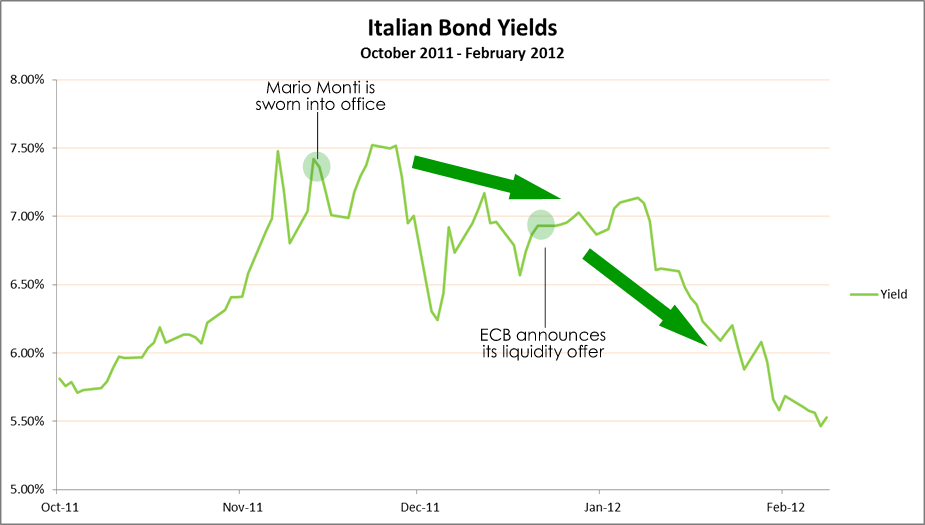

It's amazing how things can change in just a couple of months. Back in November, we saw Italian bond yields rise to unsustainable levels as problems in Greece, Ireland, and Portugal popped out one after another. Tensions in the region then had investors demanding for higher interest rates for holding on to Italy's government bonds as they felt that risk of them not getting their money back increased.

But now, despite talks of a possible Greek default, Italian bond yields have not skyrocketed. In fact, yields on 10-year Italian bonds have gone down to around 5.50%, the lowest levels we've seen since September 2011!

Could it be that Mario Monti's charm is working on investors? That's what some economic gurus are saying as bond yields soon fell from the dreaded 7% level after the technocratic Prime Minister was sworn into office.

According to them, the Italian Prime Minister's plans in cleaning up after Belusconi are working. You see, in an effort to cut down the country's 1.9 trillion EUR debt, the new government outlined 20 billion EUR worth of budget cuts and planned to charge higher taxes on fuel, cut down pension, and increase levies on homes.

On the other hand, to spur economic growth, Monti enumerated a few economic reforms aimed at liberalizing certain sectors to promote competition and create jobs. For instance, he said that the process for opening new businesses is going to be simplified and more taxi licenses will be issued.

Mario Monti's fanboys and fangirls think that this combination has convinced investors that the region's third largest economy can pull through the sovereign debt crisis, which in turn capped bond yields.

But as they say, you can't impress everyone. Those who are skeptical say that it isn't Monti's magic working on the bond markets. They point out that the only significant change that Monti has done was change the pension system in the country, increasing the retirement age of women to match those of men from 62 to 66 starting 2018.

So what is keeping yields from rising?

Most of Monti's critics say that credit is due to another Mario--Mario Draghi, the ECB President.

You see, the region's central bank launched a lending program in December referred to as the Long Term Refinancing Operations, aka "LTRO." It increased liquidity in the region by providing three-year loans to banks at a discounted rate of 1%. Draghi and the rest of the ECB predicted that by giving banks access to cheap capital, they would use the money to buy higher-yielding government bonds. And some economic gurus say that the declining yields are proof that the ECB's plan is working!

Looking at the chart of 10-year bonds, we see that yields did fall shortly after Monti became Italy's Prime Minister and when the ECB announced its liquidity offer. So who between the two Marios should we thank?

Err, to be honest, I don't really see the significance in figuring out which Mario we should give credit to. Heck, for all I know, the decline in yields could be the result of both their efforts! We should all just be thankful that investors don't seem to be worried about Italy while it lasts.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Who Is the Super Mario Behind Falling Italian Bond Yields?

Published 02/14/2012, 01:26 AM

Updated 07/09/2023, 06:31 AM

Who Is the Super Mario Behind Falling Italian Bond Yields?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.