stocks (S&P 500) have packed on Olympic-sized gains through the initial eight weeks of 2013. Fed policy uncertainty aside, 6%-plus capital appreciation on low volatility is impressive by any measure.

The bulk of the run-up is attributable to industries tied to economic growth and enhancement. Sector ETFs that represent financials, industrials, technology and energy have been the most prominent performers. This is particularly remarkable when one considers the high probability of a sequester drag on the U.S. economy.

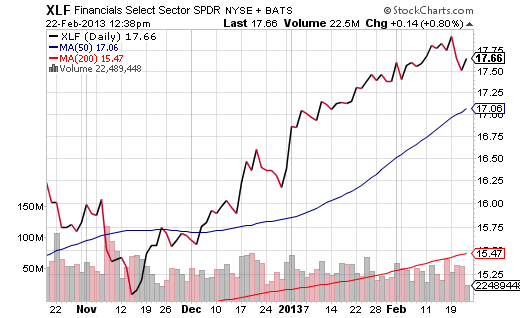

However, it is unusual for a diversified investment like SPDR Select Financials (XLF) to catapult 20% without a modest amount of resistance. It’s even more uncommon for traders to ignore the temptation to reduce their exposure. In fact, rallies that go unchecked are often prone to temporary reversals that may erode half of one’s unrealized profits.

It follows that a 5% corrective phase for the broader market could see XLF drop 10%. In fact, with XLF 12.5% above its long-term (200-day) trendline, you might even see a double-digit percentage drop.

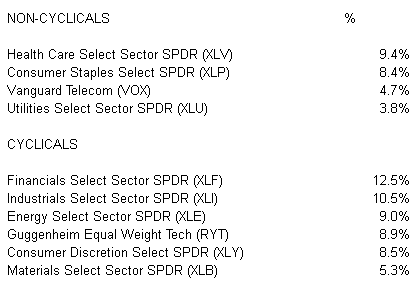

Sector ETFs: Distance Above Long-Term Moving Average

To be frank, most of the cyclical sector ETFs have “gotten ahead of themselves.” And the selling that comprised the “worst two-day stretch” of 2013 did little to change that reality. Even the so-called safer non-cyclicals like consumer staples and health care are over-extended. Telecom and utilities are within an acceptable range, but they may be the most over-valued from a fundamental point of view.

Still, it is the financial segment that I am particularly concerned about. How many times can the media point to accommodative monetary policy and a real estate recovery? It is a desirable backdrop, no doubt. Nevertheless, a government-backed housing administration is not immune to upcoming automatic spending cuts. The U.S. Federal Housing Administration (FHA) would not be able to process as many original loans or “refis.”

And there’s more. Banks are still not lending at a sufficient pace to generate profits for investors. Excess cash that sits in the banks earns next-to-nada. Worse yet, even if banks begin lending like gangbusters, the value of those outstanding loans would decrease over the decade as interest rates rise. Unless prevailing rates are lower than they are 5 to 10 years out, one can expect outstanding loans to hinder bank profitability. We might also expect demand for loans to decrease alongside any substantive increase in interest rates.

I am not advocating that an investor abandon equities or XLF. Many of my clients maintain broad-based exposure via iShares Russell 1000 (IWB), dividend exposure via Vanguard High Dividend Yield (VYM), sector exposure via SPDR Select Consumer Staples (XLP) and foreign developed exposure via iShares MSCI Australia (EWA).

I am suggesting that it is critical to have an exit plan. How you choose to protect against extreme downside risks — stop-limit loss orders, hedges, trendlines, put options — may be a matter of personal preference. In contrast, not having a protection plan is akin to buying a $1,000,000 California home without earthquake insurance.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Why An Upcoming Pullback Could Whack Financial ETFs

Published 02/23/2013, 06:47 AM

Why An Upcoming Pullback Could Whack Financial ETFs

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.