Whilst FedEx Corporation (NYSE:FDX) is on the brink of breaking key support, United Parcel Service Inc (NYSE:UPS) is just 4% from its YTD. Disappointing earnings and a lowered full-year outlook saw FedEx plummet over -10% at market open last Tuesday, and it was the main reason behind the Dow Jones Transportation sell-off whilst also triggering fresh concerns for the global economy.

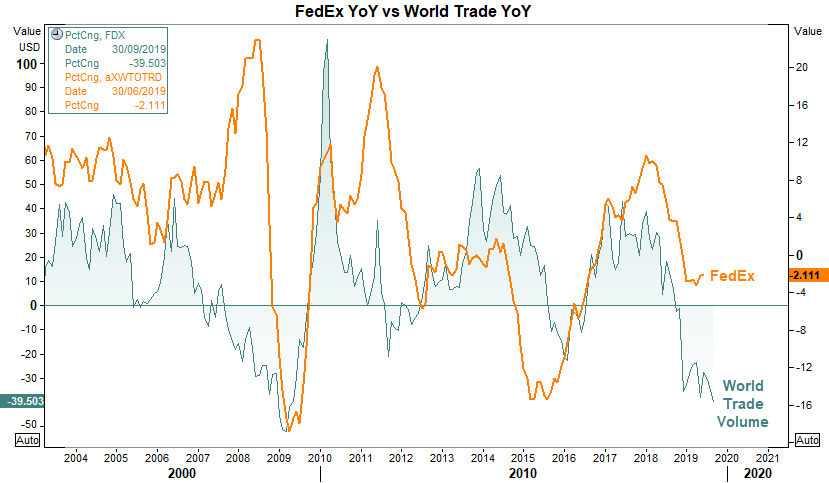

We can see that FedEx (NYSE:FDX) performance can be taken as a bellwether for global trade by comparing the YoY% of FedEx with YoY Trade volume. Whilst the correlation is not perfect, its still a decent enough proxy and would suggest that global trade is to drop further (and therefor, global growth and potential for further easing from central bankers).

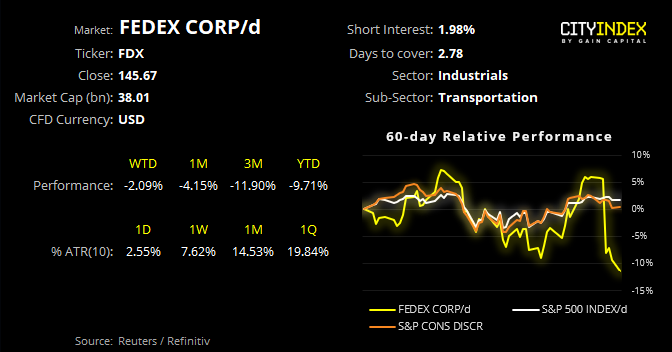

Looking at the daily FedEx (NYSE:FDX) chart, prices has been oscillating between 148 – 178 since June, although the 200-day average capped as resistance near the top of the range before rolling over to the low of the range. In fact, FedEx closed to a 3-year low yesterday and sits just ticks above key support.

Interestingly, their rival UPS isn’t facing the same headwinds with the stock trading just 4% from this year’s highs. Still, it’s failed to retest the 125 high so there is potential for this one to roll over too. But perhaps another way to look at this is as an inter-sector pairs trade, given the ratio between UPS/FDX has been rising sharply.