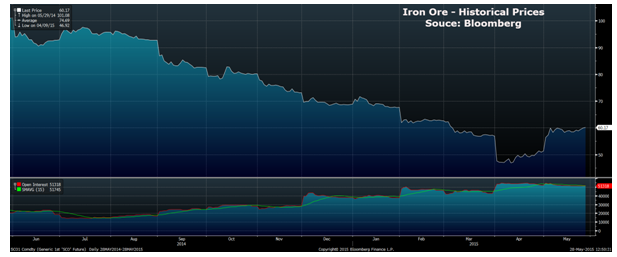

The price of iron ore has continued to be driven lower, mainly through the low cost expansion projects within Australia and Brazil. Prices for the commodity have continued falling from last July’s, high of $94.75/t, to trade currently around the $60.00/t level. This significant fall has placed many of the smaller producers under pressure as well as the Australian government’s tax receipts. Subsequently, the viability of many of the smaller producers is at risk and this has led to a range of voices calling for a change in production strategy.

There is a view, perpetuated by the smaller mining concerns, that a cartel could be created to stabilise prices at a point where all market participants can benefit. Currently, two thirds of the world’s iron ore supply is controlled by three major producers. Accordingly, this alternate view would have the major players fix global iron ore prices at a point which would maximise profits for all within the industry.

In principle, further low cost expansions could be restricted, and prices allowed tostabilise at a higher point. This would potentially allow smaller operators to set prices on a steep curve at a point that would provide economic profits whilst the risk of increased competition or supply.

However, cutting production would likely fly in the face of the continual march towards efficiency within the mining plays. In fact, Goldman Sachs estimates mining efficiency is increasing within Australia, at a rate close to 4.0%/year. These gains in efficiency lead to significantly higher production whilst reducing operating costs and represent a shifting of the efficiency frontier.

Also, coordinating such an agreement amongst the three major participants would be extremely problematic. Historically, such agreements, evident within the oil industry, have been undertaken when there are one or two major competitors within the segment. Adding an additional party to any cartel agreement is likely to significantly complicate any predictive assessment of the competitive outcomes.

However, the elephant in the room is the potential production expansion that exists on the horizon over the next few years. Estimates from GS analysts show secondary tier producers as having nearly 100mt/year of new capacity to introduce within the next two years. Subsequently, any cartel operations would need to factor in the cost of absorbing the additional capacity expansions which are already underway. This is likely to represent a significant cost to any cartel members and would further complicate any predictive supply fixing strategy.

Overall, any move to introduce a cartel to the global iron ore market is likely to face significant problems in implementation. The commodity price is likely to come under increased downward pressure in the coming years as all of the expansion projects by 2nd tier producers come online. In our view, the price is likely to continue to decline back towards the $40/t mark through to 2017 and would be unlikely to lend itself to an implausible cartel strategy.