It’s said that there’s no fever like gold fever. Big bank analysts definitely have a very positive outlook on the world’s greatest metal but

Is their outlook valid?

In the long-term, it certainly is. The economic rise of the huge numbers of gold-oriented citizens in China and India alone is enough to produce relentlessly rising gold, for the next 100 to 200 years!

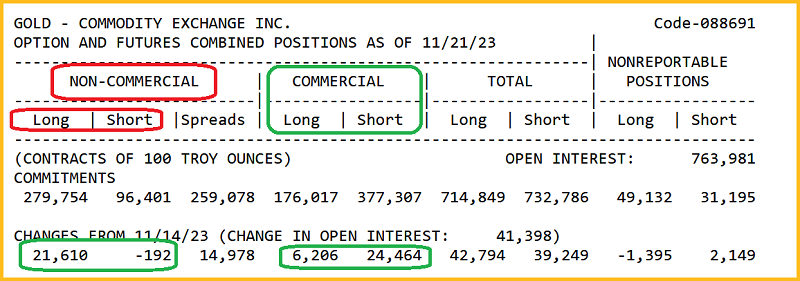

Unfortunately, it appears that the smart money big bank commercial traders have a somewhat different take on the short/medium-term outlook for gold.

The commercial traders have been aggressively shorting the gold and silver markets into the rally, and if there’s further strength in the price, they will likely continue to do so.

Investor tactics? The weekly gold chart. While I don’t think any gold bug needs to be concerned by the commercial trader action, this certainly isn’t a buy zone.

Amateur gold bugs tend to base their buys on price projections while professionals base theirs on significant price weakness.

Sometimes the amateurs get it right, but more often not. In contrast, commercial traders almost always see the price decline not long after their sell program is complete.

Likewise, their buy programs (like the latest one into $1825) tend to be followed by significant price appreciation.

Commercial traders would almost certainly be buyers at $1925. That’s the number I suggest gold bugs focus on for any new buys while cheering for gold to go to the $2080 highs before there’s any significant dip in the price.

How likely is a move to $2080? Some insight into this issue. There’s inverse H&S action all over this daily gold chart, and it’s in sync with some big Indian jewellers calling for $2200 by January or February. Clearly, $2080 is highly likely to happen soon.

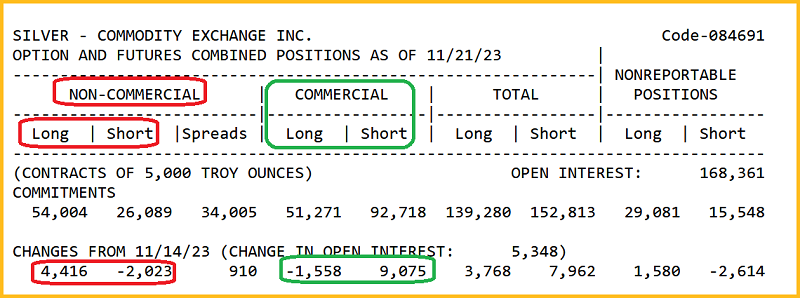

What about silver? Well, as noted, there’s no fever like gold fever with the possible exception being silver!

The daily silver chart. The bull pennant suggests silver could “overshoot” the upper channel resistance line

But whether that happens or not, silver bugs who bought basis my $1825 gold futures early October buy zone are looking great and are in the driver’s seat now.

What about new metal “bugs”, should they get involved with silver? I always suggest that investors should have an emotional connection with investments rather than just an outperformance dream.

If there’s no love for silver, focus on gold.

