Poor US Advance GDP results of 0.5% q/q and a build in Unemployment Claims to 257K has gotten the Gold Bulls stirred up again. Unfortunately for them, the best they can hope for is the re-widening of the metal’s channel. However, it might also be possible that the commodity is verging on another prodigious fall.

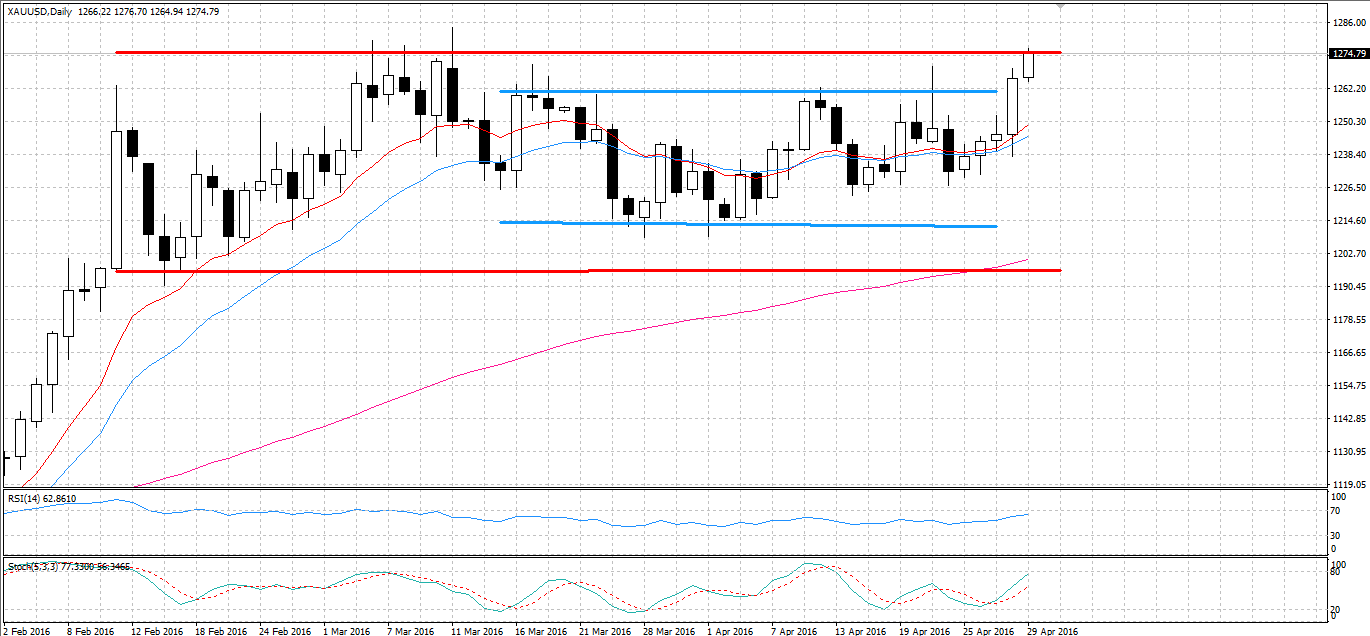

Whilst it is true that Gold has broken free of the recently narrowed channel, the yellow metal is yet to break free of the larger sideways structure. Consequently, the commodity is likely to remain constrained unless there are some major upsets in the nearing US indicator results. However, the predicted figures are all rather sober and the Chicago PMI result is predicted to decrease. As a result, much of the negative USD sentiment should already be priced into Gold.

