Street Calls of the Week

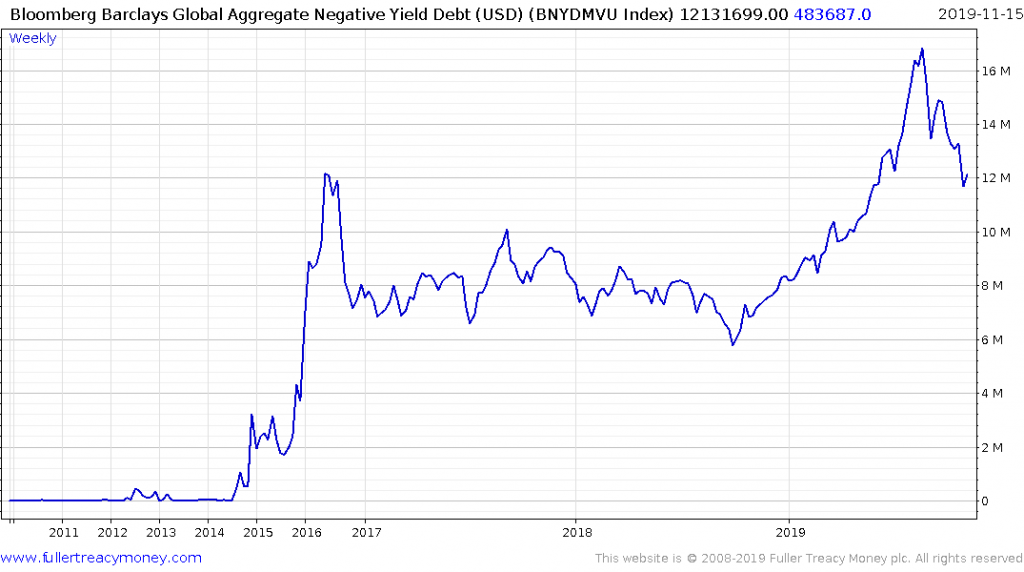

The total of global bonds on negative yields has fallen from a peak of $17 trillion to “only” $12 trillion, but there is no guarantee that this trend will continue given the “whatever it takes” attitude of the central banks. This was Draghi’s mantra but has been taken up by the Fed with their about-face in late 2018 as the markets swooned and as repo market rates exploded from sub 2% to over 10% in September this year.

Why would anyone buy a bond where the lender pays the borrower?

In order to answer that question, I’ve included a brief excerpt from Charles Gave, on precisely this topic.

“When meeting some clients a few weeks ago in Amsterdam, I made my usual remark about the stupidity of running negative interest rates. In response my host told me a sobering story. He manages a pension fund and had recently started to build large cash positions. One day he was called by a pension regulator at the central bank and reminded of a rule that says funds should not hold too much cash because it’s risky; they should instead buy more long-dated bonds. His retort was that most eurozone long bonds had negative yields and so he was sure to lose money. ‘It doesn’t matter,’ came the regulator’s reply: ‘A rule is a rule, and you must apply it.’

Thus, to ‘reduce’ risk the manager had to buy assets that were 100% sure to lose the pensioners’ money.” Negative-yielding bonds are a cancer eating away at Europe’s entire savings industry, with truly disastrous long-term implications.