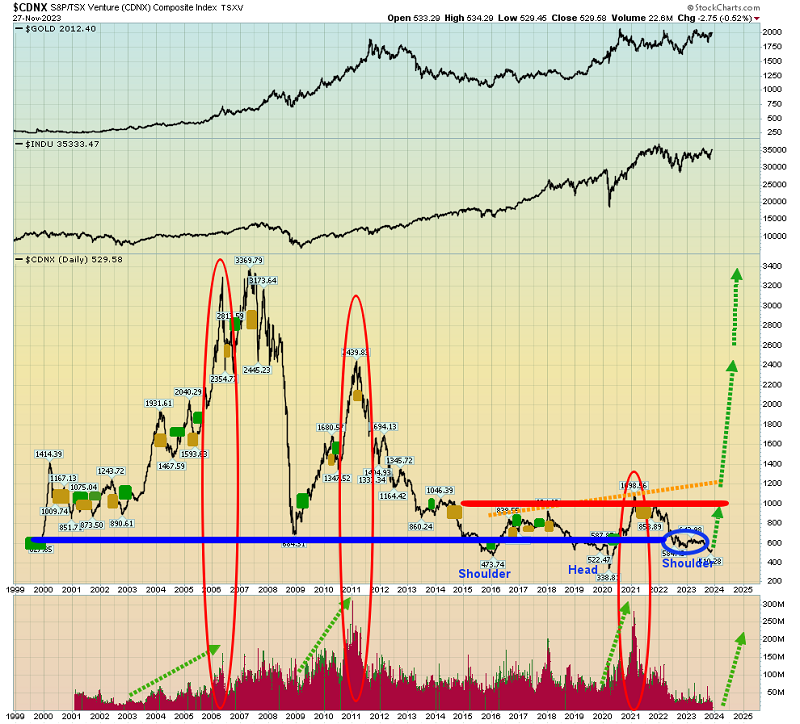

The miners? This is where the action could be for a long time, and in a very good way. The long-term CDNX chart.

The amber and green markers are where my 24/180 moving average crossovers occur. The next signal will be a buy and the huge inverse H&S pattern that’s being completed now suggests the move could be a true “barnburner”.

In the short term, the CDNX chart has suddenly become very positive too.

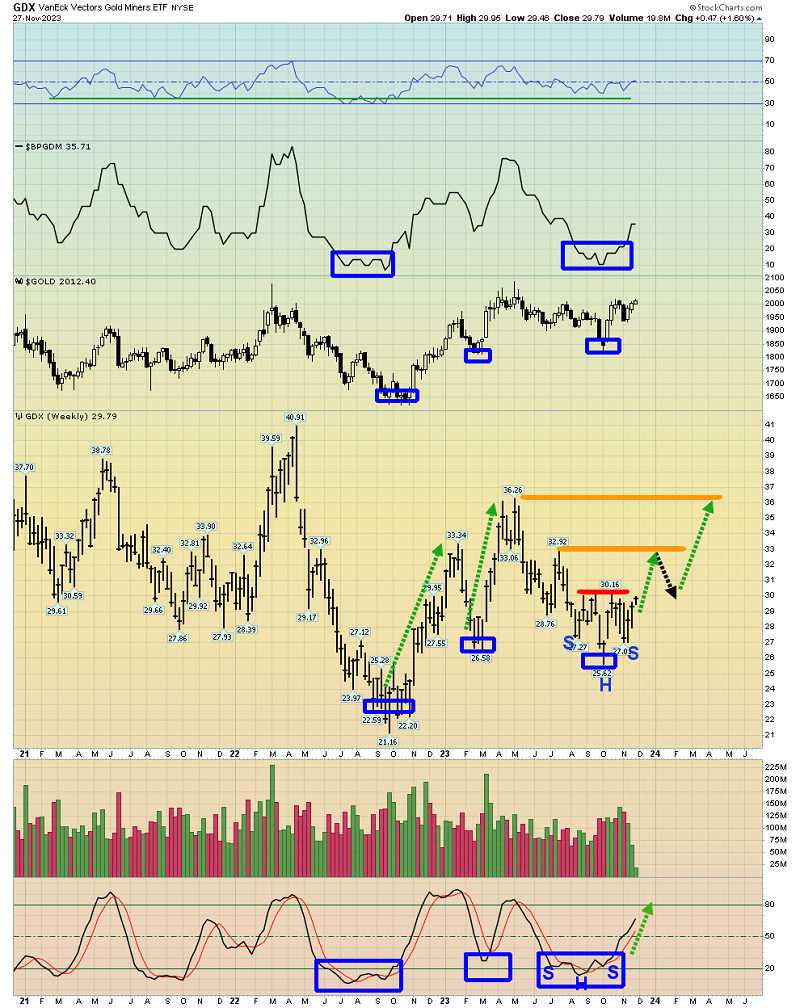

My biggest mine stock focus is the seniors. On this weekly chart, GDX looks like a rocket sitting on an inverse H&S launchpad.

Note the head of the pattern. It occurred right at the “mighty” buy zone of gold $1825/$1810. Mine stock enthusiasts are eager to see a breakout over the $30 neckline area, and I’ll dare to suggest

It could happen today!

A closer look at the action. On this GDX daily chart, the inverse H&S action is even more impressive. Also, note the action of the Stochastics and RSI oscillators; neither is overbought.

While Tuesdays are often a soft price day for the metals, today could provide investors with a glorious breakout above $30, putting the $33 and $36 targets into positive short-term play!