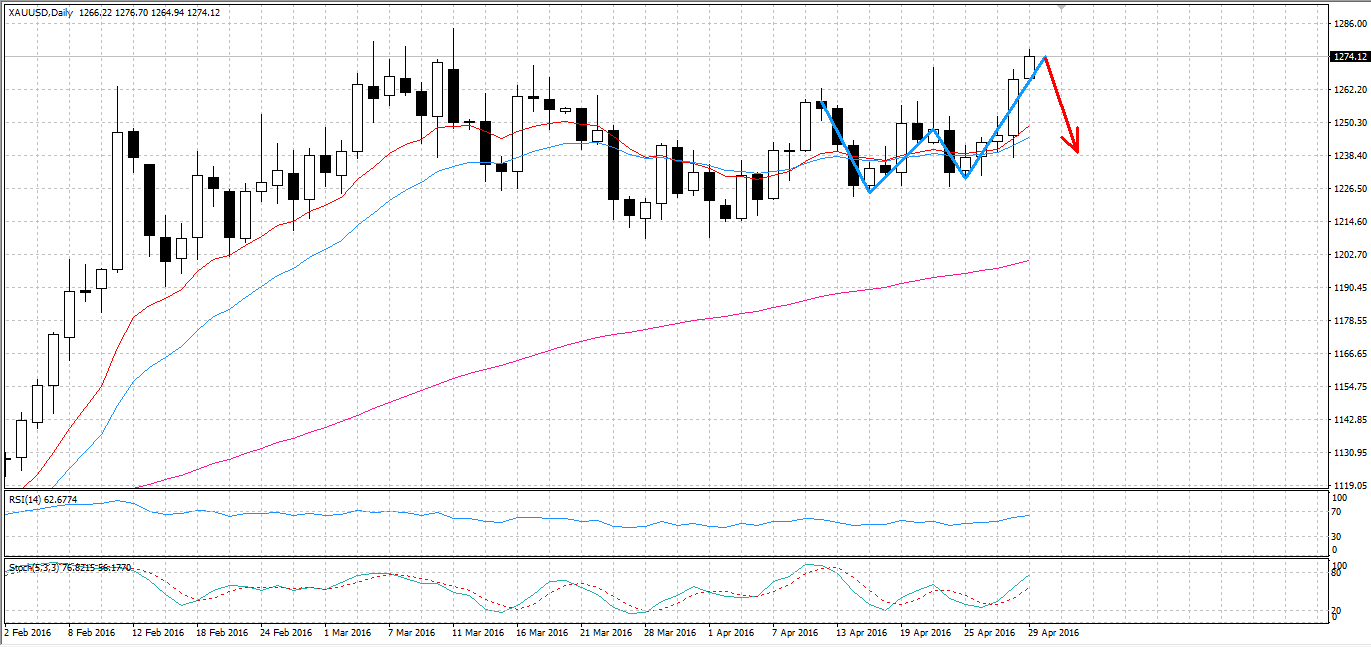

As Gold is unlikely to be making an upside breakout, the metal should be making a move back towards the lower constraint in coming days. Furthermore, highly overbought readings on the H4 RSI and stochastic oscillators are likely to spark selling pressures. However, a move back to the downside constraint might not be the full extent of the downside potential for the metal.

Two chart patterns are presently in agreement that Gold should be set to take another tumble. Firstly, the formation of a bearish crab on the daily chart is signalling that a bearish reversal should be imminent. However, the pattern could simply be preceding the fairly inevitable retracement to the downside constraint of the sideways channel.

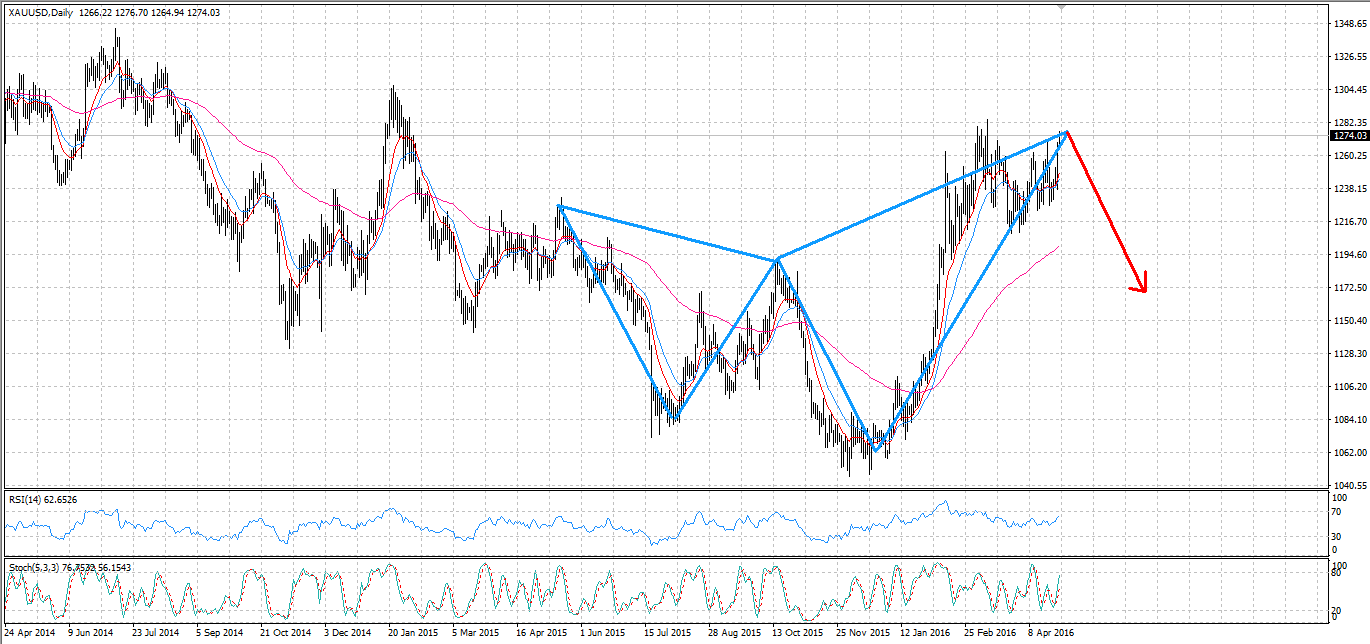

A more convincing and long term pattern is the bearish butterfly which began forming last May. The butterfly could be indicative of a far more serious plunge for the precious metal. Consequently, the resulting fall would resume the general bearish trend which has dominated the Gold Market for some time.

As shown on the weekly chart, the recent Gold rally is relatively aberrant considering how consistently the metal has declined. As a result, the potential for another large slip seems increasingly probable. Short of a huge upset in the US indicator results, the metal is unlikely to remain buoyant in the medium to long term.

Ultimately, the recent bullishness of Gold is a symptom of a Dovish Federal Reserve and some knee-jerk buying following a spate of underwhelming US result releases. In the long-term, the precious metal will either remain contained, or resume the bearish trend, which has held sway for an extended period of time. Consequently, any hopes for a strong bullish trend emergence should be held in check for now.