The point is that a party committed to small government and low taxes on the rich is, more or less necessarily, a party committed to hurting, not helping, the poor. Will this ever change? Well, Republicans weren’t always like this. In fact, all of our major antipoverty programs — Medicaid, food stamps, the earned-income tax credit — used to have bipartisan support.

And maybe someday moderation will return to the G.O.P. For now, however, Republicans are in a deep sense enemies of America’s poor. And that will remain true no matter how hard the likes of Paul Ryan and Marco Rubio try to convince us otherwise.

The vast majority of the population is not poor – but middle class. How have the political parties done in making their middle class constituents’ lives better. Unfortunately, the only proxy that even comes close to establishing a metric would be median income.

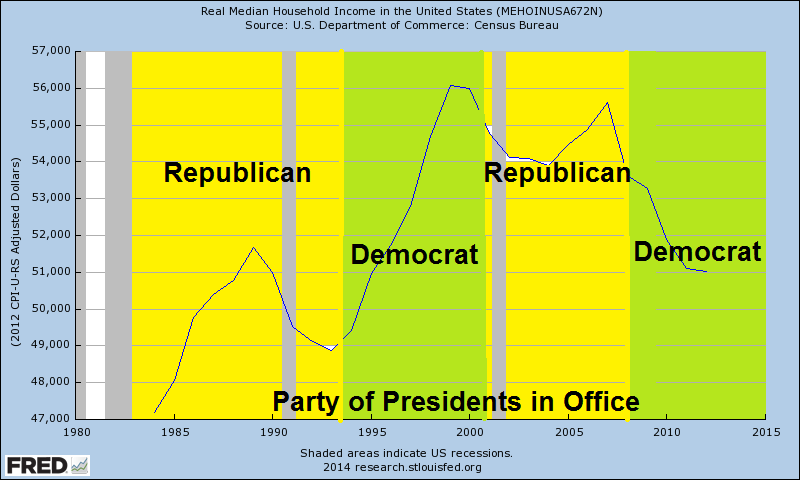

The chart below overlays the incumbent Presidential Party with median income.

There are several obvious “buts” relative to the above chart.

- for starters, the President is not responsible for fiscal policy – Congress is. The President has some executive regulatory ability but most of the policy rests with Congress;

- it can takes years for fiscal or regulatory policy to positively or negatively effect the economy.

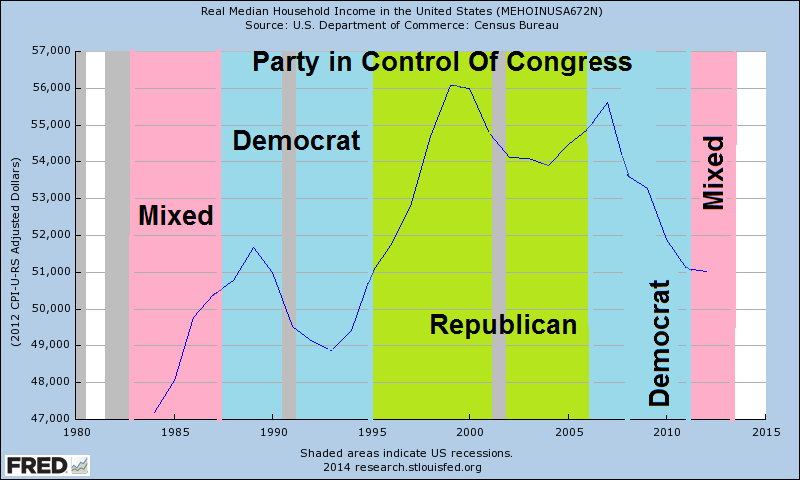

So taking the same median income chart, I have overlaid the party in control of Congress.

There is little evidence either political party has been good for the middle class. It is not the rich or the poor which drive a consumer economy – but the middle class. It follows that to ramp up the economy, a consumer driven economy must increase the ability of the middle class to spend. One party seems to believe it is their duty to protect the poor (using transfer payments from the government to fuel spending), while the other seems to protect the rich (as the rich have the ability to fuel the economy through investment). Both believe in trickle economics – feeding a weak economy using the government to transfer funds that will trickle up or feeding the rich to trickle down. There is no evidence that trickle anything works except for short periods of time. There is only one way to fuel the economy – and that is to fuel the middle class directly by increasing its ability to produce income, and lowering regulatory hurdles so the middle class can directly embark in capitalism.

