The grocery industry has been grappling with several challenges like stiff competition, and aggressive promotional environment of late. Traditional grocery rivals are strengthening their franchises and outside players are offering alternative outlets for food and other staples.

Customers are becoming more inclined toward private label products as they are low-cost alternatives to national brands. Food deflation had added to the woes over the last one year where oversupply in some types of food — particularly meat, poultry and dairy — dragged prices lower and forced grocery stores into more aggressive promotions. However, the scenario is now better with prices starting to increase.

The biggest blow to the grocery industry came when e-Commerce biggie Amazon.com, Inc. (NASDAQ:AMZN) announced an all-cash $13.7 billion deal on Jun 16 to acquire the natural and organic foods supermarket chain Whole Foods Market Inc. (NASDAQ:WFM) , citing pricing concerns. Shares of several grocery store chains tumbled on Aug 24 following Federal Trade Commission approval to Amazon to purchase Whole Foods.

While shares of big box retailers like The Kroger Co. (NYSE:KR) declined 7.71% and nearly touched its 52-week low, Costco Wholesale Corporation (NASDAQ:COST) fell more than 5%, Target Corporation (NYSE:TGT) dipped 3.99%. Sprouts Farmers Market Inc. shares declined 6.95%, while shares of SUPERVALU Inc. dropped 6.60%. On the other hand, Whole Foods’ stock inched up 0.72%.

Amazon’s Deal and Its Impact on the Food Industry

Amazon will close the deal on Aug 28 and will acquire Whole Foods’ around 470 stores across the U.S., U.K. and Canada along with 87,000 employees and its solid reputation. Notably, the Texas-based Whole Foods deals in natural and organic offerings at a premium price, which is in contradiction with Amazon’s track record of keeping the prices low.

So Amazon will lower the prices of Whole Foods’ as soon as the acquisition is completed, to lock in customer loyalty. Some of the items whose prices will be slashed include Whole Trade bananas, organic avocados, organic large brown eggs, and kale and other organic food. The company also announced certain Whole Foods products will be available through Amazon.com, AmazonFresh, Prime Pantry and Prime Now.

With Amazon’s huge cash balance and expansion capabilities, we believe such acquisitions can change the retail landscape and ward off competitors. Amazon’s move to lower grocery prices has been met with apprehension at grocery stores and supermarkets as they may experience pricing pressure and lose customers. Some investors also worry that Amazon's deal would squeeze profit margins in an industry already known for stiff competition and tight margins.

The entry of Amazon has caused a disruption in the grocery segment and has made investors skeptical of investing in the industry. However, not all food companies are underperforming. There are still quite a few food stocks which are poised to grow and investing in them will be a prudent move.

How to Pick the Best Stocks?

With the help of our new style score system, we have identified four food stocks that have excellent prospects and seem to be unaffected by this deal. Such stocks also boast a VGM score of A or B. Here V stands for Value, G for Growth and M for Momentum and the score is a weighted combination of these three metrics. Our research shows that stocks with VGM Scores of A or B when combined with a Zacks Rank #1 (Strong Buy) or 2 (Buy) offer the best upside potential. Such a score allows you to eliminate the negative aspects of stocks and select winners. You can see the complete list of today’s Zacks #1 Rank stocks here.

Prominent Choices

Based in Ridgefield, Connecticut, The Chefs' Warehouse, Inc. (NASDAQ:CHEF) is a distributor of specialty food products in the United States. The company carries a Zacks Rank #2 and has a VGM Score of B. The company has a long-term earnings growth rate of 19.00%, which also makes it a viable investors’ choice.

Investors can also count on Chicago-based Ingredion Inc. (NYSE:INGR) , which is an ingredients solutions provider specializing in nature-based sweeteners, starches and nutrition ingredients. It carries a Zacks Rank #2 and has a VGM Score of B. It has a long-term earnings growth rate of 11.00%.

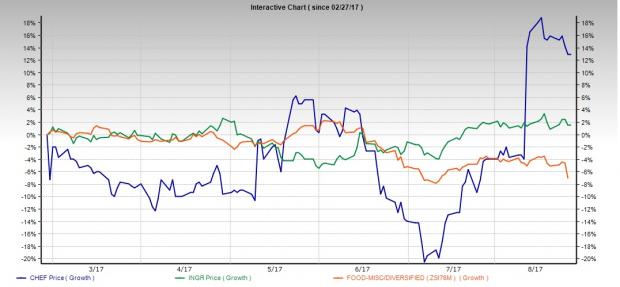

Coming to the share price movement, Chef’s Warehouse has rallied 12.9% over the last six months, while Ingredion grew 1.5%. On the other hand, the industry declined 7.0% in the same time frame.

We also suggest investing in Sanderson Farms, Inc. (NASDAQ:SAFM) , which is engaged in the production, processing, marketing and distribution of fresh and frozen chicken products. The company carries a Zacks Rank #2 and has a VGM Score of A.

Another chicken company which warrants a look is Pilgrim's Pride Corporation (NASDAQ:PPC) . The company sports a Zacks Rank #1 and has a VGM Score of B.

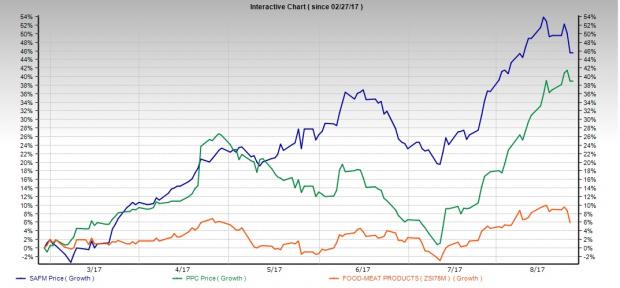

If we look into the share price movement, we note that while Sanderson Farms has rallied 45.5% in the last six months, Pilgrim’s Pride grew 38.9%. Both the stocks outperformed the industry, which gained only 5.9% over the said time frame.

Bottom Line

We believe that investing in these companies should safeguard your portfolio in the short term and yield higher returns amid food industry concerns.

4 Surprising Tech Stocks to Keep an Eye On

Tech stocks have been a major force behind the market’s record highs, but picking the best ones to buy can be tough. There’s a simple way to invest in the success of the entire sector. Zacks has just released a Special Report revealing one thing tech companies literally cannot function without.

More importantly, it reveals 4 top stocks set to skyrocket on increasing demand for these devices. I encourage you to get the report now – before the next wave of innovations really takes off.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Sanderson Farms, Inc. (SAFM): Free Stock Analysis Report

Pilgrim's Pride Corporation (PPC): Free Stock Analysis Report

Ingredion Incorporated (INGR): Free Stock Analysis Report

The Chefs' Warehouse, Inc. (CHEF): Free Stock Analysis Report

Kroger Company (The) (KR): Free Stock Analysis Report

Whole Foods Market, Inc. (WFM): Free Stock Analysis Report

Original post

Zacks Investment Research