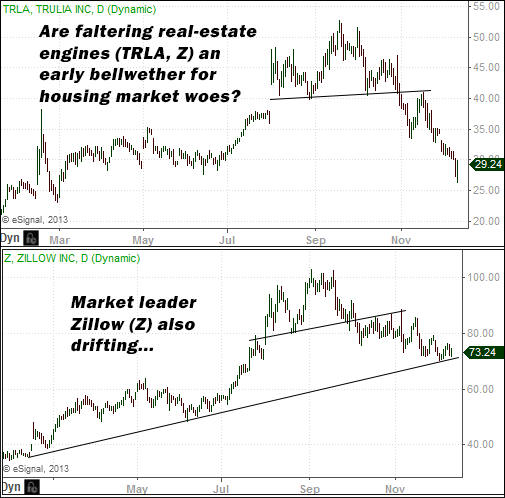

It’s always fun to see one of your shorts drop nearly 10% in a single day. That’s what happened with our short position in Trulia (TRLA), the real estate search engine. On Wednesday December 11th, TRLA closed 9.5% lower on news of a $200 million convertible senior notes offering.

One could argue that dilutive debt issuance is a company-specific problem. But investors had the option of interpreting a round of capital raising as expansive for growth, and chose not to. More importantly, the broad pattern for TRLA is quite negative (hence our initial short) and market leader Zillow (Z) is also softening.

What might this say about prospects for housing in general?

The word “bubble” has been used far too frequently by the financial media as of late. We really like Cliff Asness’ definition, the notion that “bubble” means something specific: Price levels so high that no future scenario could possibly justify them. If a potential logical explanation for a price level exists, then, such-and-such asset is not in a bubble. It might be overvalued, sure, but “overvalued” and “bubble” are two different things. To use the words “overvalued” and “bubble” interchangeably is to make the word “bubble” meaningless — and why do that when “overvalued” will do?

We agree with those who say US housing markets are not in a bubble… and perhaps not all that overvalued. While housing bubbles still await bursting in various countries — Canada, Australia, Norway, Sweden etc. — the US is not one of them.

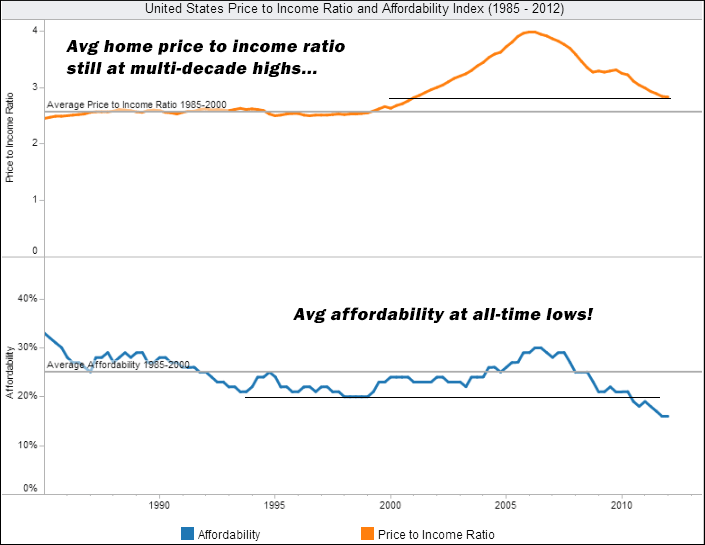

And yet the problem with the housing market — and the danger — does not have to do with bubbles, or even overvaluation per se. It has to do with affordability. Because remember, overvalued assets can go down in price too. Even fairly valued or undervalued assets can drop, depending on the circumstances! (Why does the financial media forget this?)

The above data, via Zillow, illustrates the problem. US home prices may not be back in “bubble” territory… but they remain too expensive for most Americans. The average price-to-income ratio is still at multi-decade highs, even after a sharp fall from the housing bubble peak. And average affordability levels are at all-time lows.

Why does this matter? Because of the “pull forward” effect. When, say, a car company decides to run 0% financing and huge discounts to pull in sales, it gets more revenue up front, but also “pulls” those sales from the future. If more people buy cars now, at the discount, there will be fewer consumers to purchase cars in the future, because the purchases were pulled forward.

The same phenomenon exists with big-ticket purchase items like a home. Thanks to subsidized mortgage rates and intense interest from Wall Street (private equity buyers of single family homes as mass investments), future home purchases have been “pulled forward” into the present. This means the stock of potential home buyers has been diminished… and the still-lofty price levels for the average home means that stock of potential buyers is smaller relative to supply.

Another way to look at it is, if homes were more affordable to average Americans, there would be less risk of buyers drying up and causing the housing recovery to fade. But with affordability levels as low as they are — and Wall Street poised to turn from net buyer of homes en masse to net seller — the risk of a stumble is real, even if there is no “bubble” in apparent pricing! You don’t need a bubble in car prices for automaker sales to decline, and you don’t need a bubble in home prices for a downturn either (especially after an artificially stimulated, Wall Street enabled surge like the one we’ve seen).

In further worrisome news, anecdotal evidence confirms investors are pulling back:

Investors are beginning to step back from more housing markets as rising home prices and low inventories —particularly as distressed sales dry up — have offered fewer discounts to bargain hunters, according to an analysis by real-estate research firm CoreLogic.- Wall Street Journal, Investor Purchases Ebb in More Housing Markets

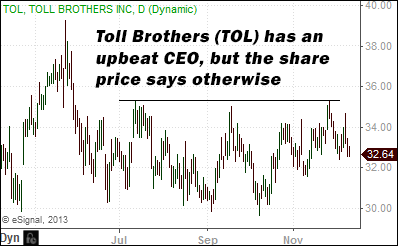

We can also see investor skepticism in the price action of housing market bellwethers, like upscale builder Toll Brothers (TOL). Though Toll Brothers CEO Douglas Yearley called 2013 an “excellent year” and has beat the drum for the housing recovery — what else is a builder CEO going to do — share prices have languished from Summer onward (even as the broad market climbed).

Who might be vulnerable to a housing market slump? First and foremost, the broad market itself would be vulnerable if the housing recovery noticeably stalled in 2014. This would move us closer to the “pushing on a string” scenario, in which further Federal Reserve stimulus failed to produce the magic pixie dust effect of increasing investor confidence. Were the meme to spread on Wall Street that the supply of home buyers has been all used up at the same time the Fed’s powers of QE levitation “run out of gas,” to borrow Ray Dalio’s analogy, “risk off” could be an uncomfortable new reality.

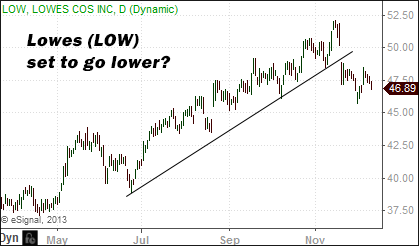

On a more granular level, a housing recovery stall-out would almost certainly hit home improvement darlings like Lowe’s (LOW, shown above) and Home Depot (HD). Furniture and knick-knack purveyors like Ethan Allen (ETH), Lazy Boy (LZB) and Pier One (PIR) could also be vulnerable. Watch the broad homebuilder indices the SPDR S&P Homebuilders, (XHB) and the iShares U.S. Home Construction ETF (ITB) — they could further function as canaries in the coal mine.

Disclosure: This content is general info only, not to be taken as investment advice. Click here for disclaimer