- lower tax burdens;

- remove regulation for small business;

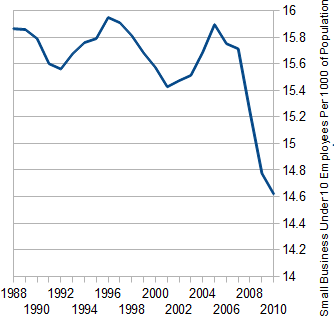

Having spent much of my life living in countries which have limited social safety nets, it always amazes me to see individuals make a living through small business endeavors. This is capitalism. Small business in the USA has been in a down trend for years. From US Census data:

Number of Small Businesses (employ less than 10 people) per 1000 of Population

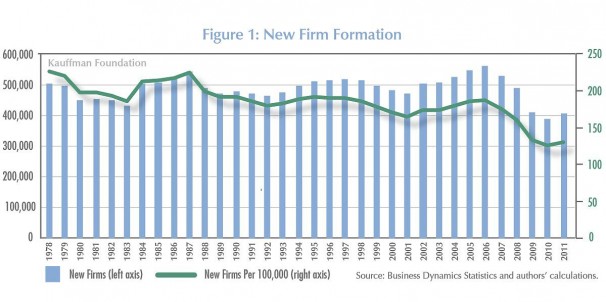

The data in the above graph cuts off at 2010, and deals with the number of businesses in existence. From the Washington Post, another graph with fresher data points out that the number of business births may be increasing (but no data was provided on business deaths so that a net number of business were known):

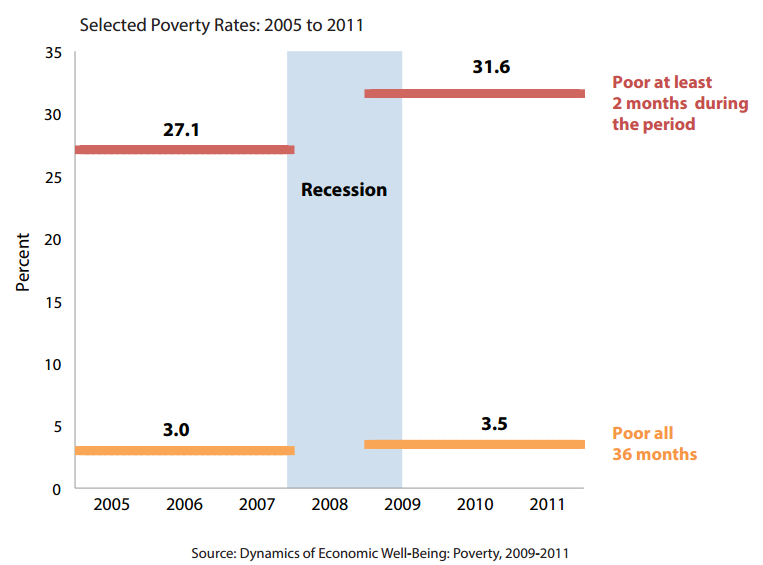

Professor Krugman maintains that one party is the enemy of the poor. He did not mention who is the advocate for the middle class – maybe because there is no advocate. If the objective was to make the middle class poor – then it is succeeding. From another Washington Post article:

Other Economic News this Week:

The Econintersect economic forecast for January 2013 predicted a slowing economic growth after several months of increasing growth. What this forecast cannot see is the effect of Obamacare – but slowing of growth in this forecast was primarily the result of the business sector.

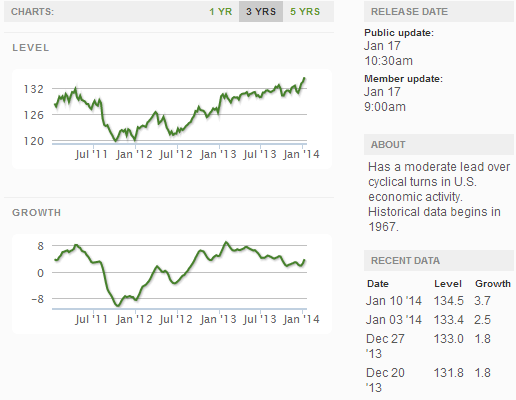

The ECRI WLI growth index value has been weakly in positive territory for over four months – but in a noticeable improvement trend. The index is indicating the economy six month from today will be slightly better than it is today.

Current ECRI WLI Growth Index:

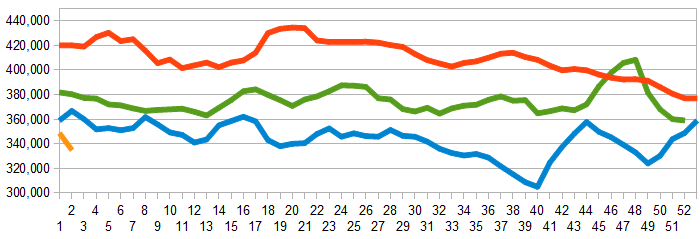

Initial unemployment claims went from 330,000 (reported last week) to 326,000 this week. Historically, claims exceeding 400,000 per week usually occur when employment gains are less than the workforce growth, resulting in an increasing unemployment rate. The real gauge – the 4 week moving average – improved from 349,000 (reported last week) to 335,000. Because of the noise (week-to-week movements from abnormal events AND the backward revisions to previous weeks releases), the 4-week average remains the reliable gauge.

Weekly Initial Unemployment Claims – 4 Week Average – Seasonally Adjusted – 2011 (red line), 2012 (green line), 2013 (blue line), 2014 (orange line)

Bankruptcies this Week: none

Weekly Economic Release Scorecard:

Click here to view the scorecard table below with active hyperlinks