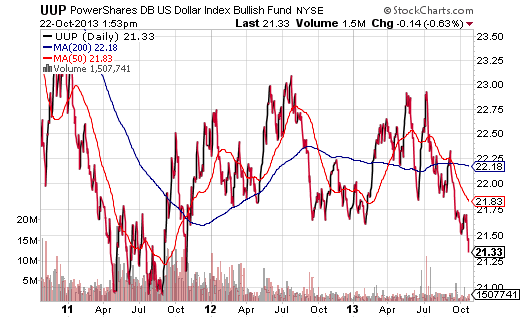

The U.S. dollar has certainly lost value since the Federal Reserve began printing greenbacks to purchase U.S. bonds. On the other hand, most of the damage occurred at the onset of the Fed’s quantitative easing program(s). Since the “euro” came under extreme pressure during the sovereign debt crisis of 2011, and since Japan’s campaign to radically devalue its currency (yen) in 2012, PowerShares DB Dollar Bullish (UUP) has been remarkably stable.

On the other hand, current market participants have sniffed out a highly probable outcome over the next six months. Specifically, the idea of the Fed slowing down its bond purchases (a.k.a. tapering) is preposterous.

In my July 31 feature, “Bond ETFs Could Shock Pundits In The Months Ahead,” I expressed serious doubts that the Bernanke-led Fed would begin tapering in 2013. I wrote:

Who genuinely believes that unemployment is falling at a rapid enough clip to warrant a change in direction? Who actually sees the Fed’s inflation measure rising at a fast enough pace to justify a policy modification? Last but not least, why would Bernanke want to rock the apple cart in any shape or form prior to his January departure?

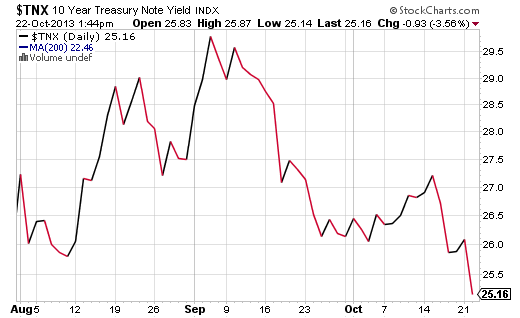

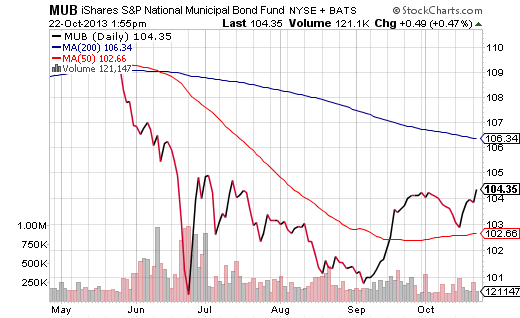

Most experts believed that I was way off base. In particular, my suggestion that the 10-year yield would likely be closer to a 2.0%-2.25% range than a 2.75%-3.0% range by year’s end seemed like a long shot. Equally controversial, I advocated that taxable account owners revisit municipal bond opportunities like iShares National Munipal Bond ETF (MUB).

Today, however, a few more folks may be coming around to my way of thinking. The number of new jobs have been steadily dropping for months. The budget debate is only getting started. And with Janet Yellen securing the chairperson post, the Fed may even try to print more money to buy bonds rather than pull away from the project.

The 10-year yield is declining:

The U.S. dollar via UUP is testing 2011 lows:

And the prospects for munis in the intermediate term appear to be brightening:

I am not suggesting that investors abandon the stock ship for the supposed safer shores of fixed income. In actuality, the electronic printing of dollars to buy bonds is benefiting stocks and commodities as well. In particular, the economies of China and Europe may be recovering with less overt currency devaluation or obvious rate manipulation. It follows that funds likethe iShares Australia ETF (EWA) may benefit from greater internal demand on the mainland. Additionally, broader-based international assets like Vanguard's All World ex-U.S. ETF (VEU) and iShares MSCI EAFE Small Cap ETF (SCZ) may figure prominently in any year-end running of the bulls.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.