The Bureau of Labor Statistics (BLS) states "Productivity is a measure of economic efficiency which shows how effectively economic inputs are converted into output." To economists, productivity is the measure of the efficient use of capital. To me, productivity is a measure of the progress of knowledge in science and technology.

Follow up:

Many believe that a major headwind to employment growth results from productivity growth. Technology puts people out of jobs by allowing more output using fewer people, but historically - it is argued technology has created new jobs which have offset the jobs lost by implementing technology. Many falsely believe the loss of jobs to technology is the main contributor to headline productivity.

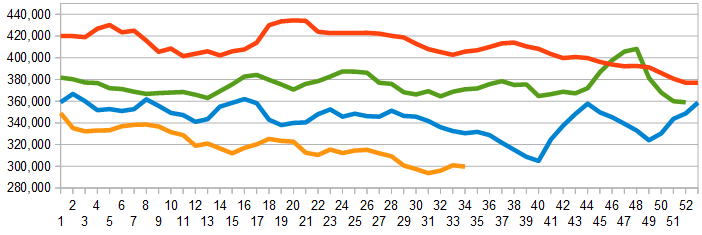

In any event, has there ever been any PROOF headline productivity affects the labor markets? The database which measures job losses is in Job Openings and Labor Turnover Summary (JOLTS) from the BLS. Using the layoffs and discharges in JOLTS and comparing it to the varying levels of headline productivity shows marginal correlation. Obviously, this includes persons laid off for a variety of reasons including business shutdowns and people laid off for cause. Still, logic would dictate some correlation as each 1% gain or loss in headline productivity would presumably effect 1% of the workforce.

Total Private Employment - Productivity (blue line, left axis) and Layoffs & Discharges (red line, right axis)

In the above graph, annual headline productivity gains since 2001 have fallen from 4% to under 1% (the 3% reduction in headline productivity growth would equal 3.5 million non-farm private workers NOT losing their jobs due to productivity gains that did not occur) - while BLS layoffs declined 5 million from 25 million. Is this a partial correlation, or proof of overstated headline productivity, or simply a coincidence caused by factors unrelated to productivity? I cannot convince myself that there is anyway to view this data set, or any other data set, to prove headline productivity is effecting jobs growth.

The measures of productivity that are kicked around in the headline discussions in reality are inflation adjusted total costs of a unit of output related to the amount of labor hours. It is nearly impossible to accurately project REAL and HONEST labor productivity using real time and motion analysis across a USA non-farm private workforce of some 115 million. What is being measured are capital productivity gains. From the BLS:

Outsourcing and offshoring have the potential for greater effect on labor productivity measures for the manufacturing sector. BLS measures output for the manufacturing sector using the sectoral output concept: gross output less sales between establishments within the manufacturing sector. Unlike the value-added measure for the business sector, this output measure includes the value of intermediate inputs purchased from outside the manufacturing sector, whether purchased from domestic or foreign suppliers.

Headline productivity is measured differently between the manufacturing and service sectors - and the real differences in headline productivity growth between manufacturing and service sectors may simply be methodology. Or could the reason headline productivity is "lagging" in the service industry is that the service industry is generally labor intensive with generally less capital investment per worker?

So if economists are measuring costs, and my position that labor productivity is not being measured (as the headline "productivity" gain is actually extra profits), then consider Keynes' words:

The transfer from wage-earners to other owners of other factors is likely to diminish the propensity to consume. The effect of the transfer from entrepreneurs to rentiers is more open to doubt. But if rentiers represent on the whole the richer section of the community and those whose standard of living is least flexible, then the effect of this [real wage reduction on output] also will be unfavorable (Keynes, 1936, p. 262).

I have washed my mouth out with soap for quoting Keynes as I am not a Keynesian of any flavor - I am a full blown pragmatist who requires proof - even for theories that seem logical and right. The headline productivity numbers are NOT labor productivity - but capital productivity. Measurement of labor productivity gains is absent. What are the real labor productivity dynamics effecting the workforce? You can read another of my rants on productivity [here].

Other Economic News this Week:

The Econintersect Economic Index for September 2014 is showing our index declined from last months 3 year high. Outside of our economic forecast - we are worried about the consumers' ability to expand consumption although data is now showing consumer income is now growing faster than expenditures growth. The GDP expansion of 4.2% in 2Q2014 is overstated as 2.1% of the growth would be making up for the contraction in 1Q2014, and 1.4% of the growth is due to an inventory build. Still, there are no warning signs that the economy is stalling.

The ECRI WLI growth index value has been weakly in positive territory for almost two years. The index is indicating the economy six month from today will be slightly better than it is today.

Current ECRI WLI Growth Index

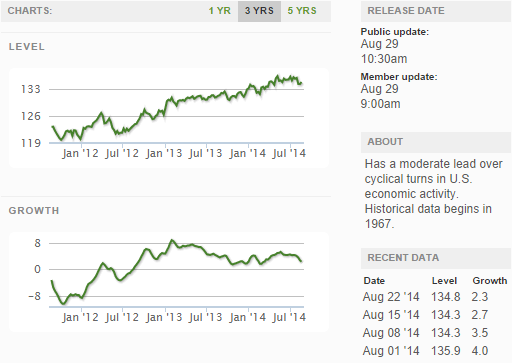

The market was expecting the weekly initial unemployment claims at 295,000 to 303,000 (consensus 300,000) vs the 298,000 reported. The more important (because of the volatility in the weekly reported claims and seasonality errors in adjusting the data) 4 week moving average moved from 301,000 (reported last week as 300,750) to 299,750.

Weekly Initial Unemployment Claims - 4 Week Average - Seasonally Adjusted - 2011 (red line), 2012 (green line), 2013 (blue line), 2014 (orange line)

Bankruptcies this Week: Privately-held Mineral Park, Privately-held Variant Holding Company

Click here to view the scorecard table below with active hyperlinks

Weekly Economic Release Scorecard: