Gold prices are retreating from a very important technical intersection around $1275/oz. Currently priced around $1260, I believe active investors will need to see gold prices rise above 1275 for the yellow metal to gain traction.

As you can see in the chart below, Gold prices are putting in a near-term rally. This rally has taken prices to the November “breakdown” area, and up as high as its downtrend line. These two areas represent a confluence of resistance that will need to be eclipsed for the price action to be seen as “constructive.” And continued strength would likely give a further boost to a similar rally developing in the ailing gold miner complex.

Gold Price – Daily Chart

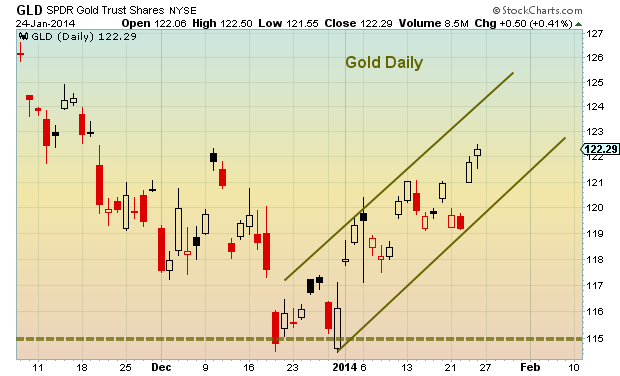

Also worth watching on a near-term basis is the developing near-term channel that Gold prices are rising within. This chart is of the Gold ETF (GLD) to provide a similar perspective for those that prefer this investment vehicle. Trade safe.

Gold ETF – GLD Daily Chart