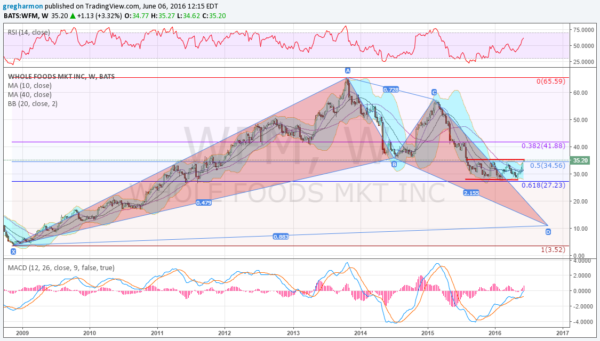

Whole Foods Market (NASDAQ:WFM) was a darling of the markets as the stock rose from the lows in 2009. But by October 2013, the party was over. There was talk of expansion happening too quickly and competition creeping in. Whether these factors played a role or the stock had just moved too much -- 1763% since the 2009 low -- in a short period, it started to move lower. With a consolidation and then bounce along the way, the stock has now been churning for 10 months. That may be about to end.

After 10 months of moving back and forth between a 50% and 61.8% retracement of the long move higher, indicators are starting to point up. The RSI is back into the bullish zone and rising. The MACD is rising and into positive territory. The Bollinger Bands® are opening higher. All this as the price is pushing up against the top of the consolidation range.

What the stock needs is a catalyst and it might soon get that as United Natural Foods (NASDAQ:UNFI), a big Whole Foods supplier, reports earnings after Monday's close. The current read on the price action suggests the range break is most likely to be to the upside. There is one pattern building, though, that looks for a lot more downside. The bullish Bat harmonic has a Potential Reversal Zone (PRZ) at the way down at about $11.