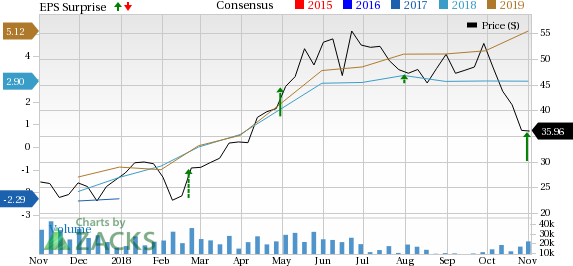

Whiting Petroleum Corporation (NYSE:WLL) reported third-quarter adjusted net income per share of 92 cents, surpassing the Zacks Consensus Estimate of 58 cents. The outperformance stemmed from cost efficiency and higher liquids realizations.The bottom line also turned around from the year-ago adjusted loss of 56 cents. Further, total operating revenues came in at $566.7 million, topping the Zacks Consensus Estimate of $522 million. The top line also recorded year-over-year growth of 75%.

Importantly, Whiting’s discretionary cash flow of $297 million exceeded capital expenditure by $90 million in the quarter. In the quarter under review, the company generated $56 million of operating cash flow over and above its capital spending. Notably, total operating expenses of the company reduced 50.6% from the prior-year level to a total of $397.3 million in the quarter under review. As costs continue to decline amid stronger oil pricing, it is expected to generate a significant amount of free cash flow over the next few years.

Production & Prices

Whiting’s total oil and gas production increased 13% from the last year’s corresponding period to 11.84 million oil-equivalent barrels (comprising 83% liquids). Roughly 83% of the company’s output came from the Williston Basin region.

The average realized crude oil price during the third quarter was $56.82 per barrel, representing an increase of 36% from the year-ago realization of $41.69.The average realized natural gas liquids price was $22.22 per barrel, up 84% from the year-ago period. Meanwhile, Whiting fetched $2.88 per thousand cubic feet (Mcf) for natural gas during the third quarter of 2018, down 0.3% year over year.

Balance Sheet & Capital Expenditure

As of Sep 30, 2018, the oil explorer had approximately $14.2 million in cash and cash equivalents. Whiting had a long-term debt of $2,835 million, representing a debt-to-capitalization ratio of 41%. In the reported quarter, the company spent $207 million on capital programs.

Guidance

Whiting expects fourth-quarter production in the range of 12.2-12.6million barrels of oil equivalent (MMBOE) and yearly output within 47-47.4 MMBOE. For 2018, the company expects a capital budget of $750 million.

Zacks Rank & Key Picks

Currently, Whiting has a Zacks Rank #2 (Buy).

Some better-ranked players in the energy space are Parsley Energy (NYSE:PE) , Enbridge inc. (NYSE:ENB) and Bonanza Creek Energy Inc. (NYSE:BCEI) , each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Parsley Energy pulled off average positive earnings surprise of 30.68% in the trailing four quarters.

Enbridge posted average positive earnings surprise of 35.27% in the preceding four quarters.

Bonanza Creek delivered average positive earnings surprise of 74.88% in the last four quarters.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +21.9% in 2017, our top stock-picking screens have returned +115.0%, +109.3%, +104.9%, +98.6%, and +67.1%.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - 2017, the composite yearly average gain for these strategies has beaten the market more than 19X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

See Them Free>>

Enbridge Inc (ENB): Free Stock Analysis Report

Parsley Energy, Inc. (PE): Free Stock Analysis Report

Whiting Petroleum Corporation (WLL): Free Stock Analysis Report

Bonanza Creek Energy, Inc. (BCEI): Free Stock Analysis Report

Original post

Zacks Investment Research