Central bankers were once beings we never heard of, and rightly so, if someone’s doing a good job you never hear about them. Back in the day all they had to do was make sure everything balanced, i.e. there was enough gold in the bank.

No-one paid attention to them because central banking was boring. Even Mervyn King said in a speech over ten years ago "…our ambition at the Bank of England is to be boring…in our management of the economy where our belief is that boring is best."

Well Mervyn, it turns out you failed because in the last ten years you have most certainly made it into the daily media and the history books, but ahead of you will be Ben Bernanke, Mario Draghi and Gideo Gono and lagging slightly behind you is Zhou Xiaochuan (PBOC) and Masaaki Shirakawa (BOJ).

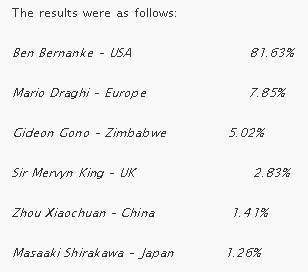

According to our poll where we asked "Which central banker does the most damage" Mervyn King was in the median average for the most damaging central banker amongst contemporaries.

As central bankers they each bear similar responsibilities, some more far-reaching than others. Each has embarked on some measure of easing, and most continue to do so. Each candidate in our poll has displayed an unbelievable lack of humility for the damage which has come about from their highly leveraged systems and easy monetary policy approaches. The majority blame forces outside of their control for measures not working.

Our winner was, of course, Chairman Ben Bernanke.

If you Google Bernanke you will find reams and reams of toilet paper worth of descriptions of how this is Bernanke’s finest hour (good luck everyone) and how he has fought arduously for the American people during this crisis.

The biggest national contribution in our poll came from the United States, where over 85% of whom voted for Bernanke. It was similar story for those of us in the UK (76%) and the majority of eurozone voters.

It’s not that surprising that Bernanke is perceived as the most damaging. He is the keeper of the world’s reserve currency, yet he’s devalued it at an increasing rate since he took over; the first two rounds of QE saw $4 trillion injected into the economy which was then exported elsewhere.

He is now in his third round of QE, after proving that it does an incredible amount of…nothing. But this isn’t his fault of course, and so he will continue to find radical ways to boost the economy. Any "improvement" seen in the economy since the money printing has been short term fixes, or literally "fixes." For instance employment numbers are purportedly going up but those on food stamps are also going up.

All the while the dollar continues to devalue, the system remains highly leveraged, the deficit continues to multiply, US GDP continues to decline and the gold price continues to climb.

More than any other central banker, today and in history, the Chairman of the Federal Reserve has a greater impact across the globe, therefore it was unsurprising that even those outside of the US voted for Bernanke.

If the perspective of Americans, those within the compound of Bernanke’s Emerald City, is this negative and those in the West also think he’s also pretty dangerous, imagine what those in the East and other emerging economies (who were not significant poll contributors) think of him.

Well, we know. They’re all buying gold, as we discussed in recent articles. The West are missing a trick. Whilst we all bemoan Bernanke’s dangerous monetary policies, governments and citizens across the emerging world are stocking up on gold, aware that the "damaging" element of Bernanke’s policies will not be so easy to hide any more, and moving away from the US dollar.

Since the financial crisis several countries including India, Malaysia and Russia are no longer allowing their currencies to follow the dollar so closely as they did pre-crisis. A study by Arvind Subramanian and Martin Kessler finds that the majority of East Asia is now on a "yuan standard," the authors expect the yuan’s influence to reach beyond this area, taking over the dollar as a key-currency around 2035.

The stragglers

Second in the poll was Mario Draghi, but with just 7.85% of the votes. Gideon Gono came in with 5.02%. The remaining three picked up just 5.5% of the votes between them.

Because of the nature of our business we suspect many respondents are well-informed individuals who are up on the fiat money system. If we asked the average man on the street I’m not sure who he would say.

Unsurprisingly our one voter in Spain voted for Draghi, this is likely because at the moment much of Spain’s fate rests in his hands. However the rest of European countries voted for Bernanke. I suspect (pure speculation) this is because Bernanke is considered more of an individual responsible for the central bank, Draghi on the other hand is new to the party and very much considered one of the Brussels lot – a pack who collectively muddle out new rules and measures.

As an economics student, prior to having my "gold-eureka" moment, I would have most definitely said Gideon Gono. He became something of a "celebrity" when I was doing my degree, the country’s hyperinflation was widely reported by the media, and he proved a useful example of dangerous money printing for our lecturers.

The man who probably had a personal printing press just to give his kids their pocket money or to pay the cleaner, Gono is responsible for the second greatest hyperinflation in history, which took place between 2003 and 2009.

Unlike the rest of them on this list, he’s got the most humility of the lot and knows when to admit he was wrong.

In a mid-term policy statement earlier this year the RBZ’s governor discussed the parallels between QE3 and his own policy of the last decade. He wrote:

"The interventions which were exactly in the mould of bail out packages and quantitative easing measures currently instituted in the US and EU, were geared at evoking a positive supply response and arrest further economic decline."

He went on to admit that rolling out the printing presses in the hope of stimulating growth does not work, "despite numerous intervention measures undertaken by government through the Reserve Bank of Zimbabwe, economic activity continued to decline progressively…the value of the local currency declined precipitously as speculative activities intensified. Against this background, transactions were increasingly undertaken in foreign currencies which were more stable and predictable."

To give him some credit he his indirectly responsible for introducing currency competition in the country after suspending the Zimbabwe dollar indefinitely in 2009.

If only the fiat dollar were as disposable

Whilst the results of our poll are no doubt slightly skewed on account of the majority of voters being American, we can still see from UK and European votes the concern held for Bernanke’s policies.

Draghi, I believe is dangerous, but his hands appear to be more tied by other European central bankers and the rules within the eurozone. His actions will be wide reaching, clearly, but the euro is most likely seen more experimental than the dollar. We hear far more debates about the end of the euro, not the end of the dollar as we know it. Therefore, the disposable nature of Draghi’s charge may have made him less attractive a candidate for this highly sought after position.

Please Note: Information published here is provided to aid your thinking and investment decisions, not lead them. You should independently decide the best place for your money, and any investment decision you make is done so at your own risk. Data included here within may already be out of date.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Who Is The Most Damaging Banker Of Them All?

Published 11/21/2012, 04:49 AM

Updated 05/14/2017, 06:45 AM

Who Is The Most Damaging Banker Of Them All?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.